Legal & Finance

Introduction

Transforming financial choices into smart decisions

2K Product Information

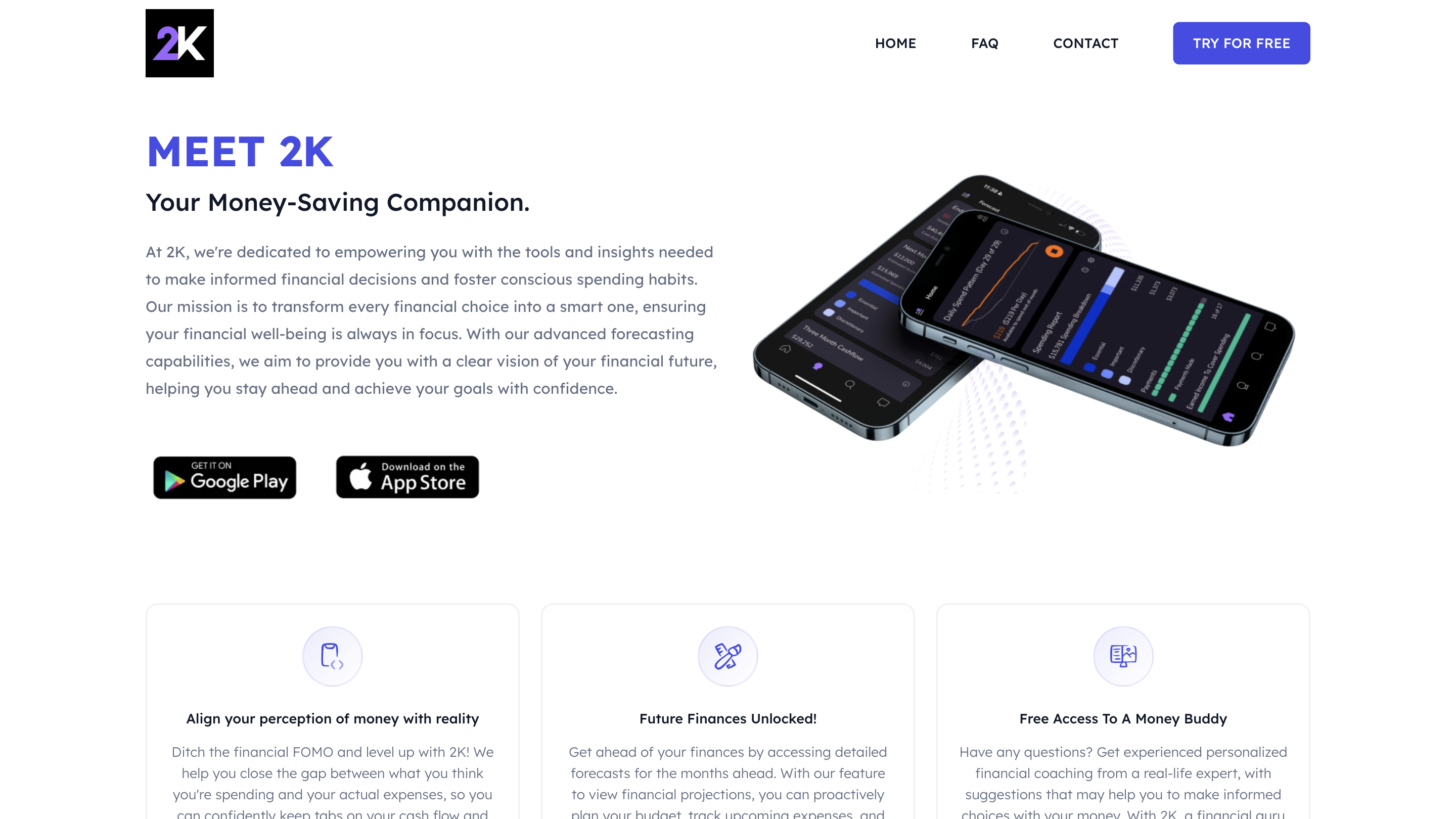

2K is your money-saving companion designed to help you forecast finances, track spending, and receive personalized coaching to support conscious spending and informed decisions. The platform emphasizes future-focused financial planning, real-time visibility into cash flow, and practical guidance from a financial coach available within the app. It aims to reduce financial FOMO by aligning your perception of money with reality and providing forward-looking projections for up to three months.

Overview

- Purpose: Empower users to understand and manage finances with advanced forecasting, detailed spending insights, and access to expert coaching.

- Key Value: Move from guesswork to data-driven decisions with future financial projections and personalized recommendations.

- Accessibility: Available on iOS and Android with upcoming web access.

How to Use 2K

- Download the app and register. Sign in and link your financial accounts to start tracking.

- Track this month’s spending. Review your current month’s spending patterns, break down expenses, payments, and income.

- View next three months’ insights. AI models generate insights and projections for the next three months to help you plan ahead.

- Consult with a financial coach. Get personalized coaching and recommendations within the app, with responses typically delivered within 12–24 hours (or sooner).

Features and Capabilities

- Real-time cash flow tracking: See spending patterns, income, and payments for the current month.

- Short-term forecasting: AI-driven projections for the upcoming three months to inform budgeting decisions.

- Personal financial coaching: Access expert guidance directly in-app to improve money management and financial literacy.

- Account aggregation: Consolidate multiple accounts into a single view for comprehensive budgeting.

- Interactive feedback loop: Receive actionable recommendations tailored to your spending habits and goals.

- Privacy and security: Uses trusted technologies and bank-linking practices to protect data while enabling helpful insights.

How It Works

- Link bank and financial accounts securely via PLAID or equivalent providers.

- 2K categorizes transactions and builds a clear picture of living expenses, debt payments, and discretionary spending.

- AI models forecast future spending and income, highlighting potential gaps or opportunities.

- A financial coach provides personalized suggestions to optimize spending, save for goals, and reduce unnecessary expenditures.

Safety, Security, and Privacy

- Data is secured using industry-standard encryption and trusted linking services.

- Transactions are read-only; 2K cannot move money or change account data.

- Users can delete linked accounts at any time, which removes associated transactions.

Core Features

- Forecasting: Detailed three-month financial projections to plan ahead.

- Spending insights: Breakdown of monthly spending, income, and payments.

- Personal coaching: Access to a real-life financial coach with timely feedback.

- Account aggregation: View all linked accounts in one place for holistic budgeting.

- Secure linking: Bank connections with strong encryption and read-only access.

- Privacy controls: Options to manage data sharing and account deletion.

- Cross-platform access: iOS and Android with upcoming web availability.