Addy

Open siteWriting & Editing

Introduction

An A.I. email assistant that drafts your emails in seconds with customizable style and tone.

Addy Product Information

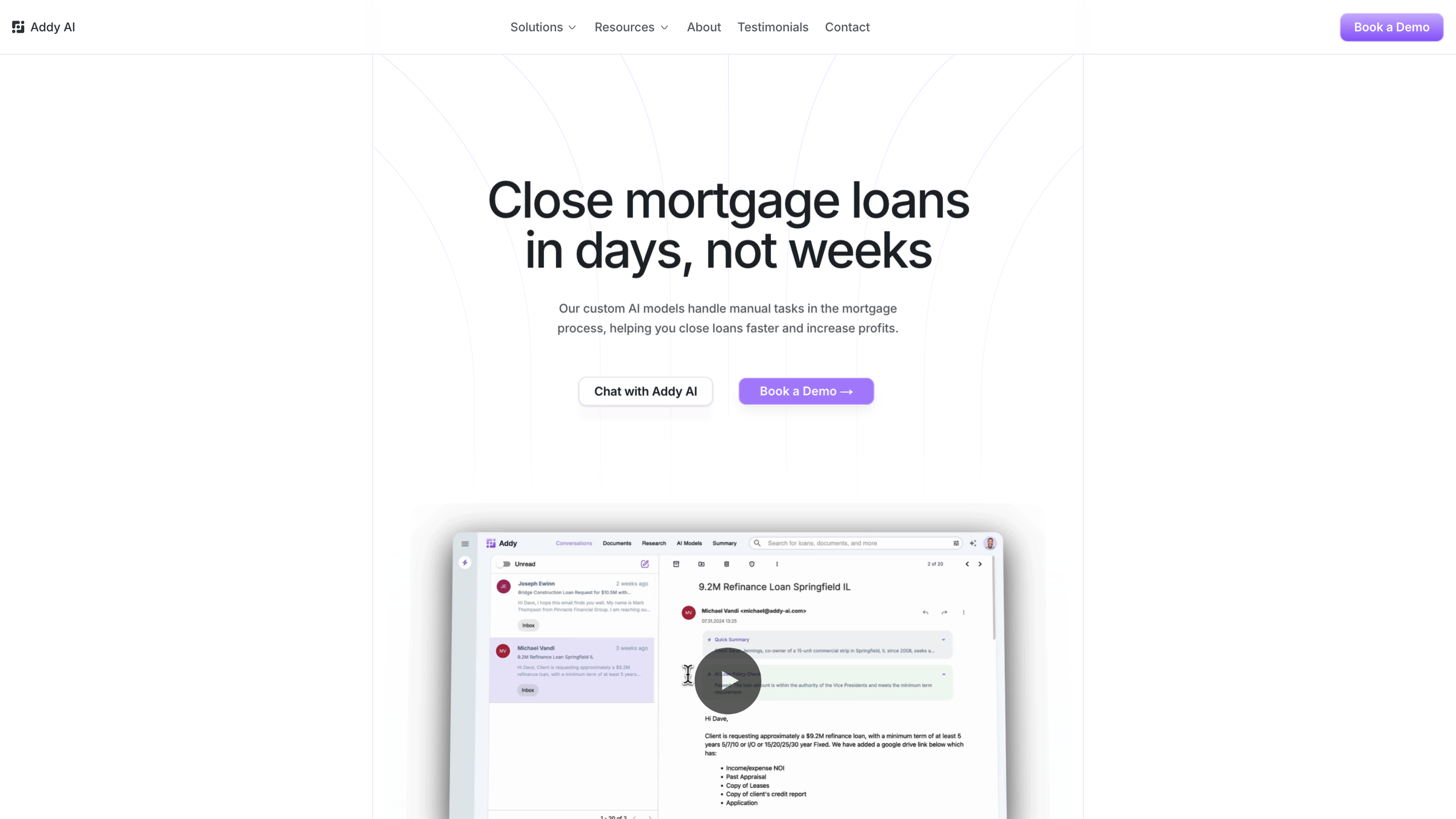

Addy AI - AI for Mortgage Lenders is an AI-powered platform designed to accelerate mortgage loan origination and streamline lender workflows. It leverages custom AI models to automate manual tasks, provide instant loan assessments, extract loan data, and integrate with existing systems to help lenders close loans faster and boost profitability. The solution is positioned as secure, private, and controllable by the user, with options to deploy chatbots and seamless CRM/LO missional integrations.

How Addy AI Helps Lenders

- Significantly speed up loan origination (claims of 90% faster) by automating manual checks, data extraction, and follow-ups.

- Provide instant, policy-compliant loan assessments and guidance to improve eligibility decisions.

- Extract relevant loan data from documents and communications in seconds (e.g., LTV and other critical fields).

- Seamlessly integrate with your CRM, Loan Origination System (LOS), email, and other tools to reduce context switching and improve workflow efficiency.

- Support client follow-ups around the clock via specialized AI models for a better borrower experience.

- Enable creation of custom AI Mortgage Lending chatbots that can answer lending guidelines and be embedded in platforms like Microsoft Teams or Slack.

- Offer security assurances and control, including privacy considerations and Google Security Certification.

How It Works

- Train and deploy AI models tailored to your lender guidelines (Fannie Mae, Freddie Mac, non-QM, etc.).

- AI automatically checks loan files against your credit policy and provides eligibility suggestions.

- Extract key loan data from documents and communications in real time.

- Integrate with your CRM/LOS to keep data synchronized and reduce manual data entry.

- Use the chatbot and automation features to handle routine questions and client follow-ups.

Use Cases

- Fast loan assessments and eligibility guidance

- Data extraction for underwriting reviews

- CRM/LOS integration to streamline operations

- AI-powered borrower communication and follow-ups

- Policy-based chatbot for mortgage lending guidelines

Safety and Compliance Considerations

- AI models can be trained on lender guidelines to ensure outputs align with regulatory requirements.

- Data integration and storage should follow your organization’s security policies and applicable regulations.

- Use the chatbot and automated processes to support human decision-making, not replace it.

Core Features

- Significantly faster loan origination (claims of 90% faster)

- Instant loan assessments aligned to lending guidelines

- Document data extraction (e.g., LTV, income, property details) in seconds

- Seamless CRM/LOS and workflow integrations

- 24/7 client follow-up automation

- Create your own AI Mortgage Lending chatbot (e.g., for Teams or Slack)

- Google Security Certified and privacy-conscious platform