Chart

Open siteOffice & Productivity

Introduction

Tool for managing and monitoring communications to improve compliance and customer interactions.

Chart Product Information

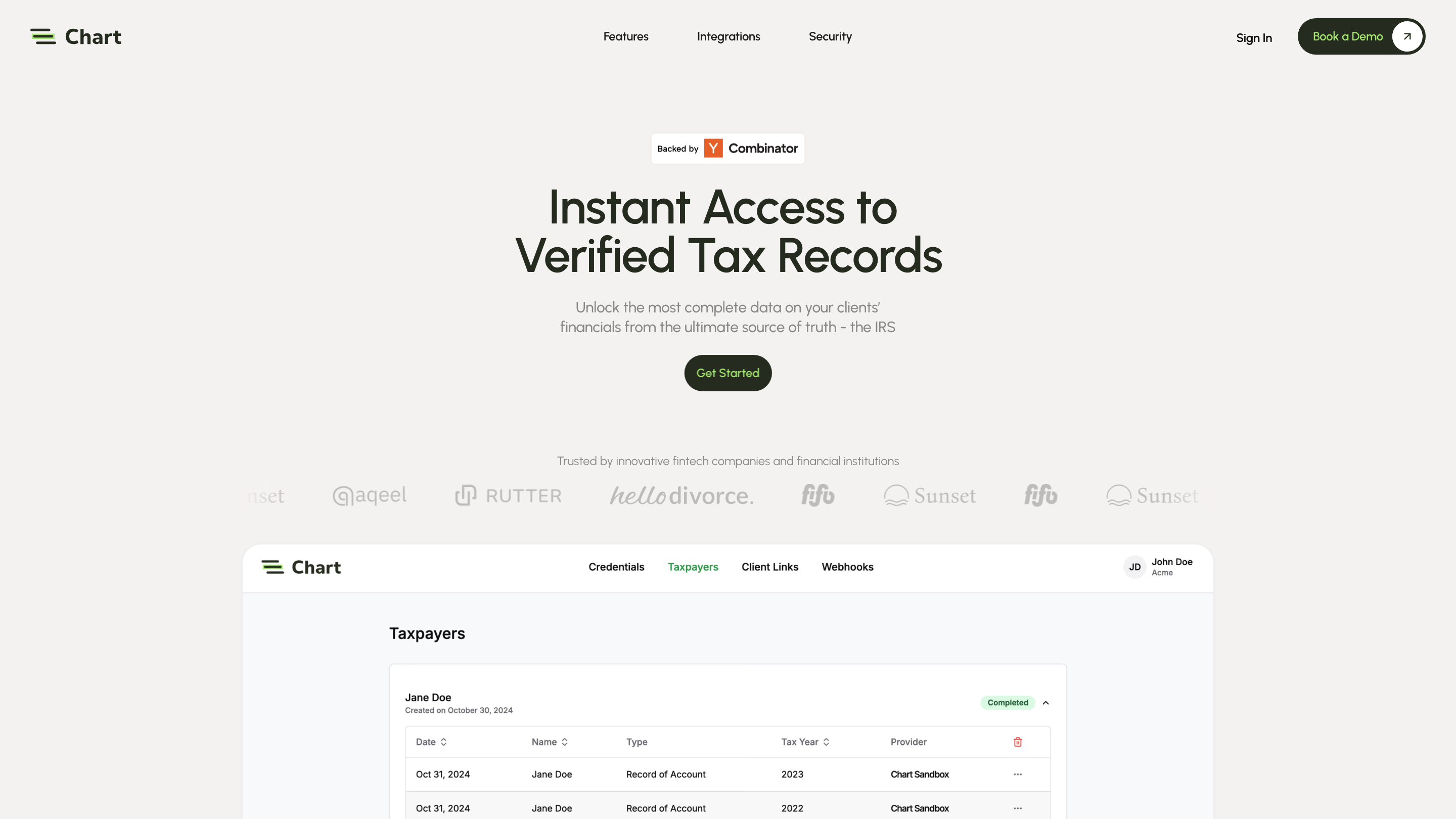

Chart – Real-time Income Verification and Tax Document Automation is an enterprise-grade fintech tool that provides instant access to verified tax records directly from the IRS and leading tax preparation platforms. It enables fintechs and financial institutions to automate client onboarding and income verification through flexible submission options, fast data retrieval, and developer-friendly APIs. The platform emphasizes security, privacy, and compliance, offering structured data, OCR processing, and SOC 2 Type II compliance to support scalable, compliant financial workflows.

Key Capabilities

- Real-time access to client tax records via direct IRS connections and leading tax prep platforms

- Verified tax documents drawn from official government sources and tax software

- Structured JSON output for easy integration

- Developer-friendly REST API with SDKs, sandbox, and comprehensive documentation

- Multiple submission options for clients (IRS Online Account, connected tax software, or official IRS forms)

- Enterprise-grade security with non-persistent credentials and strict session re-authentication

- SOC 2 Type II compliant with data security and privacy controls

- Data control and privacy features including PII reduction and anonymization on request

- Optional reports available on request

How It Works

- Submit client records via multiple channels. Clients can connect to their IRS Online Accounts, link their tax preparation software, or fill out official IRS forms.

- Direct IRS data access. Chart securely connects to government sources and tax software to fetch verified tax documents in real time.

- Structured data output. Tax documents are parsed and transformed into clean, well-formed JSON for easy integration into your systems.

- Secure processing. Sessions require re-authentication and credentials are never persisted to safeguard sensitive information.

Security & Compliance

- Enterprise-grade security with non-persistent credentials and transient sessions

- SOC 2 Type II compliant

- PII reduction and optional anonymization to protect taxpayer privacy

- Data controls including consent-driven sharing and the ability for taxpayers to remove data

Use Cases

- Automated income verification for loan onboarding

- Quick, compliant tax document collection during customer onboarding

- Streamlined financial data gathering for underwriting and risk assessment

- Secure integration with fintech platforms and financial institutions

How It Works (Developer View)

- REST API with SDKs and sandbox environments for easy integration

- Structured JSON data representing tax records for straightforward consumption

- Clear data provenance from IRS and compatible tax software partners

Safety and Legal Considerations

- Only process data with explicit client consent

- Ensure compliance with applicable privacy laws and FCRA policies when handling income records

Core Features

- Real-time access to client tax records via IRS and tax software integrations

- Verified documents from government sources with structured JSON outputs

- Developer-friendly REST API, SDKs, sandbox, and thorough documentation

- Multiple submission options for client data submission

- Non-persistent credentials and re-authentication for secure sessions

- SOC 2 Type II compliant and enterprise-grade security

- PII reduction and optional data anonymization

- On-demand access to comprehensive client financials

- Ready-to-use onboarding and verification workflows for fintechs and financial institutions