CPA Pilot

Open siteLegal & Finance

Introduction

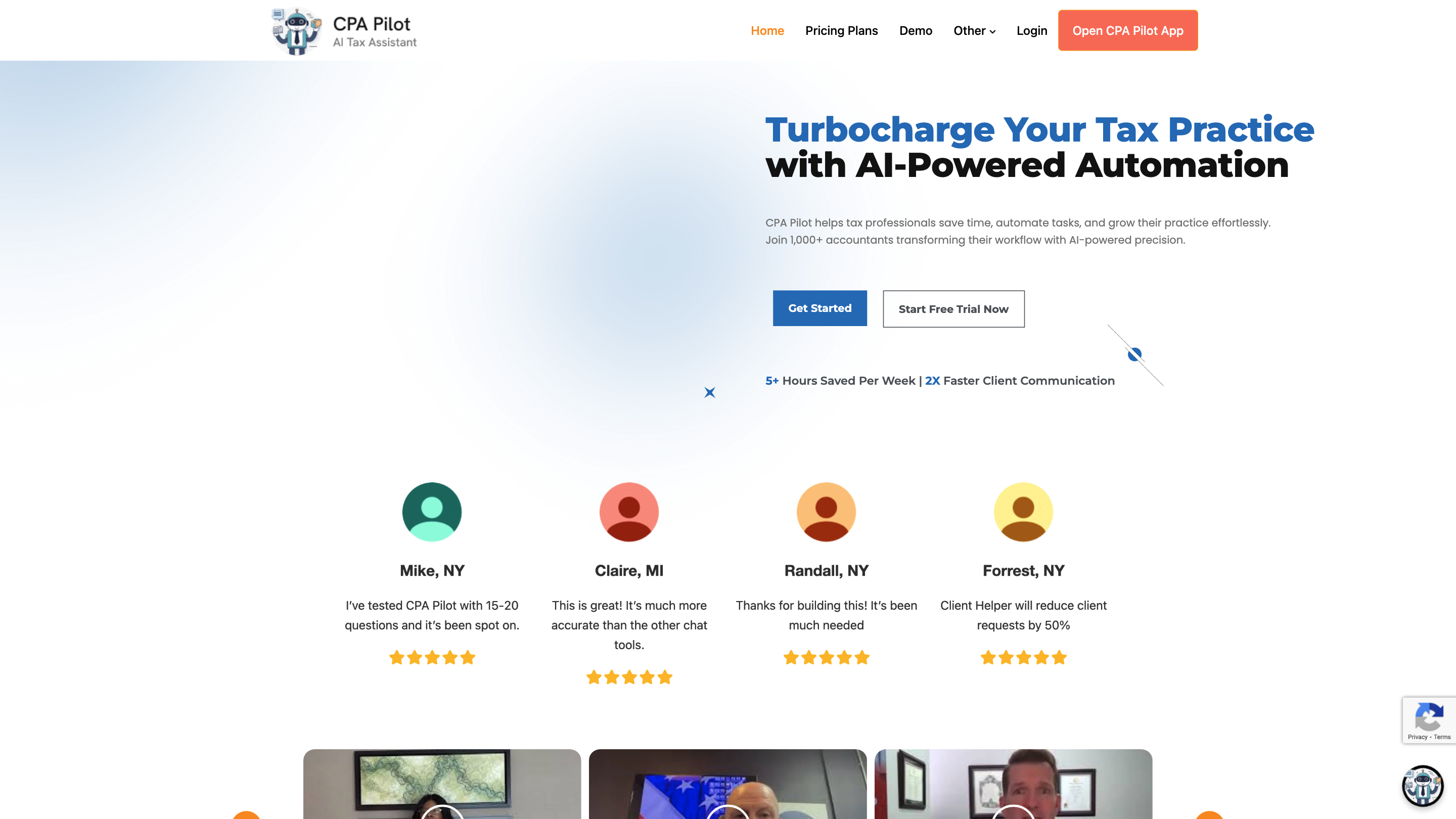

AI tax assistant, automating research, client communication, and marketing for tax accountants.

CPA Pilot Product Information

CPA Pilot is an AI-powered assistant tailored for tax professionals. It streamlines complex tax research, automates client communication, creates marketing content, and supports staff training— helping you save time, reduce stress, and grow your practice effortlessly. Used by 1,000+ accountants, CPA Pilot aims to make practitioners faster, more accurate, and more productive across tax research, client interactions, and marketing.

How CPA Pilot Helps You

- Save time: automate repetitive tasks such as tax research, client emails, and data-entry workflows.

- Increase accuracy: up to 95% accuracy with authoritative sources and citations.

- Improve client communications: craft precise, professional responses in minutes.

- Scale your practice: suitable for solo firms up to larger teams with scalable plans.

- Market more effectively: generate targeted content for newsletters, social media, and campaigns.

- Train staff easily: instant tax topic and software training without external resources.

What It Is Noted For

- Real-time access to authoritative sources (IRS, state tax codes, publications, forms).

- Clear source citations accompany answers for verification.

- 24/7 availability for instant guidance and support.

Core Capabilities

- Tax Research & Strategy: deep-dive tax research with sourced guidance.

- Client Communications: automated email replies and templated responses.

- Marketing Content Creation: newsletters, blog posts, social content tailored to tax topics.

- Staff Training: on-demand training materials and explanations.

- Tax Software Support: guidance across common tax software platforms.

- Team Collaboration: supports teamwork across a practice with shared workflows.

How It Works

- You ask a tax research question or request client communication content.

- CPA Pilot queries its sources (IRS, federal/state tax code, forms, and relevant publications) and returns an answer with citations.

- You can refine, generate emails, or craft marketing content in seconds.

- If a source is missing or outdated, you can request updates or provide feedback to improve accuracy.

Plans and Pricing (Overview)

- Plans are designed for seasonal to year-round tax practices, with options for individuals and teams.

- Messages are the unit of usage; some tiers provide a bundle of messages per month with rollover features and annual perks.

- Free trials are available in many plans to test capabilities before committing.

Safety, Accuracy & Support

- All AI tools can err; CPA Pilot emphasizes reliance on authoritative sources and includes source citations.

- It offers instant technical support to reduce downtime and speed up resolution.

- If an answer is wrong or out-of-date, you can flag it and request a source or updated guidance.

FAQ Highlights

- What sources does CPA Pilot use? IRS website, Federal/State tax codes, form instructions, and tax software support docs.

- Is CPA Pilot suitable for all tax professionals? Yes, from solo practitioners to larger firms.

- Can it help with client communications and marketing? Yes, comprehensive capabilities cover both.

- How is accuracy ensured? By prioritizing authoritative sources and providing citations; occasional errors may occur with AI tools.

Why CPA Pilot Stands Out

- Time efficiency and accuracy tailored to tax professionals.

- 99%+ user-rated correctness in internal comparisons vs. ChatGPT (as claimed in marketing materials).

- Tax-specific knowledge with up-to-date state and federal references.

- 24/7 access and scalable plans to fit different practice sizes.

Core Features

- AI-Powered tax research and strategy tailored for tax professionals

- Automated client communications (emails, responses) with professional tone

- Marketing content generation (newsletters, social posts, campaigns) in any language

- Staff training and onboarding content on tax topics and software

- Deep integration-friendly workflow support for teams

- Real-time access to authoritative IRS/state tax codes and publications

- Source citations for all AI-generated content

- 24/7 instant support and helpdesk

- Scalable plans for solo practitioners to enterprise teams

- Flexible pricing with message bundles, rollover, and annual perks