Deferred

Open siteLegal & Finance

Introduction

AI tax research assistant focused on 1031 exchanges.

Deferred Product Information

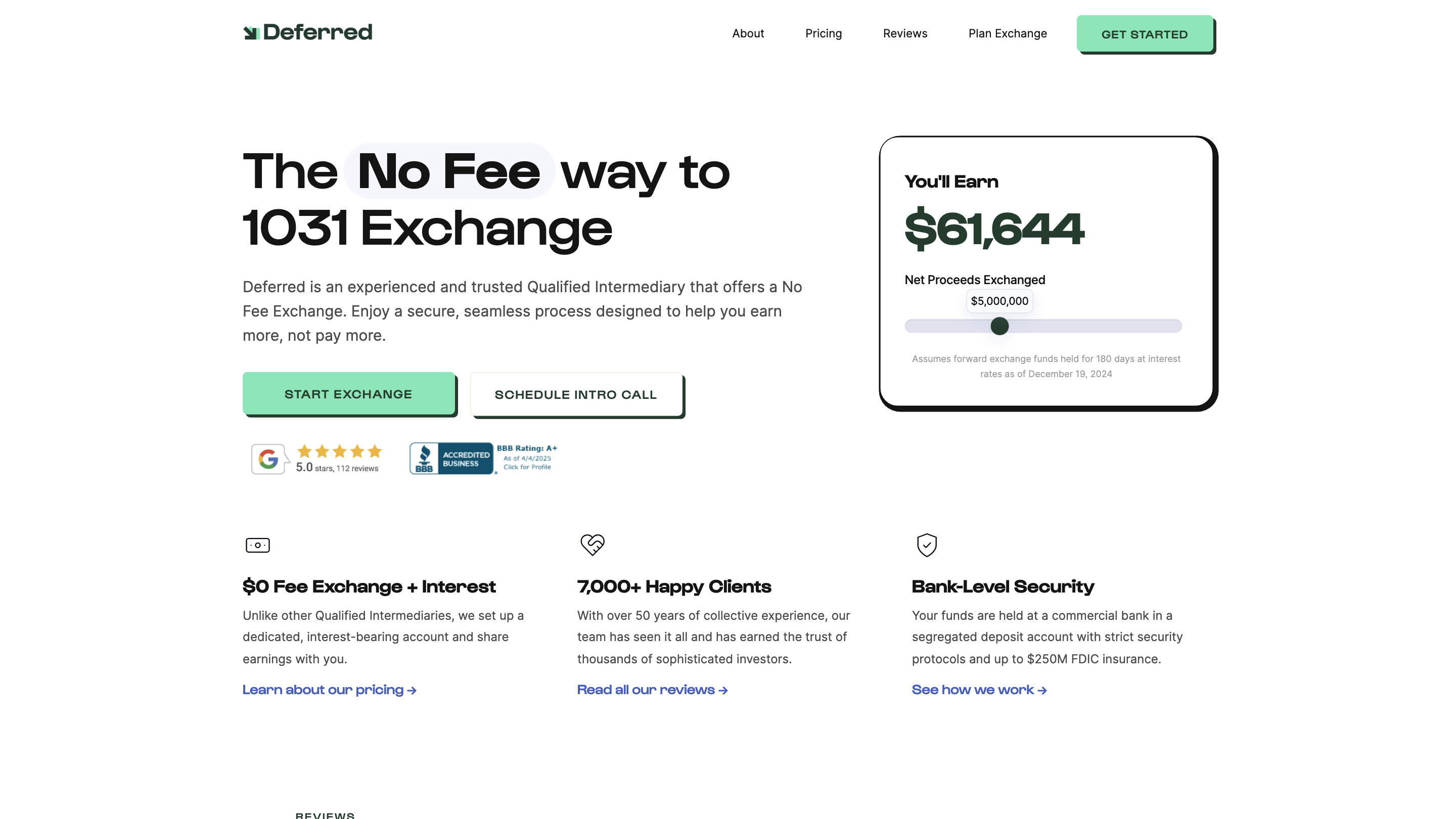

Deferred - No Fee 1031 Qualified Intermediary is a 1031 exchange intermediary that positions itself around a No Fee exchange model and shared interest on exchange funds. With over 50 years of collective experience and a focus on security, transparency, and client-centric pricing, Deferred markets itself as a high-trust partner for investors seeking to defer taxes on exchange proceeds.

How it works

- You initiate a 1031 exchange with Deferred as the Qualified Intermediary.

- Your exchange funds are placed into dedicated, interest-bearing accounts held by a commercial bank in segregated deposits.

- Deferred shares a portion of the interest earned with you to cover the intermediary’s value, effectively eliminating separate fees while maintaining expert support.

- Funds are safeguarded by multi-layer security measures, including FDIC-insured accounts and advanced fraud prevention.

Pricing and Value

- No Fee Exchange: No traditional intermediary fees.

- Earn Interest: Interest earned on exchange funds is shared with you, reducing or eliminating the typical intermediary cost.

- Transparent comparisons show Deferred as a cost-saving alternative to typical 1031 intermediaries.

Security and Compliance

- Segregated bank accounts with FDIC insurance up to $250M.

- Bank-level data encryption (AES-256) for personal and financial data.

- Advanced fraud prevention with multi-factor authentication and written/verbal approvals for transfers.

- Fidelity bond ($5M) and E&O insurance ($5M) providing additional protection.

- Trusted depository banks with protocols to ensure funds remain protected and separate from other assets.

Why Choose Deferred

- No hidden fees; upfront transparency on pricing and process.

- High-touch support from seasoned professionals (attorney & CPA team with 40+ years of experience).

- A technology-enabled platform designed to lower costs while maintaining robust security and compliance.

- Clear communication on how the no-fee model works and how you can maximize proceeds.

How to Get Started

- Get Started / Schedule a Call / Intro Call options are available to initiate a free consultation.

- Contact channels include phone (866-442-1031) and support email ([email protected]).

Safety and Legal Considerations

- Always ensure compliant use of 1031 exchange funds and adhere to IRS rules for qualified intermediaries.

Core Features

- No Fee Exchange model

- Interest sharing on exchange funds (no hidden costs)

- Segregated, FDIC-insured accounts up to $250M

- Advanced fraud prevention and bank-level encryption

- Fidelity Bond and E&O coverage (combined protection)

- 40+ years of collective 1031 exchange experience

- Online/remote accessibility with clear communication and support