DisputeAI

Open siteIntroduction

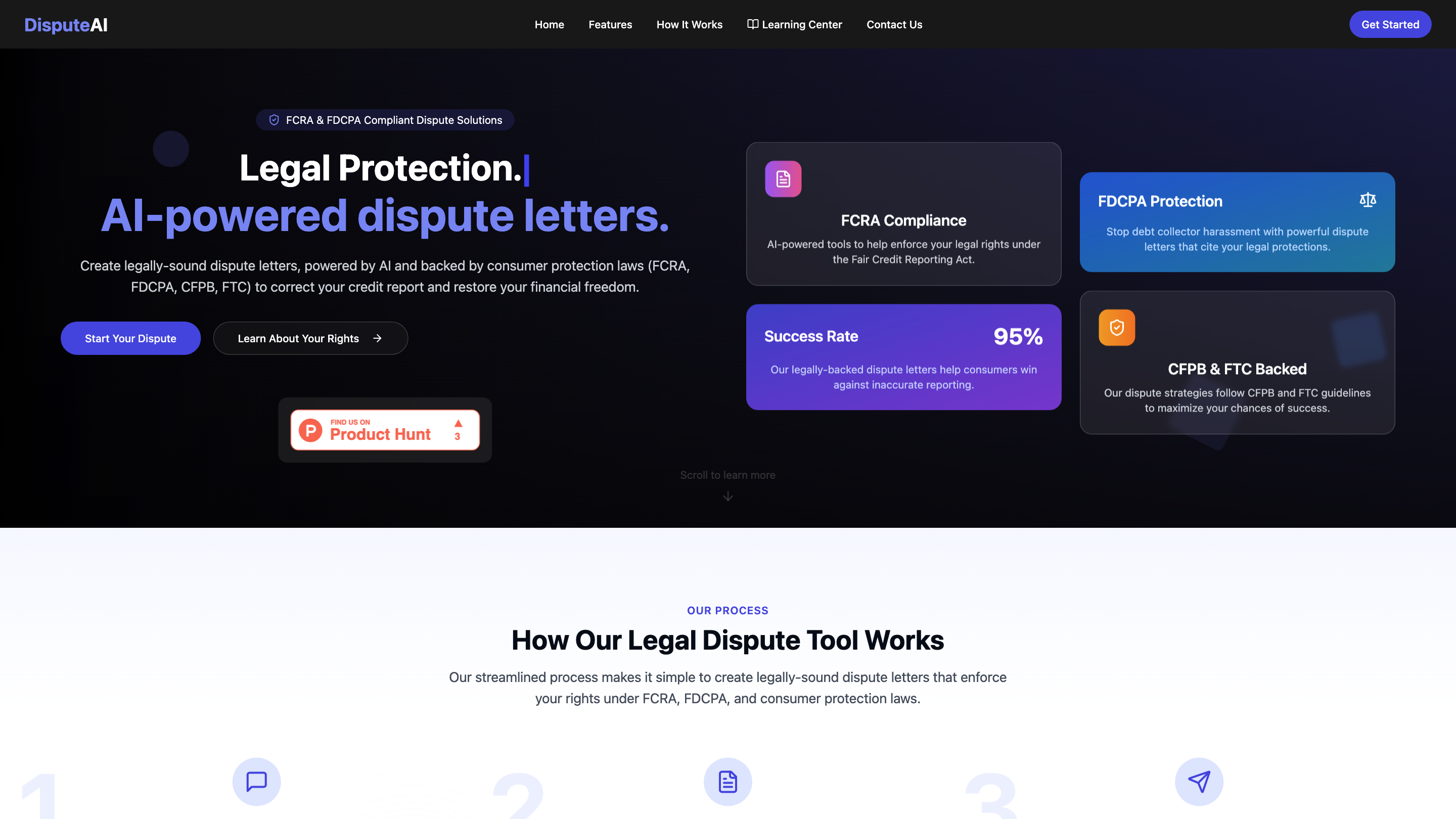

AI-powered platform for generating dispute letters for consumer rights.

DisputeAI Product Information

DisputeAI is an AI-powered dispute letter platform designed to help consumers correct inaccuracies on their credit reports and enforce their rights under FCRA, FDCPA, CFPB, and FTC guidelines. It provides legally-backed dispute letters for all major bureaus (Equifax, TransUnion, Experian) and supports mobile dispute management, tracking, and documentation to streamline the credit repair process. The service emphasizes high success rates (reported around 95%), legal compliance, and guided user workflows to navigate credit reporting disputes efficiently.

How It Works

- Chat with Legal AI: Describe your situation to our AI assistant, which cites relevant laws (FCRA, FDCPA) to build your case.

- Review Legal Content: The AI generates a legally-sound dispute letter with specific violations and customizable language.

- Send & Track: Download the letter as a PDF and send it to bureaus, debt collectors, or creditors; track responses and timelines within the app.

The platform provides a structured, law-backed approach to dispute creation, ensuring compliance with required legal timelines and proper documentation for each dispute.

Features and Capabilities

- FCRA & FDCPA compliant dispute letters with legal citations

- Dispute letter generation tailored to all three major bureaus: Equifax, TransUnion, Experian

- 90%–95% success rate metric showcased in app (disputes and outcomes)

- Mobile dispute management: create letters, track progress, manage evidence

- Follow-up letter generation for unresolved disputes

- Legal timeline tracking for bureau responses

- Document management for dispute evidence

- Rapid letter generation to expedite the process

- Identity and account ownership verification and protection measures

- Education resources on FCRA, FDCPA, CFPB, FTC guidelines

- Cease-and-desist and other FDCPA-related protections where applicable

- AI-assisted creation of legally-sound dispute letters

- Multi-bureau support (Equifax, TransUnion, Experian)

- FCRA and FDCPA-compliant templates and language

- Legal timeline tracking and milestone reminders

- Document management for dispute evidence

- Follow-up and status-tracking dashboards

- Mobile-friendly dispute management

- Education on consumer rights and regulatory guidelines

- Quick generation of letters to accelerate dispute processes

- Integration of CFPB/FTC guidelines into dispute strategies

How It Helps

- Enables consumers to challenge inaccuracies on credit reports with legally-grounded letters

- Reduces the complexity of crafting compliant disputes by leveraging AI-driven templates

- Provides clear progress tracking and documented evidence for each dispute

- Supports reporting and educational resources to empower long-term credit health

Safety and Compliance Considerations

- Tools generate letters intended to comply with FCRA, FDCPA, CFPB, and FTC guidelines

- Users should review generated content for accuracy and tailor to their specific situations

- Ensure timely submission and proper handling of dispute responses as per bureau timelines

Getting Started

- Begin a new dispute, chat with the Legal AI, and generate your first letter

- Download PDFs for printing or electronic submission

- Track active disputes and review outcomes within the dashboard

Note: This tool focuses on legally-backed dispute letters and consumer protection compliance to enhance your ability to correct credit report errors and push for accurate information.