Folionomics

Open siteLegal & Finance

Introduction

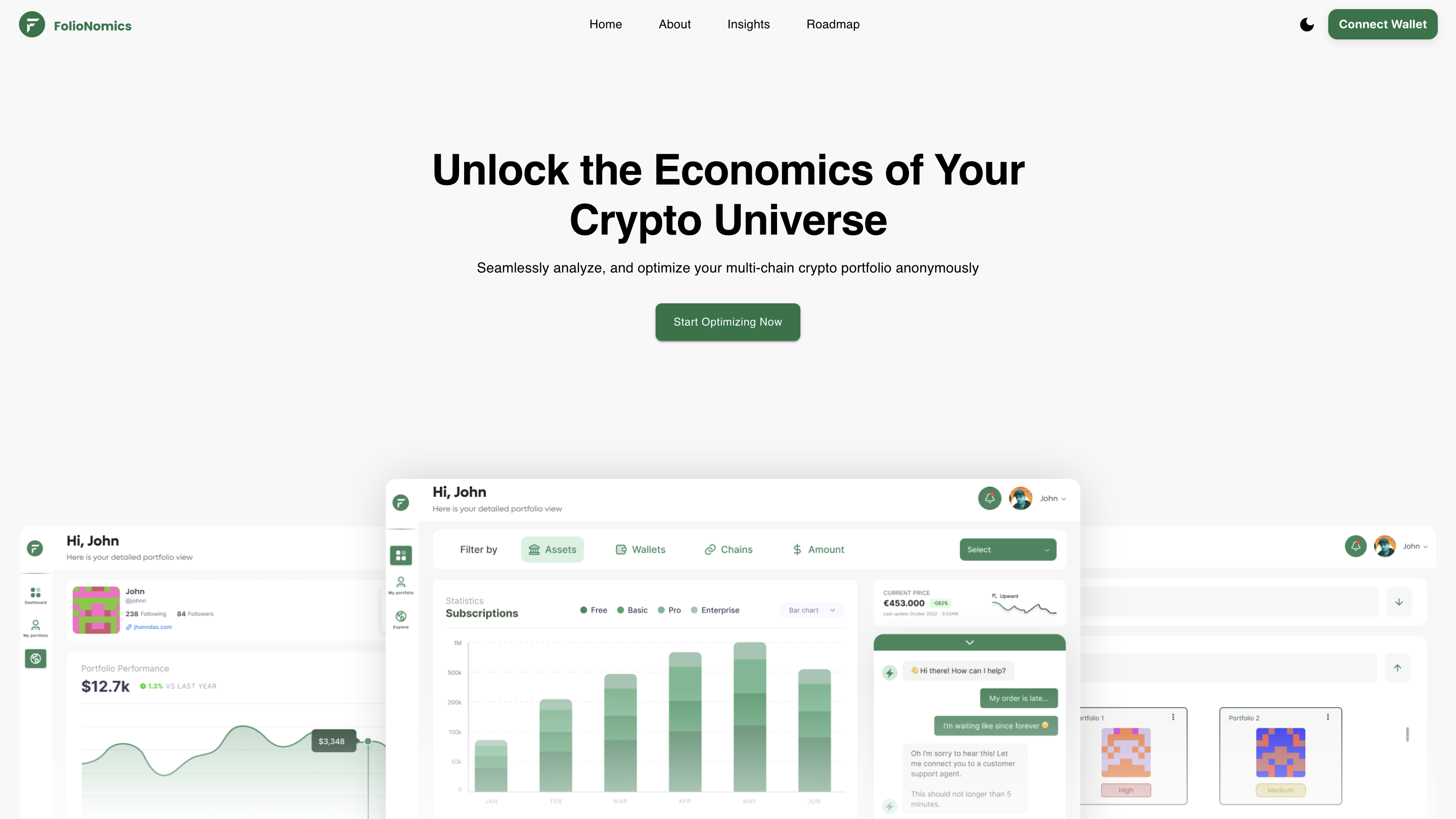

Manage and optimize multi-chain crypto portfolios in one place.

Folionomics Product Information

FolioNomics is an anonymous, multi-chain crypto portfolio management tool designed to analyze, optimize, and manage assets across 50+ blockchains. It emphasizes privacy, personalized AI-driven insights, and advanced portfolio customization to help users optimize returns while controlling risk.

Overview

- Seamlessly analyze and optimize your crypto portfolio across multiple chains without revealing personal data.

- Start from account creation, connect wallets, and build a diversified, risk-aware portfolio.

- Access AI-powered recommendations, risk control, and diversification insights to potentially improve performance.

How It Works

- Create Your Account – Your identity and data are protected with strong privacy measures.

- Add Your Wallets – Connect wallet accounts to start transactions and portfolio tracking.

- Build Portfolio – Buy, sell, and rebalance assets while monitoring performance and risk.

Getting Started

- Simple onboarding to begin investing in cryptocurrency.

- Privacy-first design ensures personal data is not shared with third parties.

- Focused on simplifying wallet management without compromising security.

Amazing Features

- Multi-Chain Wallet Aggregation: Manage assets across 50+ blockchains (including Ethereum, Bitcoin, L1s/L2s, and Solana).

- Advanced Filters: Customizable filters to tailor portfolio views to your strategies, risk profiles, and goals.

- AI-Driven Insights: Personalized portfolio recommendations from an AI chatbot, with risk control and diversification guidance.

- Privacy & Security: Your privacy is the top priority; no sharing of information with third parties.

- Easy Getting Started: Simple steps to create your account, connect wallets, and begin building your portfolio.

- Intuitive Portfolio Management: Buy/sell popular currencies and track performance with clear, actionable insights.

Why Portfolio Management Boosts Returns

- Diversification Benefit: Properly diversified portfolios can potentially reduce risk by up to 40% without sacrificing returns.

- Asset Allocation Impact: Asset allocation explains up to 90% of a portfolio's return variability over time.

- Risk-Adjusted Performance: Active management can improve risk-adjusted returns (Sharpe ratio) by 0.3 to 0.8 points vs. passive investing.

- Rebalancing Advantage: Regular rebalancing can potentially add 0.35% to 0.75% to annual returns.

Safety and Privacy Considerations

- Privacy-first design; no personal data sharing with third parties.

- Focus on secure handling of wallet connections and transaction processes.

Core Features

- Multi-Chain Wallet Aggregation across 50+ blockchains (Ethereum, Bitcoin, L1s/L2s, Solana, etc.)

- Advanced Portfolio Filters tailored to strategies, risk profiles, and goals

- AI-Driven Insights with personalized portfolio recommendations

- Risk control and diversification guidance

- Privacy-focused design: no sharing of personal data with third parties

- Easy onboarding: create account, connect wallets, build and manage portfolio

- Buy/sell management and performance tracking across supported assets