FurtherAI

Open siteLegal & Finance

Introduction

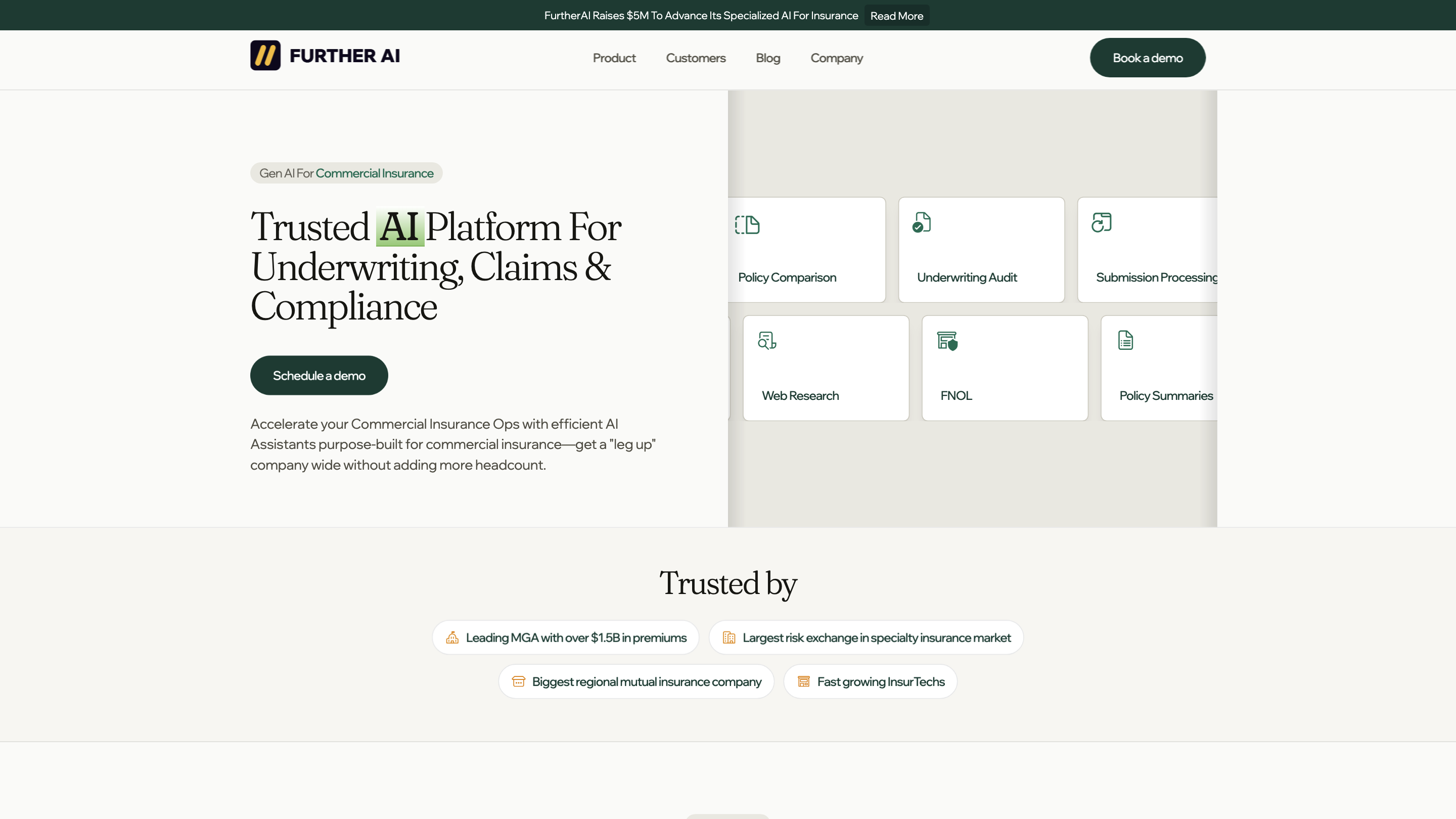

AI Assistants for automating insurance workflows and tasks.

FurtherAI Product Information

FurtherAI for InsuranceOps is a specialized AI platform tailored for commercial insurance, designed to automate complex document processing, streamline underwriting, audits, and policy management, and integrate disjointed systems. The AI assistant is purpose-built for the insurance domain, fine-tuned to understand policy language, underwriting rules, and regulatory requirements, enabling faster submissions, improved accuracy, and scalable operations without increasing headcount.

Key Capabilities

- Automated document processing: extract, summarize, and validate data from PDFs, SOVs, and policies; perform policy comparisons and audits.

- Workflow automation: trigger downstream processes via email or messages; initiate calls or messages as part of automated flows.

- Insurance-specific reasoning: understand policy language, underwriting rules, and compliance requirements to support risk assessment.

- Multi-model architecture: combines the strengths of multiple large language models to maximize accuracy and minimize blind spots.

- System integration: designed to seamlessly connect with existing underwriting, claims, and policy management systems.

- Security and compliance: enterprise-grade security, isolated data stores, and third-party audits to protect client data.

- Measurable impact: accelerated submissions, shortened audit times, and potential ROI gains through streamlined operations.

How It Works

- Ingests and analyzes documents (policies, SOVs, audits).

- Extracts key data fields and performs validations against business rules.

- Compares policies and flags discrepancies; triggers appropriate workflows.

- Automates routine tasks (data extraction, eligibility checks, communications).

- Integrates with existing processes to augment underwriting, audits, and claims workflows.

Use Cases

- Submissions Processing: accelerate client intake and data extraction, enabling faster risk evaluation.

- Policy Comparison: instantly surface discrepancies between policies and standards with high accuracy.

- Underwriting Audit: streamline auditing across MGA portfolios and policy files to reduce manual effort.

- Automation of repetitive tasks: trigger flows, send notifications, and perform routine checks automatically.

Benefits

- 30x faster submissions by automating data extraction and eligibility checks.

- 45% reduction in audit time through automated data processing and policy reviews.

- Higher accuracy and consistency in underwriting and compliance decisions.

- Ability to reclaim time for strategic work by shrinking busywork across operations.

Security & Compliance

- Enterprise-grade security with industry-standard controls.

- Client prompts and data are never used for training.

- Completely isolated, firm-specific data storage.

- Regular third-party security audits and tests.

Core Features

- Purpose-built AI assistant for commercial insurance workflows

- Automates complex document processing (PDFs, SOVs, policy documents)

- Data extraction, validation, and policy comparison

- Trigger-based workflow automation (email/messages, calls)

- Policy language and underwriting rules understanding

- Seamless integration with existing underwriting, claims, and policy management systems

- Multi-LLM architecture for robust performance

- Enterprise-grade security and data isolation

- Case studies and ready-to-go readiness for MGAs and insurers