Greip - AI-powered Fraud Prevention

Open siteLegal & Finance

Introduction

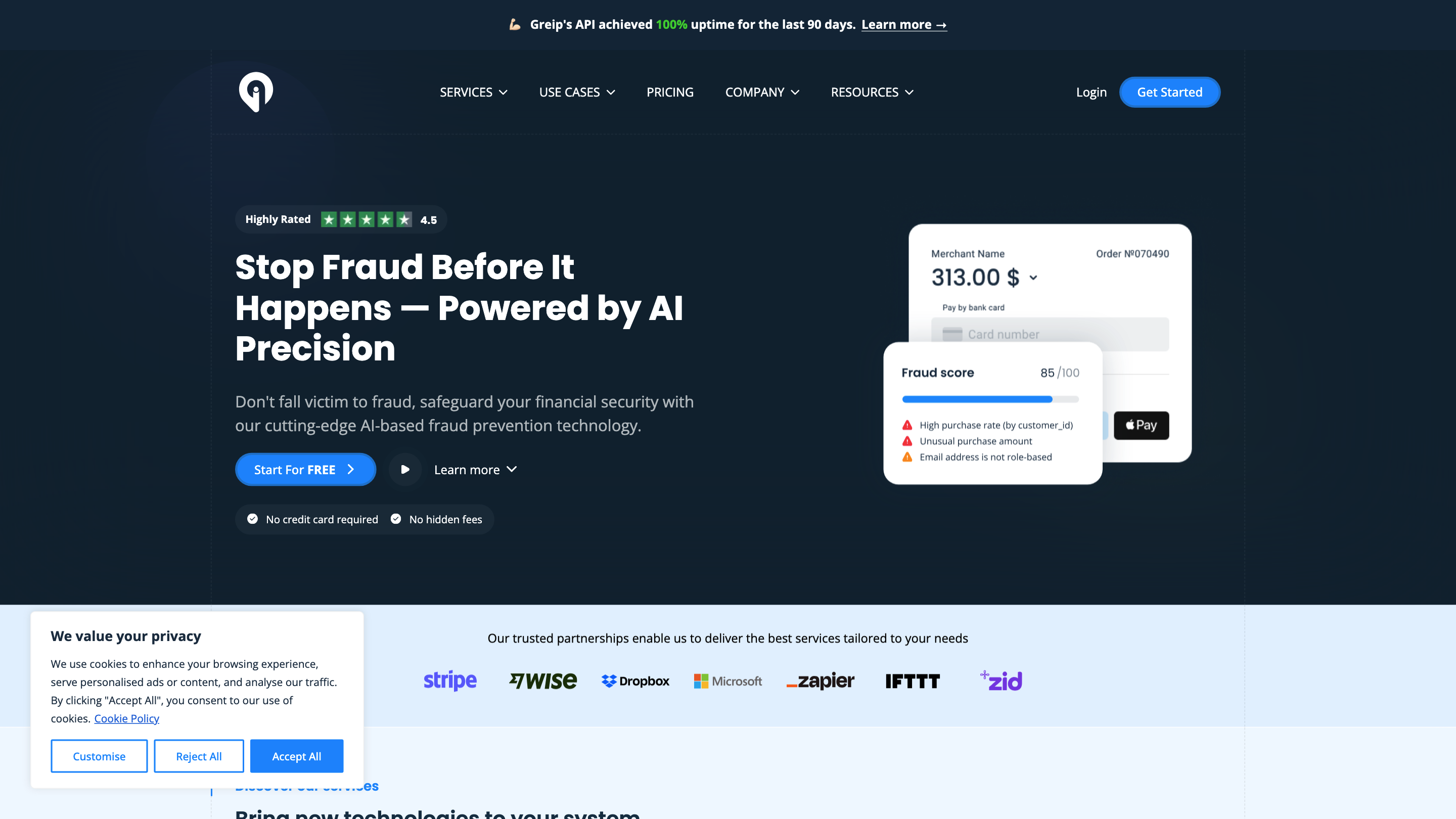

Greip is an AI-powered fraud prevention solution for app's financial security.

Greip - AI-powered Fraud Prevention Product Information

Greip - AI-powered Fraud Prevention is a comprehensive fraud prevention platform offering a range of AI-driven services to detect and mitigate fraudulent activities across payments, accounts, and content. The API focuses on real-time insights, risk scoring, and actionable signals to help businesses prevent fraud, protect users, and optimize conversions. It emphasizes easy integration, flexible customization, and enterprise-grade reliability (uptime claims and extensive libraries across languages).

How Greip Works

- Integrates via API to analyze and score risk for various inputs (payments, user signups, content, and network data).

- Combines BIN/IIN checks, transaction analysis, IP intelligence, device cues, and user data validation to detect high-risk events.

- Provides lookups and enrichments (Card Issuer, IBAN, ASN, IP location, country data) to improve decision making.

- Supports customizable rules and blacklists to tailor fraud prevention to your needs.

Use Cases

- Payment Fraud: Stop fraudulent payments before they occur.

- Fake Accounts: Detect and deter fake account creation.

- SMS Fraud: Identify non-deliverable or spoofed SMS traffic.

- Account Takeover: Prevent unauthorized access and protect user accounts.

- Content Moderation: Maintain safe interactions by filtering profanity and harmful content.

- Web Personalization: Personalize experiences while safeguarding against abuse.

How to Use Greip

- Get an API token from your Greip account.

- Choose the appropriate service (Payment Fraud Analysis, Card Issuer Verification, IBAN Verification, Content Moderation, IP/Network Intelligence, etc.).

- Send a lookup or risk analysis request (IP address, email/phone, transaction details, etc.).

- Interpret risk scores and signals to decide on actions (allow, challenge, or block).

Core Features

- Payment Fraud Analysis: Combined BIN checks and AI-driven transaction analysis to detect high-risk payments.

- Card Issuer Verification: Retrieve issuer details (bank, brand, country) to enhance security.

- IBAN Verification & Insights: Validate IBANs and gain insights about issuer country and bank.

- Content Moderation: Identify and filter offensive language and harmful content.

- Proxy & VPN Detection: Detect VPNs and proxies to mitigate masked access.

- IP Location Intelligence: Obtain precise IP-based location data for targeting and risk scoring.

- Network Intelligence (ASN): Retrieve ASN details for network ownership and routing.

- Country Intelligence: Access detailed country data for compliance and risk assessment.

- User Data Scoring & Validation: Validate and score emails and phone numbers to flag fake or temporary accounts.

- Real-time Dashboard: Monitor threats and insights with an intuitive dashboard.

- Custom Rules & Blacklists: Tailor detection logic with unlimited custom rules and blacklists.

- Libraries & SDKs: Official libraries for popular languages to simplify integration (PHP, Node.js, Python, JavaScript, Go, Ruby, Dart/Flutter, etc.).

- Documentation & Integrations: Comprehensive guides, quick integration, and multi-language support.

- Scalable Plans: Flexible pricing and high-volume capabilities for large enterprises.

Safety & Compliance Considerations

- Use for legitimate fraud prevention only; ensure you comply with data privacy and local laws when processing user data.

- Leverage custom rules to minimize false positives and avoid blocking legitimate users.

Language/CODE Snippets (Representative Integration Snippets)

- IP Lookup (example in multiple languages) - shows a typical usage pattern to fetch IP data and interpret results.

Why Choose Greip?

- AI-powered, real-time risk scoring across multiple use cases.

- Broad data enrichment (IP, ASN, IBAN, card issuer, country) to improve decision accuracy.

- Highly customizable with rules and blacklists to fit unique business needs.

- Developer-friendly with multi-language SDKs and thorough documentation.

- Notable uptime performance and a focus on scalable, enterprise-grade protection.

Getting Started

- Sign up for Greip, obtain your API token, and integrate using the provided SDKs.

- Explore the various services to build a layered defense against fraud across payments, signups, and content.

Related Resources

- Case studies, pricing plans, and integration guides are available on Greip’s website for deeper details.

Core Features Summary

- Payment Fraud Analysis with AI-driven transaction evaluation

- Card Issuer Verification for issuer details

- IBAN Verification & Insights

- Content Moderation for profanity and harmful content

- Proxy & VPN Detection

- IP Location Intelligence

- Network Intelligence (ASN)

- Country Intelligence

- User Data Scoring & Validation

- Real-time Dashboard with actionable insights

- Unlimited Custom Rules & Blacklists

- SDKs/Libraries for major languages

- Flexible, scalable pricing and integrations