IDWise

Open siteIntroduction

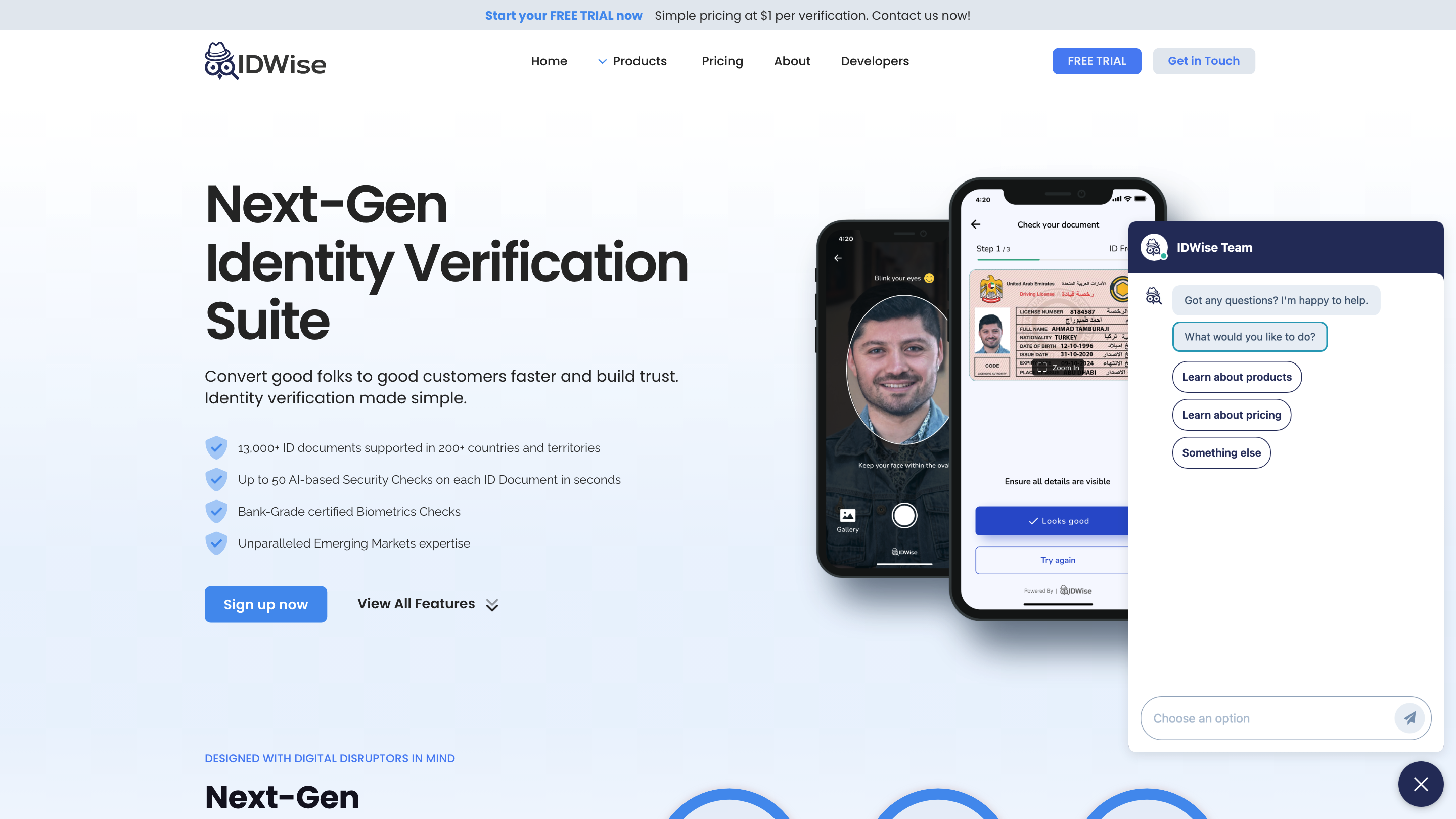

IDWise is an AI-based identity verification solution that helps businesses authenticate customer identities.

IDWise Product Information

IDWise: AI-Based Identity Verification – Trust But Verify

IDWise is an AI-powered, enterprise-grade identity verification suite designed to convert good folks to good customers quickly while maintaining stringent security and regulatory compliance. It supports a wide range of verification steps, document types, and global coverage to streamline onboarding, reduce fraud, and accelerate conversions across emerging markets.

How IDWise Works

- Document Verification: Recognizes government-issued ID documents, extracts data, and validates authenticity in seconds. Supports 13,000+ documents across 200+ countries and territories.

- Facial Verification: Captures a live selfie and matches it against the document photo to confirm the applicant’s real presence.

- e-KYC & AML Compliance: Performs comprehensive screening (PEP, sanctions, adverse media) and real-time fuzzy matching against global watchlists.

- Proof of Address (PoA): Auto-captures and verifies address documents to prevent fraud and money laundering.

- Onboarding Orchestration: Integrates seamlessly into onboarding journeys with optional no-code/low-code integrations and multiple data capture and webhook options. Data can be stored encrypted on IDWise servers or on your premises.

The platform emphasizes speed (onboard within seconds to minutes), accuracy, and a user-friendly experience while delivering robust fraud prevention and regulatory compliance.

Key Capabilities

- AI-driven identity verification with automated, in-house technology

- Global coverage: 13,000+ ID documents, 200+ countries/territories

- Document verification: recognition, data extraction, and validation

- Facial verification: live liveness + face-match checks

- e-KYC & AML: comprehensive screening (PEP, sanctions, adverse media) with real-time updates

- Proof of Address: automatic capture and verification

- High automation with minimal human intervention

- Multiple integration options: Mobile/Web SDKs, APIs, Webhooks, low-code/no-code options

- Flexible deployment: cloud or on-premise data handling

- End-to-end onboarding in seconds to minutes with high first-time pass rates

- Data security and privacy: encrypted data storage with configurable data residency

- UX-focused: streamlined, frictionless customer journeys

Why IDWise

- Simple, scalable onboarding tailored to diverse requirements

- Bank-grade, enterprise-ready identity verification for high-assurance environments

- Global reach with strong performance in emerging markets and non-Latin languages

- Robust fraud prevention without compromising user experience or conversion rates

- Dedicated support from a London-based team with 24/7/365 availability

Use Cases

- Onboarding new customers in fintech, banking, and digital services

- Compliance-driven verification for AML/KYC and regulatory submissions

- Remote identity verification for borderless or hybrid work environments

- Fraud reduction through combined document, facial verification, and PoA checks

Security and Compliance Aspects

- Instant, automated checks with evidence-ready results

- AI-powered but transparent decisioning with auditable trails

- Global AML/PEP/Sanctions screening layered into the verification flow

- Encrypted data handling and flexible data residency options

Getting Started

- 30-day free trial available

- Quick integration with multiple options (SDKs, APIs, Webhooks)

- Clear pricing and scalable plans to fit business needs

Final Note

IDWise positions itself as a proactive, AI-enabled onboarding solution that balances security, compliance, and user experience. It is designed for organizations operating in diverse regulatory landscapes and high-growth markets, enabling faster customer conversion while maintaining rigorous identity assurance.