Inven

Open siteBusiness Research

Introduction

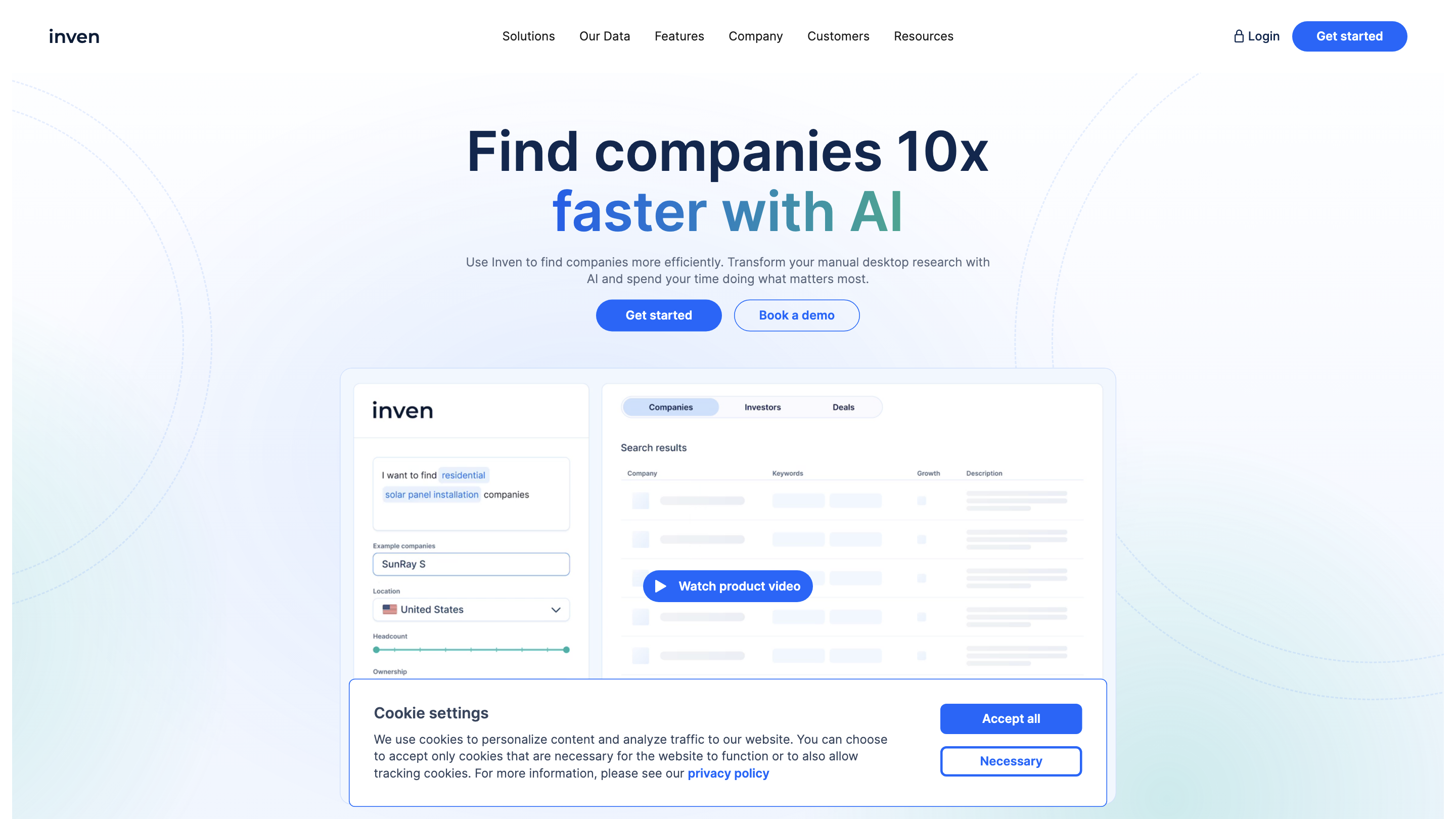

Save time with AI-powered company search.

Inven Product Information

Inven – Find M&A targets 10x faster is an AI-powered platform designed for private equity, investment banking, search funds, business brokers, consulting, corporate development, and venture capital professionals. It enables users to identify high-potential companies and connect with investors or buyers faster by transforming manual desktop research into an AI-assisted discovery process. The platform emphasizes broad market coverage, fast data delivery, and actionable insights drawn from millions of sources.

How It Works

- Describe your target or criteria. Tell Inven what you’re looking for (industry, size, geography, financials, signals, etc.).

- AI-driven data synthesis. Inven pulls from millions of sources, analyzes data, extracts essential details, and delivers a refined list of relevant companies.

- Smart prioritization. Receive opportunities with key data points, reducing endless searching and enabling rapid prioritization.

Core Capabilities

- Identify acquisition targets across private equity, corporate development, search funds, and related areas.

- Discover potential buyers and investors active in your niche.

- Access private market deal data, including company descriptions, financials, and signals.

- Retrieve contact data and key decision-maker information for outreach.

- Integrate with CRM workflows and leverage a Chrome Extension for on-the-go data access.

- Access millions of data points from diverse sources (news outlets, private databases, etc.).

Data and Coverage

- 21M+ companies

- 1M+ transactions

- 430M+ contacts

- 160+ countries

Why Professionals Choose Inven

- Faster target discovery with AI-driven search

- Broad coverage of lower-middle to middle-market companies

- Ability to identify synergistic targets and potential buyers

- Time savings: one tool replaces extensive manual research

- Trusted by leading industry professionals and firms (testimonials available on the platform)

Use Cases

- Private equity firms sourcing potential platform and add-on targets

- Investment banks conducting deal discovery for buyers or sellers

- Search funds seeking acquisition targets aligned with strategic criteria

- Corporate development teams identifying synergy targets for potential acquisitions

- Venture capital firms scouting for potential portfolio exits or acquisition opportunities

How It Helps Your Workflow

- Streamlines target identification and prioritization

- Accelerates outreach by providing decision-maker contact data

- Supports fast, data-driven decision making for deal sourcing

- Reduces reliance on manual Google searches and fragmented data sources

Safety and Ethical Considerations

- Ensure compliance with data privacy and outreach regulations when contacting potential targets or investors.

- Use ethical sourcing practices and respect recipient preferences during outreach.

Core Features

- AI-powered target discovery across private markets

- Fast identification of acquisition targets, buyers, and investors

- Access to private market deal data and actionable insights

- Large-scale data coverage (21M+ companies, 430M+ contacts, 160+ countries)

- CRM integrations and Chrome Extension for seamless workflows

- Comprehensive data points to inform deal discussions and outreach