Kick

Open siteLegal & Finance

Introduction

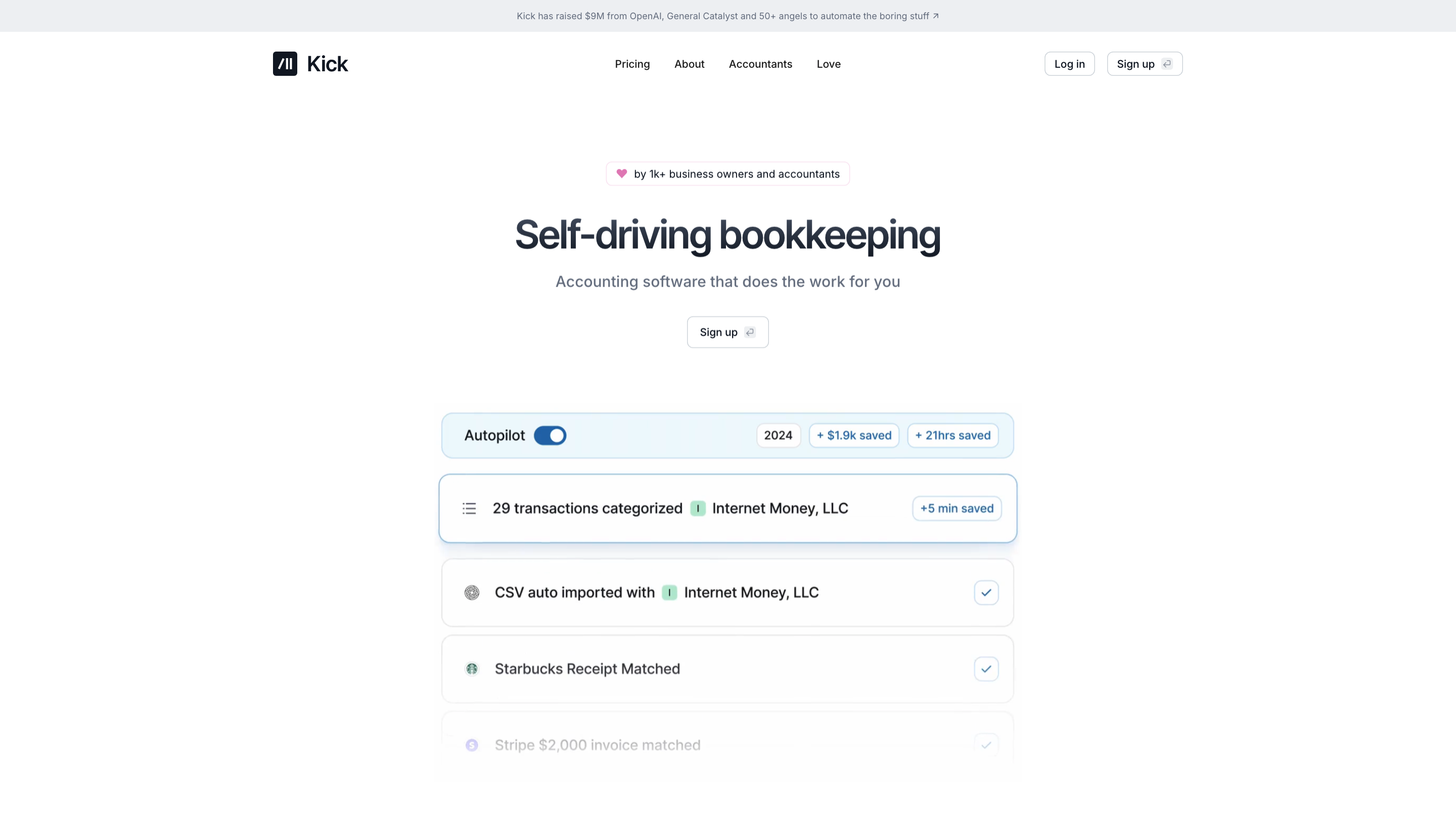

AI-driven accounting software for automated bookkeeping.

Kick Product Information

Kick | Self-Driving Bookkeeping is an AI-powered accounting software that automates bookkeeping tasks so business owners and accountants can focus on what matters. It offers real-time transaction categorization, rule-based automation, expense insights, multi-entity support, and tax-ready financials, all designed to operate with minimal manual effort and to collaborate with your tax advisor or CPA.

How it works

- Auto-categorization in real-time. Transactions are categorized automatically and reviewed by an expert for accuracy.

- Customize rules. Adapt suggested automation rules to fit your business needs and lifecycle.

- Identify deductions. Automatically catch easy-to-miss deductions (home office, vehicle, travel, etc.).

- Revenue insights. Create custom revenue lines to show monthly income sources.

- Monitor spending. Monthly breakdowns by vendor across one or multiple accounts or businesses to identify unnecessary expenses.

- Multi-entity support. Manage insights across all your business entities at no extra cost.

- Dual-entry accounting. Built to collaborate with your tax advisor and ensure reconciled entries.

- General ledger. Multi-entity Journal Entries that balance quickly.

- Tax-ready financials. Produce Profit & Loss and Balance Sheet reports you can share with your accountant.

Key Features

- Auto-categorization of transactions in real-time with expert review

- Customizable rules to tailor automation to your business

- Automatic deduction identification (home office, vehicle, travel, etc.)

- Revenue insights with custom revenue lines

- Spending monitoring with monthly vendor breakdowns across accounts/entities

- Multi-entity support with insights across all entities

- Dual-entry accounting designed for collaboration with tax professionals

- General ledger with fast, balanced journal entries

- Tax-ready financial statements (Profit & Loss, Balance Sheet)

- Intercompany and multi-entity reconciliation and transfers

- Ease of onboarding and modern, automated bookkeeping workflow

Why users choose Kick

- Automates repetitive bookkeeping tasks to save time

- Helps maintain financial hygiene and accuracy

- Facilitates collaboration with accountants and CPAs

- Scales across multiple entities without added cost

Safety and Compliance Considerations

- Designed to support collaboration with tax advisors; ensure accuracy with expert reviews where needed.

- Suitable for small to medium-sized businesses seeking hands-off bookkeeping with audit-ready outputs.