Kyber

Open siteLegal & Finance

Introduction

AI tool for efficient insurance notice drafting and management.

Kyber Product Information

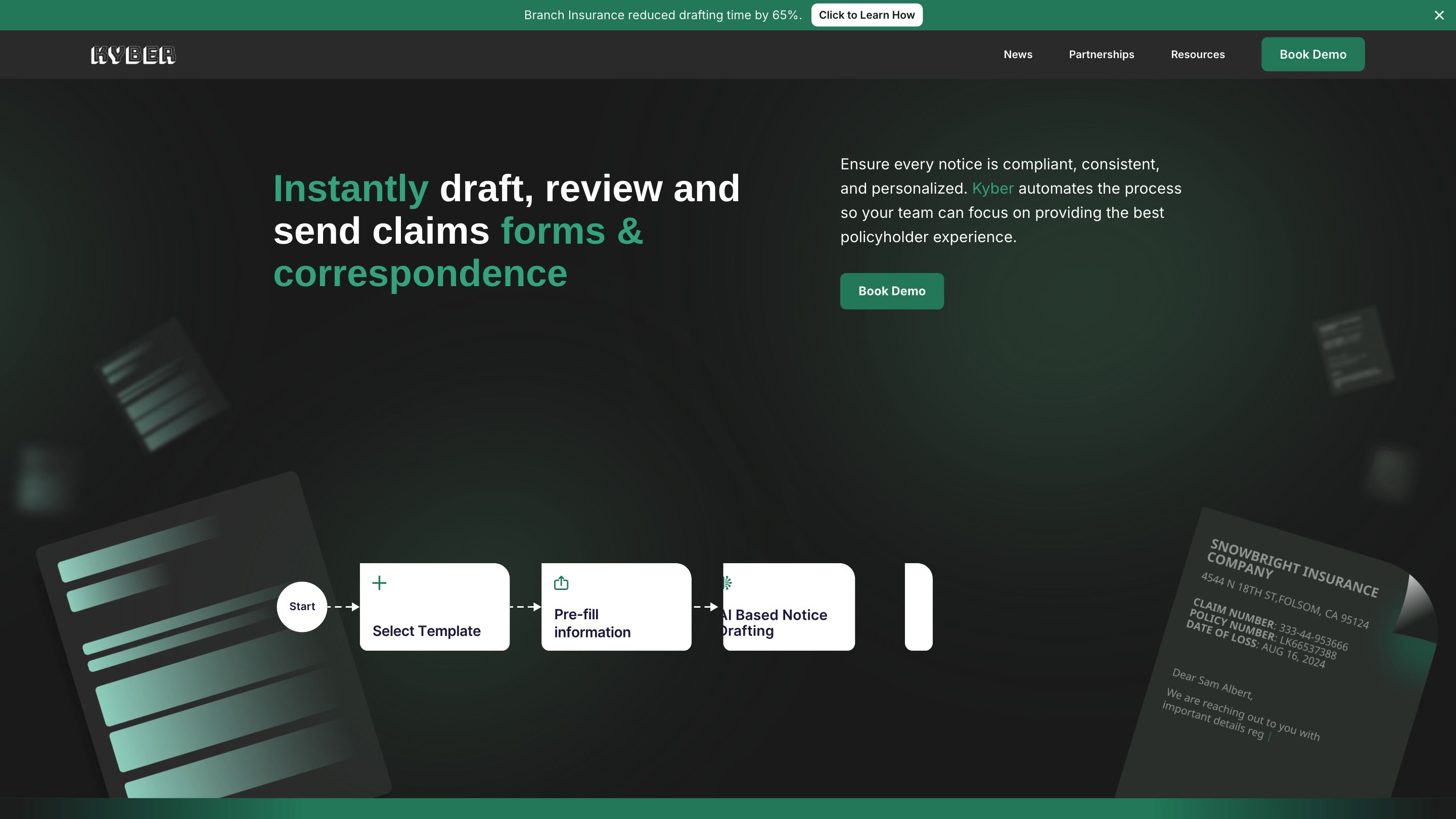

Kyber - AI Workflow for Complex Insurance Notices is an AI-powered claims communications platform designed to dramatically reduce drafting time, ensure compliance, and deliver personalized, audit-ready notices. Built for P&C (property & casualty) claims, Kyber pulls policy details, claim data, and jurisdictional requirements into dynamic templates, enabling instant generation, review, and omnichannel delivery of notices. The system emphasizes accuracy, compliance, collaboration, and seamless integration with existing claims workflows to enhance policyholder experience and operational efficiency.

How It Works

- Purpose-built for P&C claims, supporting every step from first draft to final send.

- Generates structured, compliant notices in seconds by pulling policy data, claim details, and jurisdictional rules into managed templates.

- AI extracts relevant policy language, drafts narratives from claim notes, and formats notices instantly to save time.

- Built-in review workflows with tracked edits, multi-layer approvals, real-time collaboration, version control, and role-based visibility.

- Fully tracked omnichannel delivery with automatic routing to the right channel (print mail or email) and recipient, with delivery details synced to the claims system for compliance and audit readiness.

- Centralized, self-service template management with dynamic templates that adjust by claim type, coverage, and state.

Benefits

- Significantly reduces drafting time (examples show substantial efficiency gains).

- Improves accuracy and compliance by pre-filling correct policy language and applying jurisdictional requirements.

- Enables scalable, consistent notices across the organization with a single source of truth.

- Integrates with existing claims systems and workflows with minimal IT lift.

- Auditable, SOC 2-compliant security posture with options for on-premise deployment.

Core Features

- AI-powered drafting: pulls policy language, applies jurisdictional rules, auto-generates notices.

- Structured templates: dynamic, claim-type/state-specific templates with one-click customization.

- Review and collaboration: built-in workflow with edits, approvals, and version history.

- Multichannel delivery: automated print/mail and email delivery with tracking and status updates.

- Claims-system integration: seamless integration with existing core systems and processes.

- Compliance and auditability: end-to-end audit trails for all drafts, edits, and deliveries.

- Template management: centralized, self-service management of templates and formatting.

- Rapid onboarding and scalability: designed for enterprise use with scalable template governance.

Use Cases

- Generating policyholder notices for claims acknowledgments, denials, settlements, and reserve communications.

- Jurisdiction-specific notice generation across multiple states or entities.

- Centralized management of notice templates and assurance of consistency across volumes.

- Audit-ready document generation for compliance reviews and regulatory inquiries.

Safety & Compliance Considerations

- SOC 2 Type II compliant security posture with options for on-premise deployment.

- Role-based access, data handling controls, and audit trails to support regulatory requirements.

Why Kyber Stands Out

- It is not just a template library; it uses AI to assemble the exact policy language, apply rules, and generate accurate notices automatically, with full traceability.

- Lightweight implementation that fits into existing claims ecosystems with minimal disruption.

- Clear time savings, reduced risk of formatting errors, and scalable, consistent communications across the enterprise.