LoanSim

Open siteLegal & Finance

Introduction

Track loans easily

LoanSim Product Information

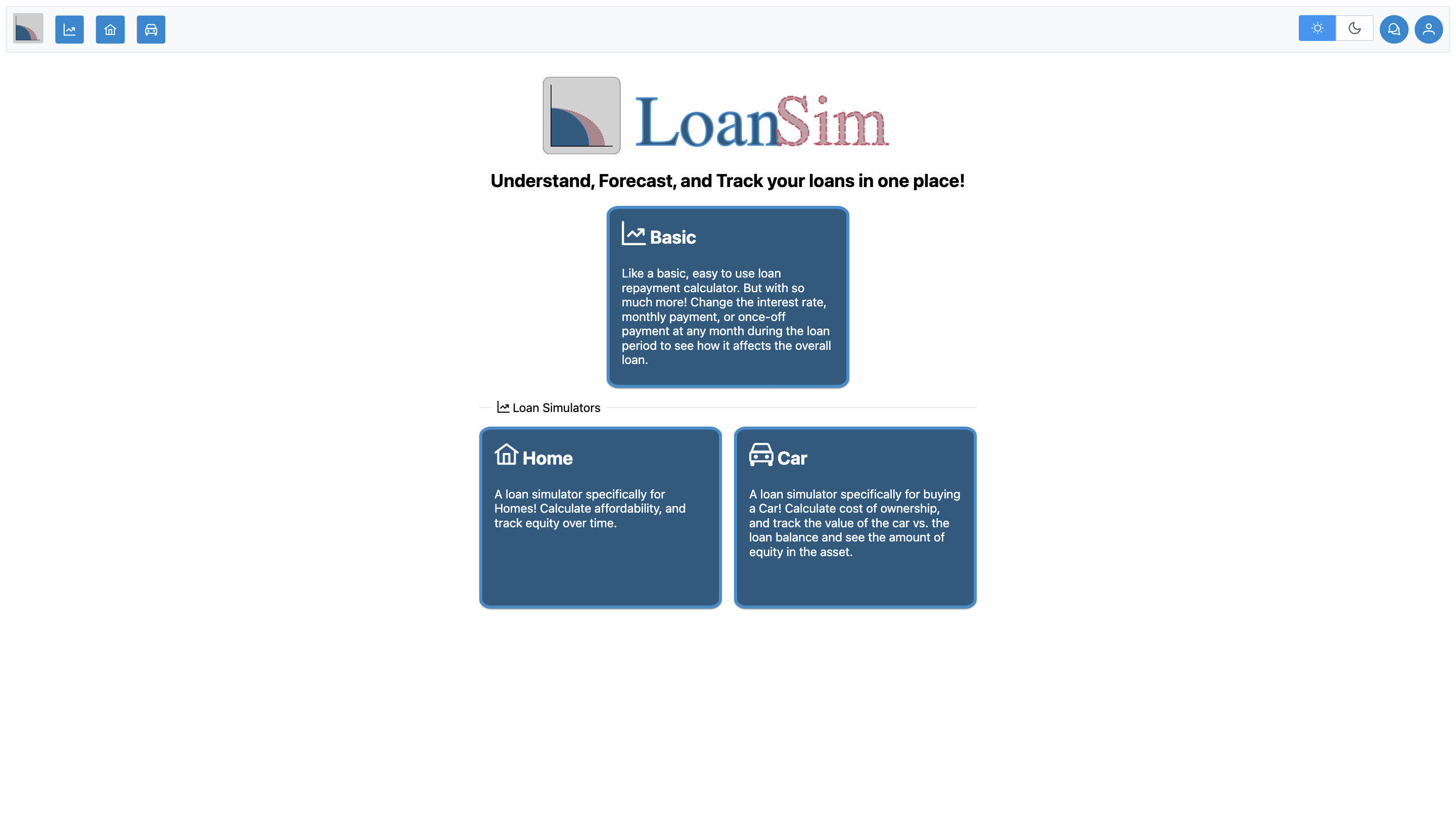

LoanSim: Understand, Forecast, and Track Your Loans in One Place

LoanSim is a versatile tool designed to help you understand, forecast, and monitor loans. It starts as a basic loan repayment calculator but adds powerful features that let you adjust variables like interest rate, monthly payments, and one-off payments at any month to see how these changes impact the overall loan. The platform includes specialized simulators for Homes and Cars to help with affordability, equity tracking, and cost-of-ownership insights.

How it works

- Start with a loan profile. Enter loan amount, interest rate, loan term, and any upfront or monthly payments.

- Experiment with changes. Modify the interest rate, monthly payment, or insert a one-off payment at any month to visualize effects on total interest, payoff date, and remaining balance.

- Use specialized simulators. Switch to Home or Car simulators to analyze affordability, equity, and ownership costs over time.

- Track progress. Monitor your equity buildup for homes and the balance vs. asset value for cars as you repay the loan.

Loan Simulators

- Home: A loan simulator specifically for Homes. Calculate affordability and track equity over time.

- Car: A loan simulator specifically for buying a Car. Calculate cost of ownership and track the value of the car vs. the loan balance to see the amount of equity in the asset.

How to Use LoanSim

- Create a loan profile. Enter principal, interest rate, term (months/years), and any initial or ongoing payments.

- Adjust as needed. Change interest rate, monthly payment amount, or add a one-off payment in any month to observe the impact on payoff date and total interest.

- Switch simulators for context. Use Home or Car modules to assess affordability, equity, and ownership costs relevant to your asset.

- Review dashboards. Track payoff progress, remaining balance, and equity/value relationships over time.

Safety and Legal Considerations

- Ensure inputs are accurate and up-to-date with your loan terms. Use the tool for planning and educational purposes and consult a financial advisor for formal guidance.

Core Features

- Basic loan repayment calculator with interactive capability to alter rate, payments, and timing

- Dynamic visualization of payoff date, total interest, and remaining balance

- One-off payment modeling at any month to see effects on loan trajectory

- Dedicated Home loan simulator for affordability and equity tracking

- Dedicated Car loan simulator for cost of ownership and equity analysis

- Consolidated view to understand multiple loans in one place

- Intuitive UI designed for quick scenario analysis and planning