Lorna

Open siteLegal & Finance

Introduction

Investment platform using CFMS for smarter decisions.

Lorna Product Information

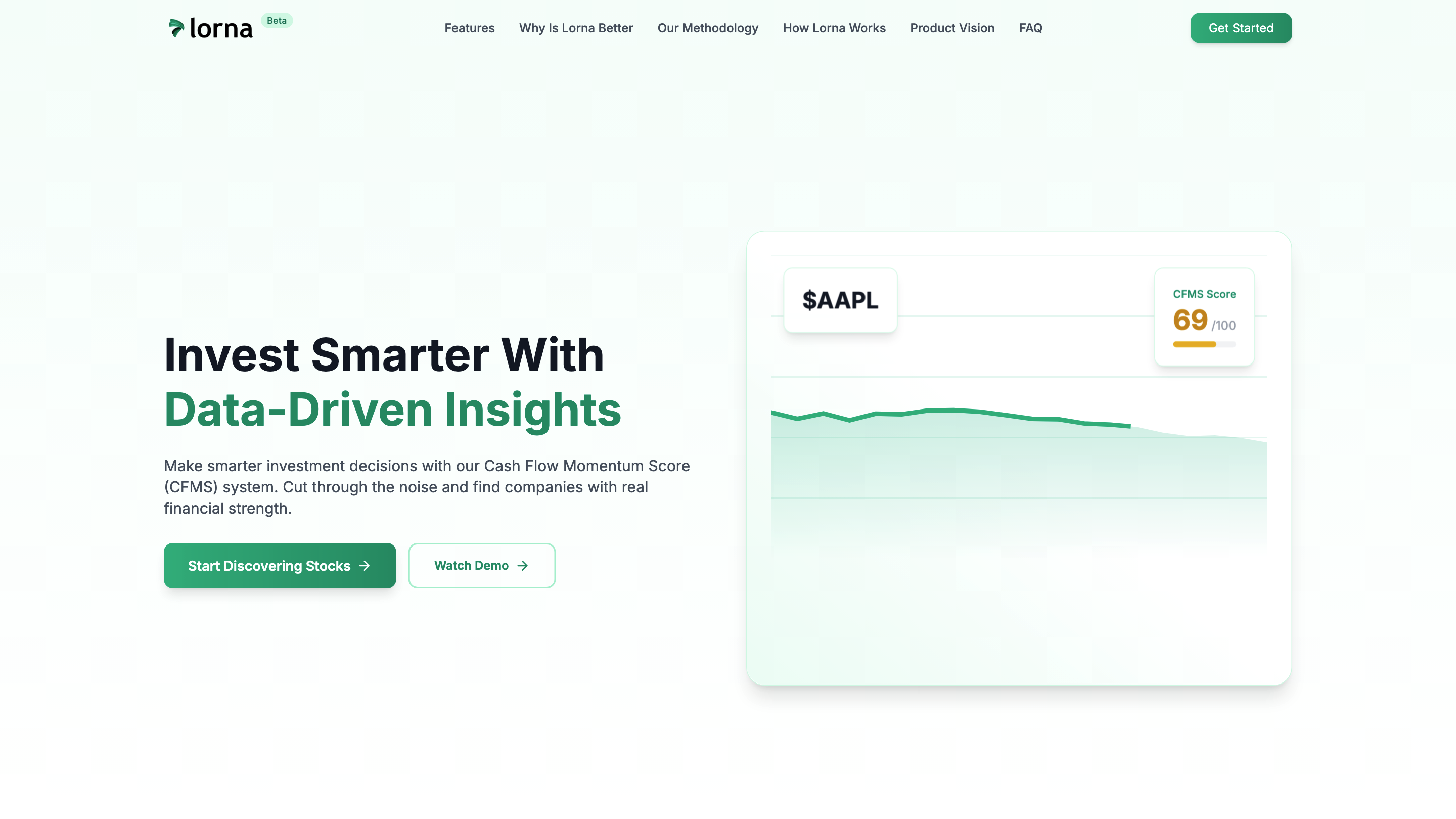

Lorna - Invest Smarter With Data-Driven Insights is a data-driven investment platform that uses the Cash Flow Momentum Score (CFMS) to identify financially strong companies. It emphasizes cash flow as the key indicator of a company’s health and growth potential, offering comprehensive analytics, actionable insights, and AI-powered discovery to help users make smarter investment decisions. The platform covers thousands of U.S. and Canadian companies, with real-time updates and automated tools to support research, screening, and strategy execution.

How Lorna Works

- Analyze Companies – The system scans thousands of publicly traded companies, extracting financial data from SEC filings and official reports.

- Calculate CFMS – A proprietary algorithm computes the Cash Flow Momentum Score for each company.

- Identify Opportunities – Companies with strong cash flow health and growth potential are highlighted for potential investment.

Why CFMS Scores Matter

- Cash flow is the true indicator of a company’s health and resilience, especially during economic downturns.

- Lorna’s CFMS provides holistic, data-driven insights beyond traditional earnings-focused analyses.

- The scoring is designed to be transparent, rigorous, and unbiased, helping investors make informed decisions.

What You Get with Lorna

- Comprehensive Cash Flow Analysis: Evaluate ability to generate and grow cash flow over time.

- Comprehensive Scoring: Holistic view of financial health via the CFMS system.

- Risk Mitigation: Flag potential red flags and weak financial foundations.

- Actionable Insights: Clear, data-driven recommendations for investment decisions.

Core Metrics & Methodology

- Five key metrics analyzed by the CFMS algorithm (e.g., Operating Cash Flow Growth, Cash Flow Efficiency, Return on Invested Capital, EBITDA Margin, Free Cash Flow Yield).

- Score Range: 0-100 for final output.

- Data Sources: SEC Filings (10-K, 10-Q, 8-K), quarterly earnings, cash flow statements, balance sheets, income statements.

Platform Capabilities

- CFMS Dashboard: AI-driven analysis with real-time market coverage.

- Intelligent Discovery: AI-powered stock discovery and CFMS-based screening.

- Automated Execution: Strategic automated investing with customizable execution settings.

- 5,000+ Companies Covered, 99.9% Accuracy Rate, 365 Daily Updates.

- Machine learning-powered stock screening and predictive growth indicators.

- Real-time performance tracking and risk management.

- Intelligent Document Analysis: NLP for SEC filings, earnings calls, and corporate communications (future release).

How Lorna Works (Simple Three-Step Process)

- Analyze Companies – Scan thousands of publicly traded companies and collect financial data.

- Calculate CFMS – Apply the proprietary CFMS algorithm to score each company.

- Identify Opportunities – Highlight companies with strong cash flow health and growth potential.

Latest Insights & Resources

- Platform overview and educational content on cash flow-driven investing.

- Articles on why cash flow matters and the CFMS index as a benchmark.

- Investor education resources to empower retail investors.

Getting Started

Join thousands of investors using Lorna to discover high-quality stocks and improve portfolio performance. Get started today.

FAQ Highlights

- What is CFMS? How often is it updated? Is it suitable for beginners? What markets are covered? How accurate is CFMS?

- Access to tools and support through Help & Support, FAQs, and Legal policies.

Core Features

- CFMS scoring for thousands of companies (0-100 scale) using cash flow-focused metrics

- AI-powered stock discovery and screening based on CFMS

- 5,000+ companies covered with 365 daily updates

- Real-time market analysis and predictive indicators

- Automated execution and risk management for strategy deployment

- Transparent, data-driven, and unbiased insights beyond earnings reports

- Desktop and mobile access with user-friendly interfaces

- Educational resources to empower retail investors

- Privacy-conscious data handling and secure platform