MindBridge AI

Open siteLegal & Finance

Introduction

Global leader in financial risk discovery

MindBridge AI Product Information

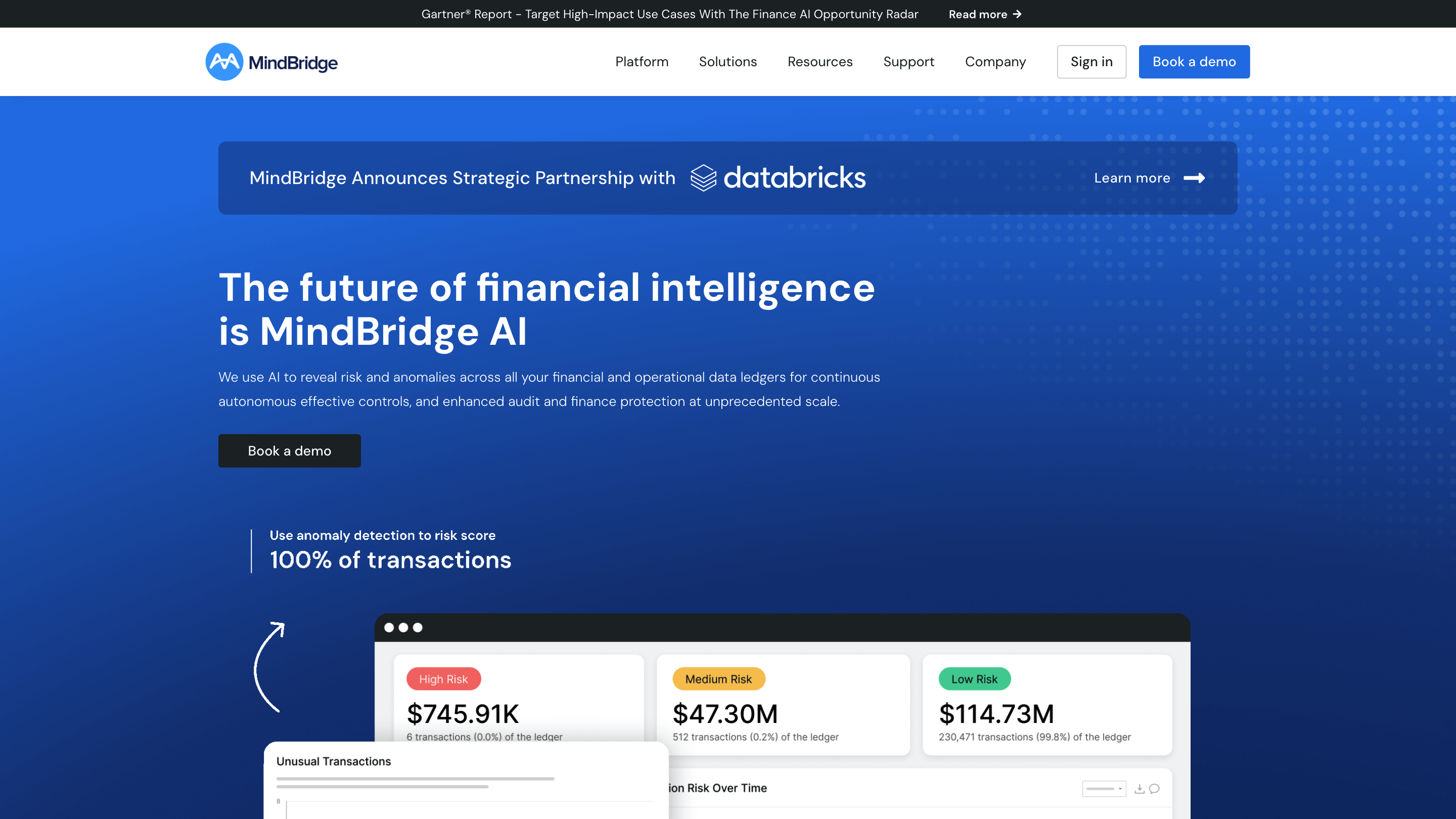

MindBridge AI Platform is a financial risk discovery and anomaly detection solution that continuously analyzes 100% of an organization's financial and operational data across ledgers to provide autonomous, effective controls and enhanced audit and finance protection at scale. It combines advanced machine learning, statistical methods, and traditional business rules to identify errors, anomalies, and potential risks that might go unnoticed with manual or traditional risk management approaches.

What it does

- Provides continuous oversight of financial transactions to uncover irregularities, errors, and potential fraud across the general ledger, payroll, travel and expense, vendor invoices, and customer revenue scenarios.

- Delivers a holistic view of risk by analyzing 100% of transactions, aimed at improving accuracy, trust in financial reporting, and the effectiveness of controls.

- Enables proactive risk management by surfacing actionable insights and prioritizing investigation focus areas.

How it works

- Pre-built machine learning control points (over 250) analyze all transactions in real time, applying statistical methods and business rules.

- Outputs targeted risk signals and analytics to auditors, finance teams, and risk managers, guiding deeper investigation where it matters most.

- Facilitates streamlined implementations to accelerate time-to-value and enable scalable risk discovery across large data sets.

Use cases

- General Ledger Analysis: improve accuracy and holistic oversight of ledger data.

- Customer Analysis: assess revenue recognition risk, segmentation, and unusual activity.

- Payroll Analysis: detect misallocations and payroll anomalies.

- Travel & Expense Analysis: identify card transactions anomalies and spending trends.

- Vendor Analysis: flag incomplete or late invoices and related risks.

Core Benefits

- Continuous monitoring of all financial data to catch errors before they escalate.

- AI-driven anomaly detection combined with traditional controls for robust risk coverage.

- Scalable, out-of-the-box risk analytics designed for audit, assurance, and finance teams.

- Data-driven insights that support faster, more accurate decision-making and enhanced public trust.

Outcomes

- Reduced financial risk exposure and improved control effectiveness.

- Proactive identification of irregularities to prevent financial losses and compliance issues.

- Enhanced audit quality and efficiency through targeted, data-backed investigations.

How to Talk About MindBridge AI Platform

- It’s the AI-powered platform that continuously analyzes all transactions to reveal risk and anomalies, enabling autonomous controls and enhanced protection at scale.

- It’s suitable for enterprise audit, assurance, and finance teams seeking deeper visibility into financial risk across all ledgers and processes.

Features

- Continuous, 100% transaction coverage across ledgers and operational data

- Pre-built ML-based risk controls (250+) and statistical techniques

- Universal applicability to GL, payroll, travel & expense, vendor, and customer data

- AI-driven anomaly detection with actionable insights and prioritized investigations

- Out-of-the-box configurations for rapid deployment and time-to-value

- Scalable for large organizations with zero compromise on coverage or speed

- Integration-friendly platform supporting enterprise audit and assurance workflows

- Trusted by global brands and professional services firms for enhanced financial oversight