NRI GPT

Open siteIntroduction

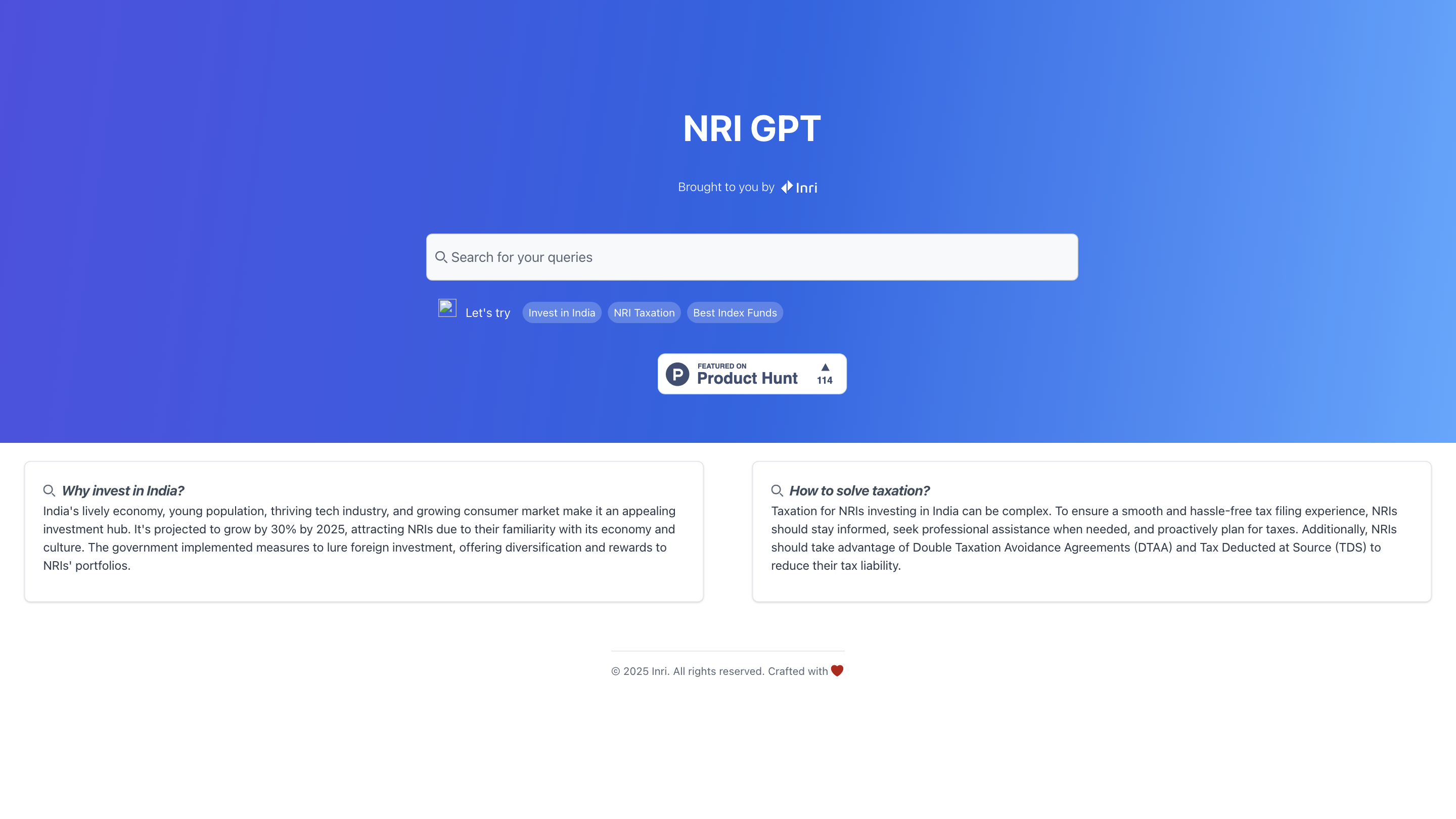

Summary: NRI GPT is a chatbot for NRIs, helping with India investing and taxes.

NRI GPT Product Information

NRI GPT: Your Guide to Investing in India for NRIs

NRI GPT is an AI-powered information and advisory tool designed to help Non-Resident Indians (NRIs) understand and navigate investing in India. It highlights why India is an appealing investment destination, outlines essential tax considerations (including DTAA and TDS), and provides guidance on selecting investment options such as index funds. The content emphasizes staying informed, seeking professional assistance when needed, and planning for taxes to ensure a smooth filing experience.

Why invest in India?

- India’s economy is dynamic with a young population and a thriving tech sector.

- A growing consumer market and favorable government initiatives attract foreign investment.

- The economy is projected to grow substantially in the near term, presenting opportunities for diversification and portfolio growth.

Taxation and Compliance for NRIs

Taxation for NRIs investing in India can be complex. Practical guidance includes:

- Stay informed about tax rules and filing requirements.

- Seek professional assistance when needed to ensure accuracy and compliance.

- Leverage Double Taxation Avoidance Agreements (DTAA) to reduce tax liability.

- Understand Tax Deducted at Source (TDS) implications on Indian investments.

How to Solve Taxation for NRIs

- Consult a qualified tax advisor who specializes in NRI taxation.

- Keep updated on DTAA provisions between India and your country of residence.

- Plan tax implications ahead of income events (dividends, capital gains, etc.).

- File your tax returns accurately and on time to avoid penalties.

Investment Options Highlighted

- Best index funds and other suitable instruments for NRIs seeking diversified exposure to the Indian market.

- Guidance on diversification, risk tolerance, and long-term growth.

Safety and Legal Considerations

- This content provides informational guidance and should not be considered official tax or legal advice.

- Always consult with qualified professionals for personalized planning and compliance.

Core Features

- NRI-focused investment guidance for India

- Tax planning insights including DTAA and TDS considerations

- Information on the best index funds and diversified investment options

- Practical steps for tax filing and compliance

- Emphasis on professional consultation and proactive planning

How to Use NRI GPT

- Ask questions about investing in India as an NRI (e.g., suitable index funds, tax implications, DTAA benefits).

- Review tax considerations (DTAA, TDS, filing requirements) and seek professional help if needed.

- Plan and implement investment strategies with awareness of regulatory and tax implications.

Disclaimer: The information provided is for informational purposes only and does not constitute professional tax or legal advice.

© 2023 Inri. All rights reserved. Crafted with