Osfin.ai

Open siteLegal & Finance

Introduction

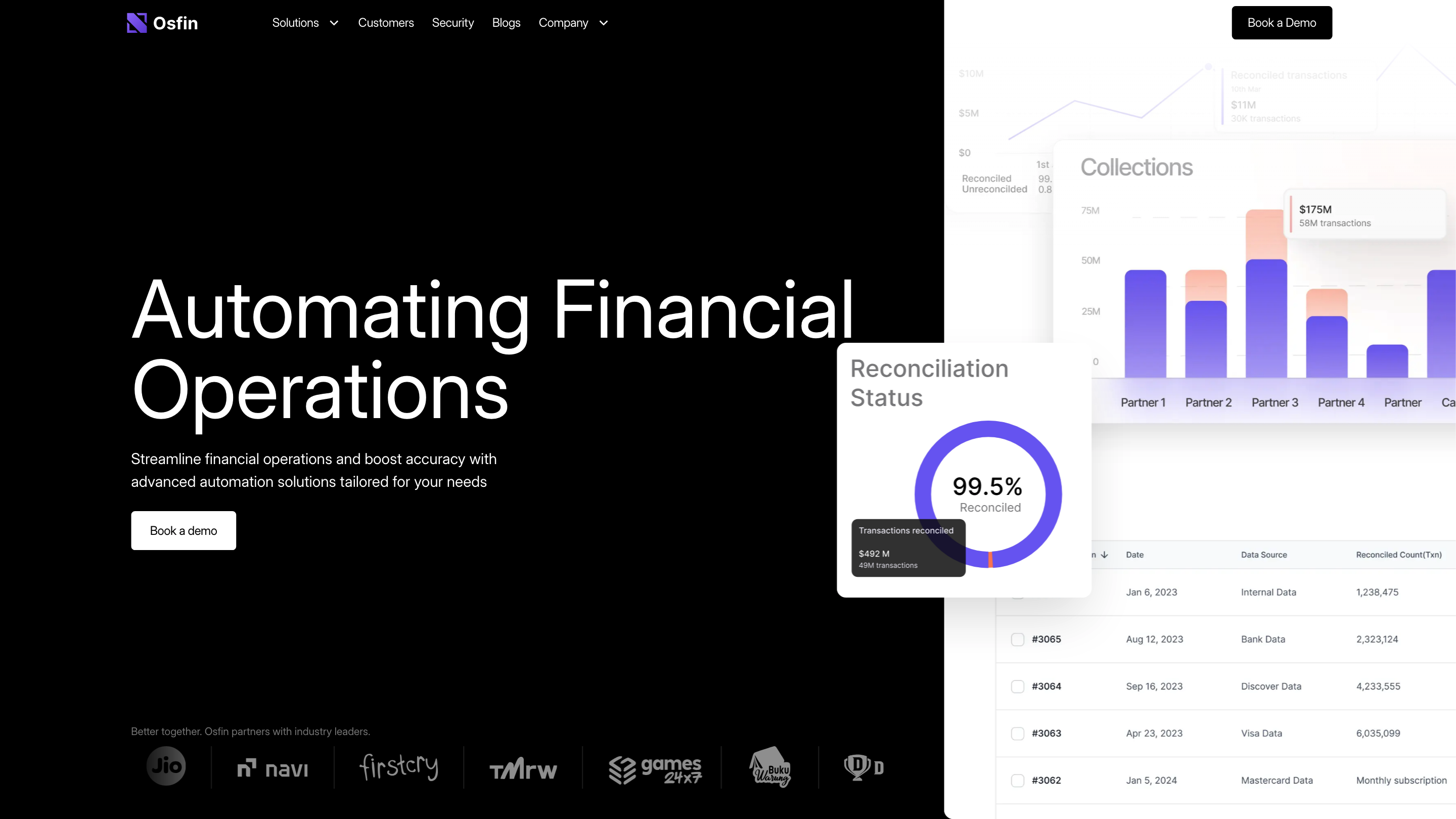

Finance and accounting automation platform.

Osfin.ai Product Information

Osfin | Automated Financial Operations Solutions is a comprehensive automation platform designed to streamline and accurately reconcile large volumes of financial data across banking, payments, fintech, insurance, capital markets, gaming, and retail workflows. The solution emphasizes high-speed reconciliation, data unification, and intelligent automation to boost cash flow visibility, reduce manual effort, and minimize revenue leakage. It targets enterprises seeking end-to-end automation of financial operations with robust security and compliance.

Key Use Cases

- Banking & Payments: High-speed reconciliation for ACH, deposits, loans, payments, invoices, and more.

- Fintech: Unify data and automate reconciliation across diverse fintech data sources and payment flows.

- Insurance: Automate insurance reconciliation to handle intricate transactions seamlessly.

- Capital Markets: Maintain and reconcile high-volume trades, positions, and related settlements, including crypto transactions.

- Gaming Platform: Real-time reconciliation for high-volume gaming transactions to ensure accuracy and speed.

- Retail: Seamlessly reconcile retail transactions across channels with high accuracy.

How Osfin Works

- Leverage a low-code platform to integrate data from 170+ sources and systems.

- Automate end-to-end reconciliation across deposits, payouts, loans, payments, invoices, and more.

- Provide real-time visibility into cash flows with insightful dashboards and reports.

- Proactively support operations with continuous customer support to ensure successful implementation and utilization.

Core Capabilities

- Automate reconciliation across multiple domains (Banking, Payments, Fintech, Insurance, Capital Markets, Gaming, Retail).

- High-speed data processing and matching for large-scale financial transactions.

- Data unification to create a transformed fintech ecosystem with streamlined payment processing and lending efficiencies.

- Tailored automation for payouts validation, data reporting, and operational workflows.

- Proactive, dedicated customer support and ongoing operational assistance.

- Strong security posture and compliance alignment (GDPR compliant, ISO 27001, SOC 2, PCI DSS & PCI SSF) to protect data and processes.

Why Teams Choose Osfin

- Achieve real-time visibility of cash flows at granular SKU or transaction levels.

- Reduce manual reconciliation effort and prevent revenue leakage.

- Improve cash flow management, accuracy, and operational efficiency across finance teams.

How to Get Started

- Book a demo to discuss your reconciliation needs and how Osfin can be tailored to your environment.

- Explore automated setups for banking, payments, and other supported domains.

- Leverage the low-code integrations and configurable workflows to fast-track deployment.

Security & Compliance

- GDPR compliant, ISO 27001 certification, SOC 2 compliance.

- 256-bit SSL encryption and PCI DSS/PCI SSF standards for data security.

What’s Included

- Dashboarding and reporting for clear, actionable financial insights.

- Proactive support to ensure successful implementation and ongoing optimization.

- 170+ integrations to accelerate data ingestion and reconciliation.

Features

- Automated reconciliation across Banking, Payments, Fintech, Insurance, Capital Markets, Gaming, and Retail

- High-speed, scalable data processing and matching

- Data unification to create a cohesive fintech data ecosystem

- Low-code platform with 170+ integrations

- Payouts validation, data reporting, and customizable reconciliation workflows

- Real-time cash flow visibility and detailed dashboards

- Proactive customer support and ongoing optimization

- Security and compliance: GDPR, ISO 27001, SOC 2, PCI DSS/PCI SSF