Parthean

Open siteEducation & Translation

Introduction

Parthean is a platform that uses AI to educate and empower users in finance.

Parthean Product Information

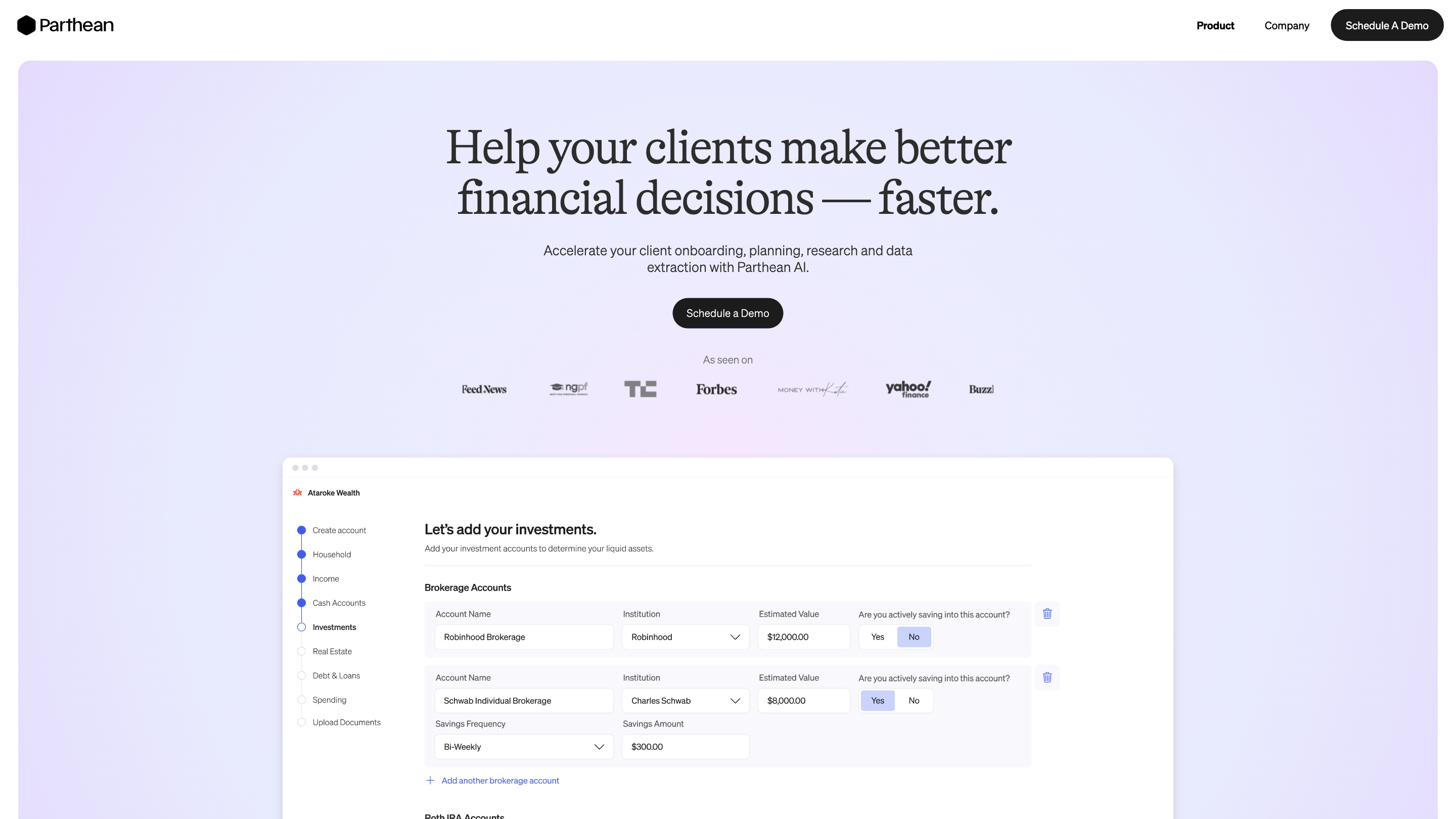

Parthean For Advisors is an AI-powered financial planning assistant designed to accelerate client onboarding, planning, research, and data extraction. It combines planning modules, data gathering and extraction tools, and an AI paraplanner to help Advisors deliver faster, more organized financial guidance to clients. The platform emphasizes efficiency, deeper client insights, and enhanced collaboration through AI-assisted workflows.

Overview

- An AI-enhanced financial planning platform that helps gather client information, perform comprehensive research, and automate routine tasks.

- Targets Advisors, Analysts, and Researchers, providing tools to streamline planning, data extraction, and client communication.

- Aims to reduce hours spent on document reading and data entry while delivering structured, actionable outputs such as 1-page memos, portfolio analysis, and customizable first-draft plans.

How It Works

- Gather client data through customizable forms and onboarding questionnaires.

- Use data extraction capabilities to import information from documents (tax returns, investment statements, etc.).

- Leverage AI paraplanner agents to conduct research, analyze client details, and answer planning questions.

- Generate planning outputs (memos, drafts, agendas) and shareables that can be used in client meetings.

- Clients access advice and status via a mobile or desktop app, enabling collaboration and transparency.

Use Cases

- Tax-efficient strategy: tailor tax optimization, harvest losses, and donor-advised fund planning.

- Investment memos: produce concise 1-page research summaries on securities.

- Portfolio analysis: assess risk metrics, asset/sector allocation, and optimization suggestions.

- Planning opportunities: identify actionable opportunities across liquidity, insurance, budgeting, investing, and estate planning.

- Meeting prep: generate tailored meeting agendas to fit client needs.

- First draft financial plans: create draft plans quickly for client review.

How to Use Parthean AI

- Build or customize client intake forms using the dynamic form builder. Send onboarding forms, risk tolerance questionnaires, and document uploads directly through the platform.

- Upload documents to be parsed by 15+ extractors to populate client data within the platform.

- Engage the AI Paraplanner to perform in-depth research and analyze client details to answer planning questions.

- Generate output documents (1-page memos, draft plans, meeting agendas) and share with clients.

- Clients access the platform to view accounts, track tasks, upload/view documents, monitor spending, schedule calls, and chat with you.

Data Handling & Compliance

- Data extraction and analysis are designed to minimize manual entry and to centralize client information within Parthean’s planning environment.

- The platform emphasizes educational use and professional guidance; it explicitly positions itself as a tool to support advisors, not as a substitute for professional judgment.

- Users should ensure compliance with applicable regulations and maintain appropriate oversight when using AI-generated outputs.

Safety and Legal Considerations

- Parthean is educational and not a financial advisor, broker, or accountant. It is intended to support advisor workflows and client education, not provide binding financial advice.

- All outputs should be reviewed by a licensed professional before use with clients. Do not rely solely on AI-generated conclusions for regulatory or transactional decisions.

Core Features

- Customizable form builder for client onboarding and risk questionnaires

- Data extraction with 15+ extractors to import documents directly into the platform

- AI Paraplanner agents to perform extensive research and analyze client details

- 1-page investment memos for quick, digestible insights

- Portfolio analysis with risk metrics, allocation insights, and optimization suggestions

- Planning modules for liquidity, insurance, budgeting, investing, estate planning, goals, and more

- Meeting prep with tailored agendas aligned to client needs

- First-draft financial plan generation for rapid client proposals

- Client-facing access via mobile and desktop apps for transparency and collaboration

- Educational, non-solicit approach with clear disclaims to encourage responsible use