PortfolioPilot

Open siteLegal & Finance

Introduction

PortfolioPilot is an advanced tracker to effectively manage investment portfolios.

PortfolioPilot Product Information

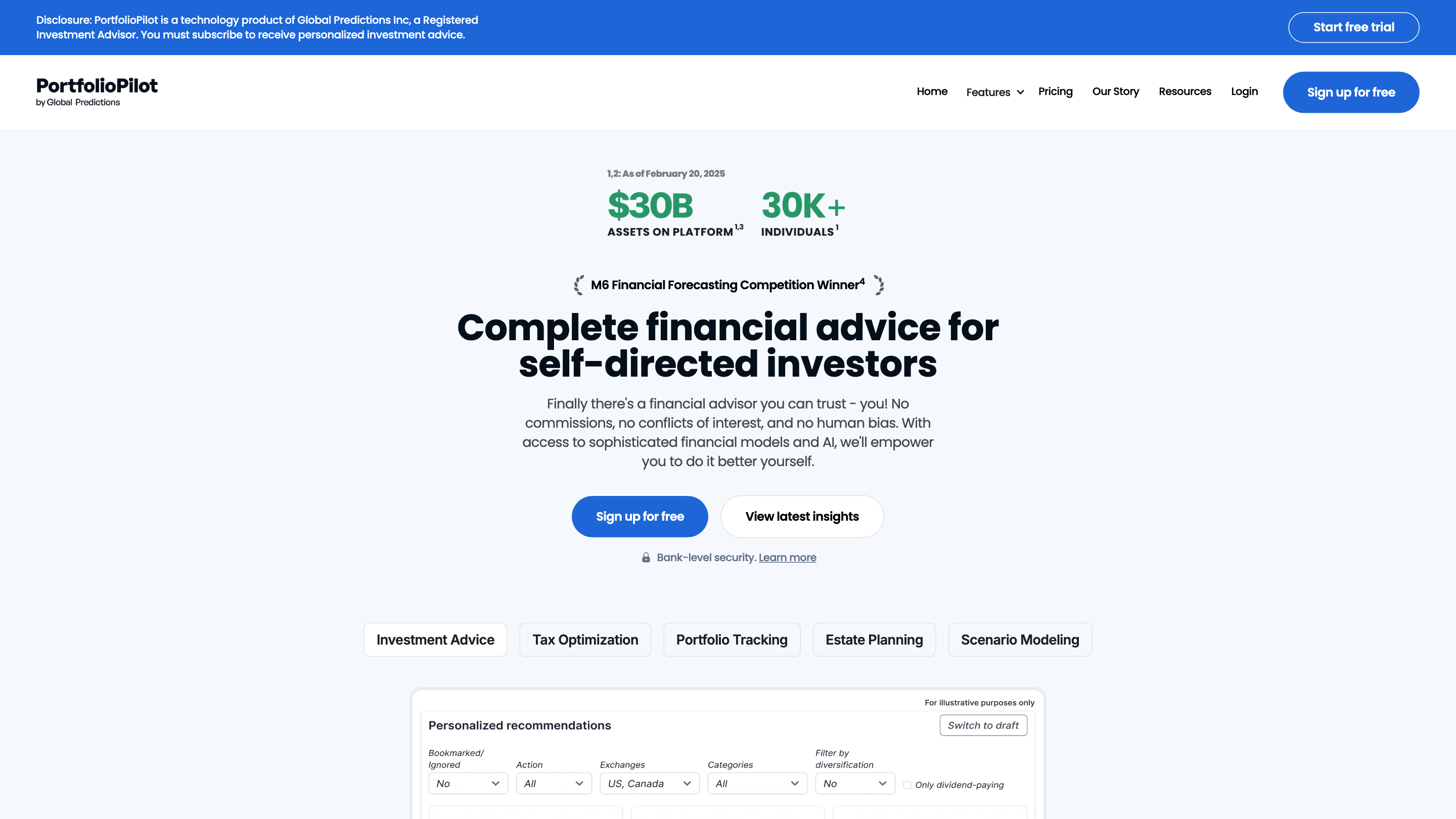

PortfolioPilot – Your Personal AI Financial Advisor

PortfolioPilot is a technology product from Global Predictions Inc (a SEC Registered Investment Advisor) that provides AI-assisted financial insights and planning tools for self-directed investors. Access to personalized investment advice requires a subscription, with a free trial available. The platform emphasizes fiduciary, bias-free guidance, bank-level security, and a data-driven approach to portfolio management. It aggregates and analyzes a broad set of assets, offers scenario modeling, tax optimization, estate planning, and real-time portfolio tracking to help users optimize their financial outcomes.

How PortfolioPilot Works

- Aggregate your assets. Connect and visualize all holdings across brokerage accounts, 401(k)s, IRAs, crypto, cash, real estate, private equity, precious metals, and more in a single net-worth view.

- AI-driven recommendations. The hybrid AI engine combines hedge-fund-inspired models, large-language models, and machine learning to generate personalized portfolio recommendations tailored to your goals, risk tolerance, and constraints.

- Scenario modeling. Use Monte Carlo and other simulations to forecast potential outcomes under different decisions and market conditions.

- Estate planning & tax optimization. Automated tools provide estate planning insights and continuous tax-loss harvesting opportunities to improve after-tax returns.

- Security & control. The platform uses bank-level security with read-only access to connected accounts, ensuring you retain control of your finances.

- Understand your risk. A Portfolio Score measures risk-adjusted performance by aligning your risk preferences with your portfolio’s exposure and downside protection.

Core Capabilities

- Net Worth Tracking: visualize and monitor all assets in one dashboard.

- Portfolio Tracking: monitor performance, risk, and allocation across all accounts.

- Scenario Modeling: run simulations to foresee outcomes under various strategies.

- Tax Optimization: continuous tax-loss harvesting and tax impact analysis.

- Estate Planning: tools to protect and transfer assets efficiently.

- Investment Advice: personalized, AI-assisted recommendations based on your goals.

- Data Security: bank-level security and read-only access to connected accounts.

- Accessibility & Transparency: clear disclosures about advisor status, fiduciary responsibility, and limitations of publicly available information.

How It Differs From Traditional Advising

- No guaranteed results; management is in the user’s hands with AI-assisted guidance.

- Emphasizes fiduciary responsibility and transparency about data use and security.

- Provides a cost-efficient alternative with pricing designed to be substantially lower than typical financial advisory fees.

Safety and Compliance Considerations

- Investment advice is provided through an advisory relationship; publicly available content is informational and not tailored to any specific individual unless via official advisory agreements.

- Users should assess personal risk tolerance, financial objectives, and consult tax/legal professionals as needed.

Pricing (Examples)

- Free plan available with essential features.

- Gold plan: $29 per month (discounted to $20/mo when billed annually) includes personalized AI recommendations, tax optimization features, AI assistant access, and enhanced insights.

- Platinum: higher tier with advanced AI equity research tools and additional features (pricing varies).

What You Get

- AI-powered personalized investment advice via a hybrid AI engine

- Comprehensive portfolio tracking and net worth visualization

- Estate planning support and scenario modeling

- Continuous tax-loss harvesting and tax impact assessment

- Bank-level security with read-only access to connected accounts

- 360° insights including risk scoring and portfolio strength analysis

- Flexible pricing with a free tier and paid Premium options