ProofUp

Open siteLegal & Finance

Introduction

Tenant screening revolutionized with identity and income verification

ProofUp Product Information

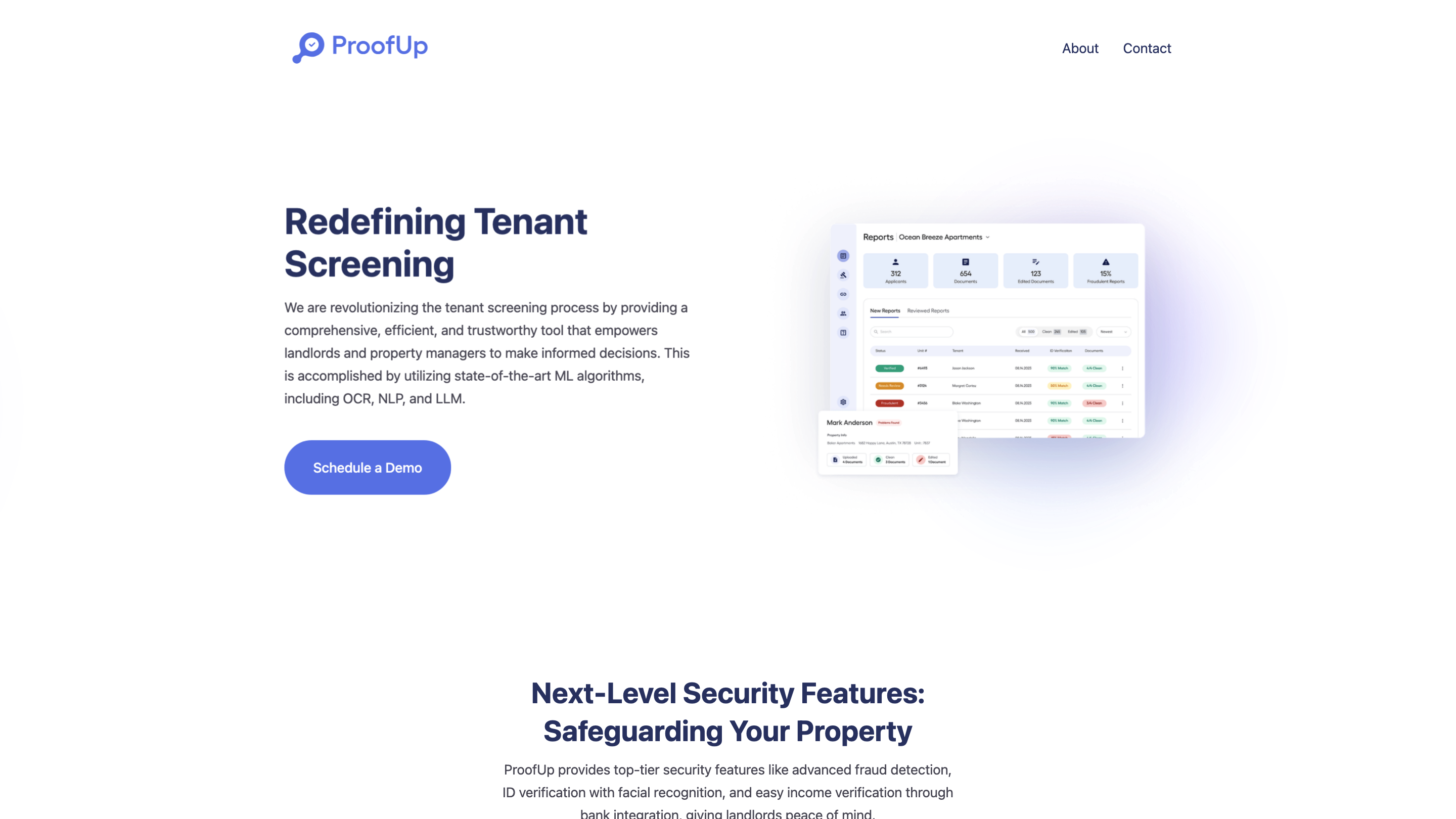

ProofUp is a tenant screening tool designed to streamline the screening process for landlords and property managers. It leverages state-of-the-art machine learning technologies including OCR, NLP, and large language models (LLMs) to provide comprehensive, efficient, and trustworthy tenant assessments. The platform emphasizes security, fraud prevention, and seamless verification workflows to help users make informed leasing decisions.

How ProofUp Works

- Collect applicant data: Gather documentation such as IDs, pay stubs, bank statements, and other supporting documents.

- Verify identity: Use facial recognition to match government-issued IDs with applicant selfies for robust ID verification.

- Verify income: Integrate with Plaid to securely link bank accounts and extract pay stubs and employment information from bank statements.

- Assess documents: Employ OCR and NLP to analyze PDF documents for authenticity, consistency, and potential forgery.

- Fraud detection: Run dynamic, ML-powered checks to detect edits, fake PDFs from known creation sites, and other manipulation indicators.

- Make informed decisions: Consolidate findings into actionable insights for landlords and property managers.

- Demo & deployment: Schedule a demo to explore streamlined workflows and control over screening processes.

Security & Compliance Highlights

- Advanced fraud detection to identify manipulated documents and forged PDFs.

- ID verification with facial recognition to ensure applicant identity.

- Income verification via Plaid to validate employment-related income from bank data.

- Constant ML-driven updates to adapt to evolving fraud patterns and new threat vectors.

- Privacy-conscious design with secure data handling and access controls (implementation details may vary by deployment).

Safety and Legal Considerations

- Ensure compliant use aligned with local tenant screening laws and privacy regulations.

- Obtain applicant consent for ID verification and data processing.

- Maintain transparent data retention and deletion practices.

Key Benefits

- Faster, more reliable tenant screening using automated document analysis.

- Reduced risk of fraud through multi-layer verification and dynamic detection.

- Improved decision-making with clear, ML-generated insights.

- Streamlined workflows with easy scheduling and demo access to showcase capabilities.

Core Features

- OCR-based document analysis for PDFs and other documents

- NLP and LLM-powered interpretation of applicant data

- ID verification with facial recognition

- Income verification through Plaid integration

- Dynamic fraud detection that detects PDF manipulation and fraudulent creation sources

- End-to-end screening workflow tailored for landlords and property managers

- Schedule a Demo functionality to explore platform capabilities

- Secure data handling and privacy-focused design