Rize Capital

Open siteLegal & Finance

Introduction

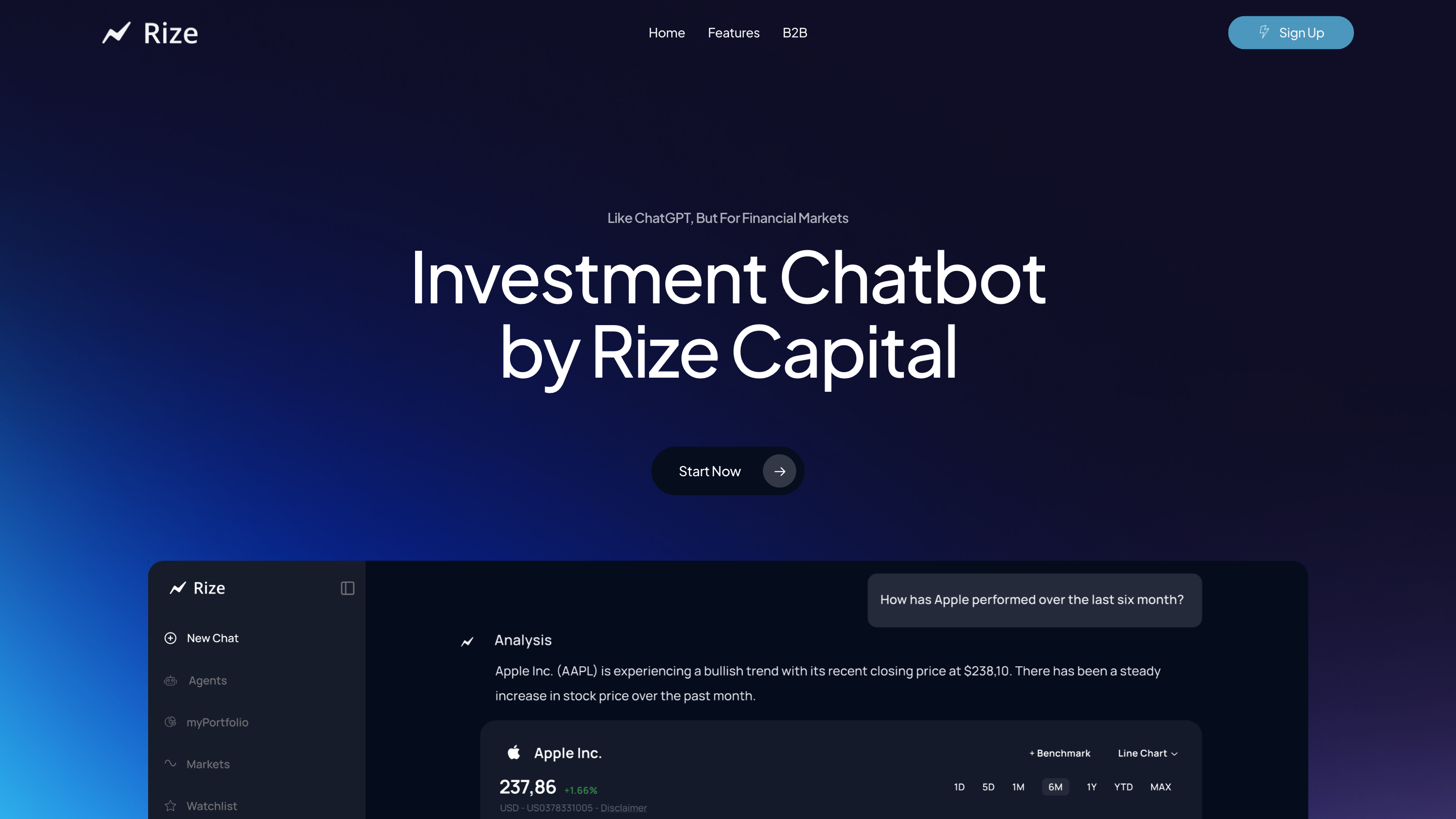

AI investment chatbot for real-time financial insights.

Rize Capital Product Information

Rize Capital — Investment Chatbot is an AI-powered financial assistant designed for real-time stock, ETF, crypto, and broader market analysis. It connects to institutional-grade financial data and official company reports to deliver fast, data-driven answers for investors, portfolio managers, financial advisors, analysts, and fintechs. The tool positions itself as a specialized alternative to generic chatbots like ChatGPT for finance, with emphasis on accuracy, speed, personalization, and multilingual support.

What it does

- Provides real-time, data-driven answers for stock analyses, portfolio questions, market trends, ETF/crypto insights, and general financial concepts.

- Access to company reports, transcripts, and expansive data for informed decision-making.

- Interactive, generative UI that adapts to user needs, including interactive charts and optional personalized insights.

- Custom AI agents to automate research workflows and tailor analytics to individual preferences.

- 24/7 availability with multilingual support to accommodate global users.

- Emphasizes reliability by leveraging institutional-grade data as opposed to generic AI responses.

How to use

- Engage via a chatbot interface to ask questions like stock performance, financial metrics, portfolio risks, or market trends.

- Request summaries of company reports, slides, and earnings transcripts to support decision-making.

- Query real-time data for more than 100,000 assets (stocks, ETFs, crypto, indices, funds, etc.).

- Create or customize AI agents to automate repetitive research and obtain personalized insights.

Why choose it

- Faster, more precise answers due to direct access to professional financial data.

- Personalization: answers adapt to your level of expertise and preferences.

- Multilingual support for a global user base.

- A specialized finance-focused alternative to general-purpose AI for investing.

Safety and Considerations

- The tool is designed for informed investment research and fast answers, but users should verify critical decisions using primary sources and own due diligence.

Core Features

- Real-time data for 100,000+ assets (stocks, crypto, ETFs, indices, funds, etc.)

- Access to company reports, transcripts, slides, and lengthy financial documents

- Interactive, AI-powered UI with adaptable charts

- Portfolio analysis tools (coming soon but announced as a capability)

- Custom AI agents for personalizedautomation and insights

- Multilingual support and 24/7 availability

- Institutional-grade data integration for accuracy