Trezy

Open siteIntroduction

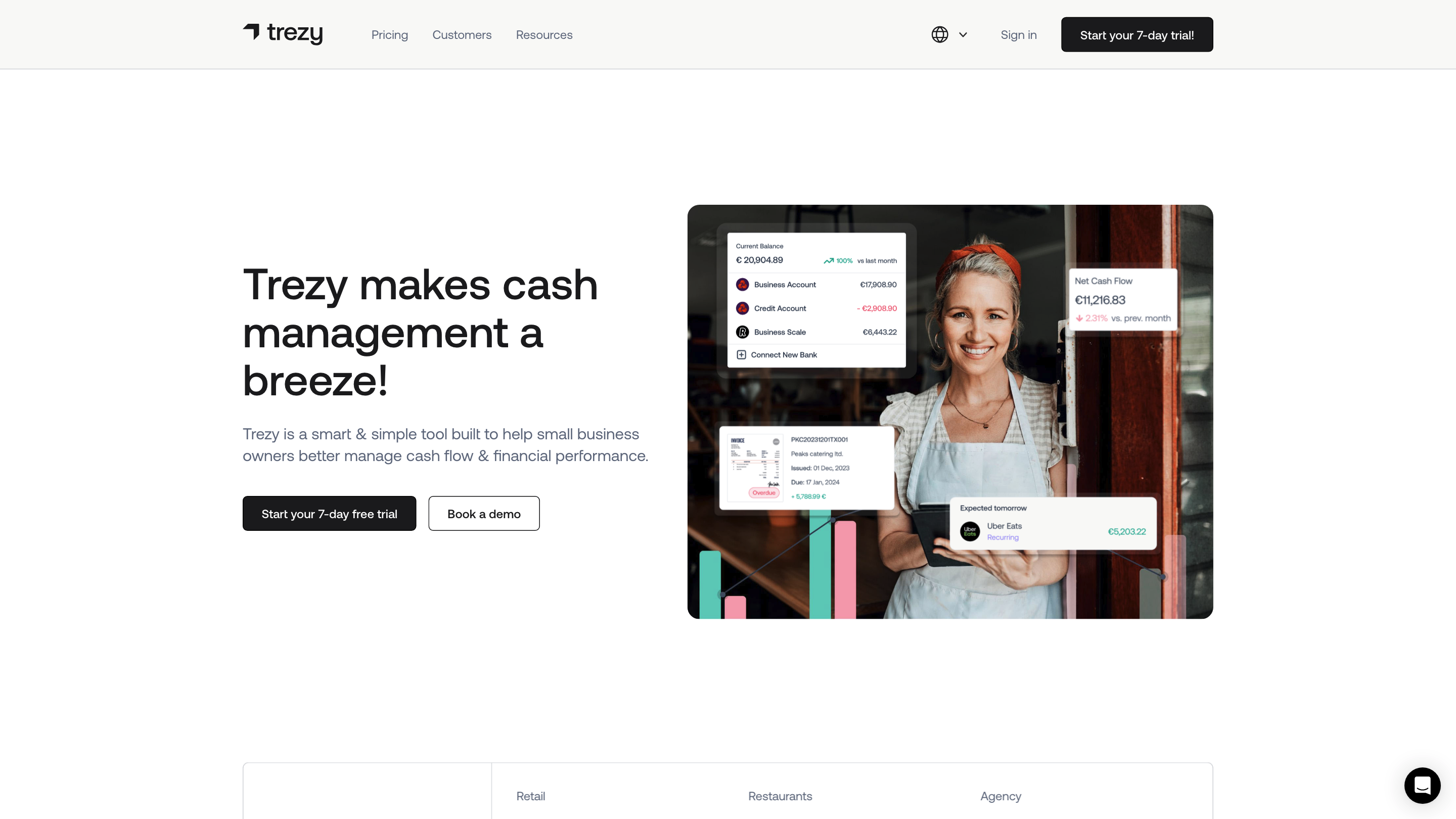

Cash flow management tool for small businesses

Trezy Product Information

Trezy | The Simple Cash Flow Tool is an AI-powered cash management platform designed for small businesses. It consolidates balances from multiple bank accounts, provides real-time visibility into cash flow, forecasts scenarios, and offers AI-driven insights to improve financial performance. The tool emphasizes ease of use, automated categorization and reconciliation, and benchmarking against industry peers. Trezy positions itself as a cost-effective alternative to traditional accounting-only or basic cash flow tools, aiming to enhance decision-making without replacing your accountant.

How Trezy Works

- Real-time cash flow monitoring by aggregating balances from multiple sources.

- Predictive forecasting to simulate scenarios and alert users when performance deviates from plans.

- Auto-categorization of transactions using AI and predefined preferences.

- Auto-reconciliation that matches documents and transactions to reduce manual work.

- Financial performance dashboards that reveal profitability, cash flow coverage, payables, and receivables.

- Benchmarking against industry peers to identify areas for optimization.

How to Use Trezy

- Sign up for a 7-day free trial or request a demo.

- Connect your bank accounts and import historical cash transactions.

- Let Trezy auto-categorize your transactions and set up your preferred planning scenarios.

- Review real-time cash position, forecasts, and performance insights to guide decisions.

- Use benchmarking and reports to identify operational improvements and optimize cash management.

Safety and Professional Guidance

Trezy is designed to augment financial decision-making and does not replace professional accounting advice. For complex tax or regulatory concerns, consult your accountant.

Core Features

- Real-time cash flow monitoring across multiple bank accounts

- AI-powered transaction categorization and smart rule-based preferences

- Auto-reconciliation of documents and transactions

- Predictive forecasting and scenario planning with alerts

- Consolidated view of cash balances and true cash position

- Financial performance metrics with key ratios and benchmarks

- Benchmarking against industry peers for continuous improvement

- Cost-effective alternative to traditional cash flow tools and heavy accounting automation