Accorata

Open siteIntroduction

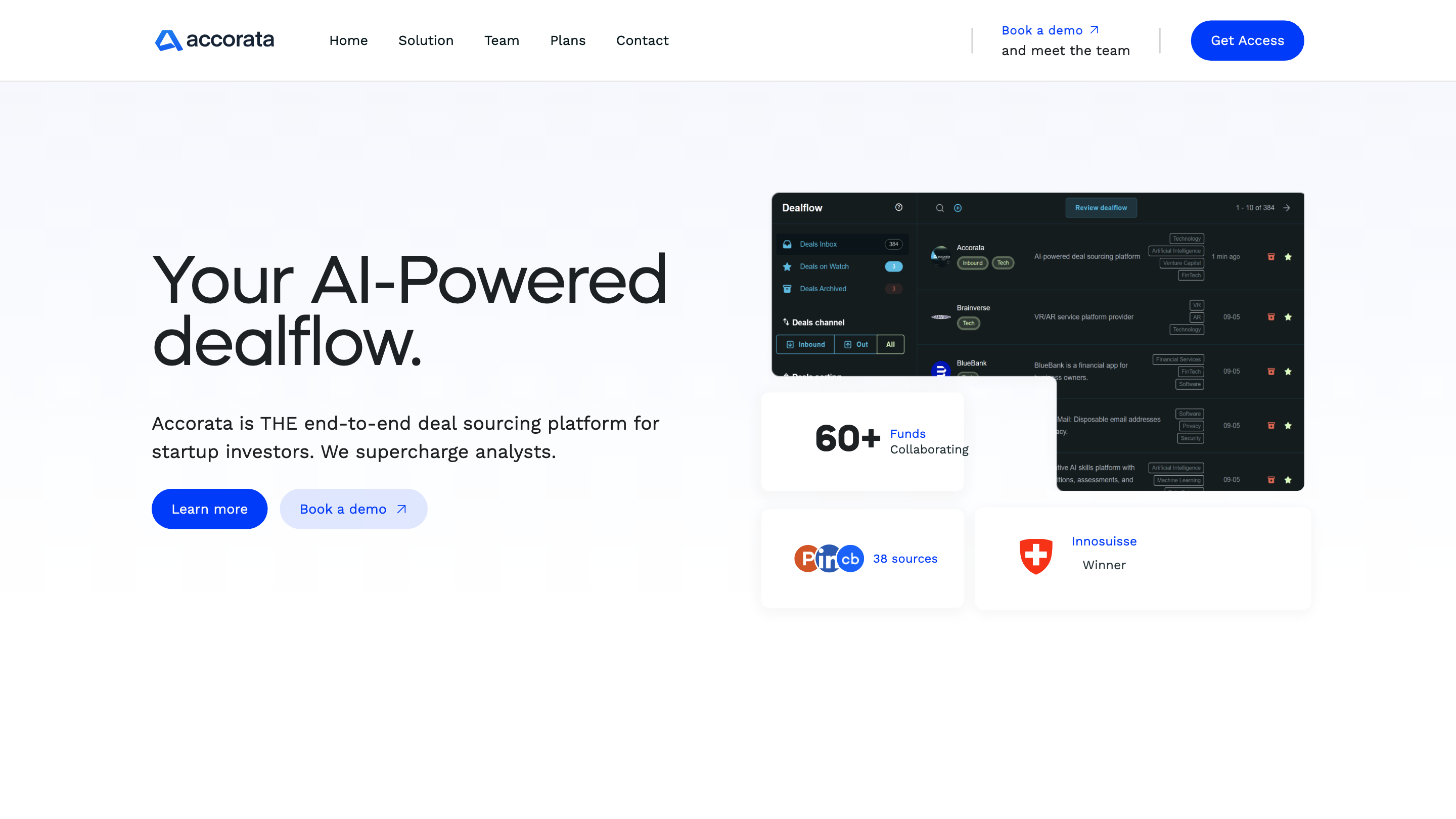

AI deal sourcing for early-stage investors.

Accorata Product Information

Accorata — AI-Powered Dealflow Platform is an end-to-end deal sourcing solution designed for startup investors to accelerate sourcing, enrichment, querying, assessing, collaborating, and integrating with existing tools. It claims to broaden deal flow, provide daily pre-researched deals aligned to investment theses, and integrates with major deal management systems while prioritizing privacy and data protection (EU standards).

How Accorata Works

- Sourcing: Access the fastest data refresh on the market with new deals every 24 hours, sourced from 30+ platforms.

- Enriching: Upload any deck or enter a website URL; Accorata processes new deals with proprietary algorithms and can integrate with your inbox.

- Querying: Navigate deal flow using natural language and soft filters to surface startups recently raised, or those connected with specific founders.

- Assessing: Receive top curated deals each morning with direct insights on market, competition, team, and strengths/weaknesses.

- Collaborating: Share deals with your network in one click, including AI-powered research and a 360-degree company view.

- Integrating: Integrate with deal management tools like Affinity, HubSpot, Attio, Pipedrive, Salesforce, and more.

Accorata positions itself as the only platform unifying both VC inbound and outbound sourcing, expanding deal flow while delivering pre-researched opportunities that match an investor’s thesis.

What You Get

- Daily, fast, and scalable deal flow across 30+ sources with guaranteed new deals every 24 hours.

- Automated inbound sourcing that can plug into your inbox to focus on relevant decks.

- Tailored to your investment strategy with advanced learning to surface overlooked opportunities.

- Sovereign technology with data stored on Swiss and German servers to comply with strict European data protections standards.

- Co-building and premium IT support, with tailor-made integrations for early adopters and enterprises.

- Trusted quotes from early users highlighting time savings and scouting efficiency.

Plans and How Pricing Works

- Plans include Business, Angel, Basic, VC, Data-driven VC, and Enterprise tiers with scaled access for inbound/outbound sourcing, deck limits, and SLA commitments.

- Feature tiers define user limits, deck quotas per year, lead times for inbound/outbound, and support SLAs (ranging from 24 to 72 hours depending on plan).

- Premium support offers faster response times and custom features, sources, and integrations.

How It Supports Investment Workflows

- Built to speed up initial screening, diligence, and collaboration across teams.

- Provides a foundation to keep up with high volumes of startup data while maintaining governance and data protection.

- Enables integration into existing CRM and deal management stacks to centralize sourcing activity.

Core Features

- End-to-end deal sourcing (inbound & outbound) in one platform

- Daily refreshed deals from 30+ sources

- Automated deal enrichment from URLs or decks

- Natural language querying with soft filters for quick discovery

- Curated daily deal insights covering market, competition, and team

- AI-assisted research and 360° company view for collaboration

- Integrations with major deal management tools (Affinity, HubSpot, Attio, Pipedrive, Salesforce, etc.)

- Data protection aligned with European standards (data stored on Swiss/German servers)

- Customizable plans with scalable quotas and SLA options

- Free PoC and executive briefings to validate fit

How It Works (Summary)

- Source new deals daily from multiple sources

- Enrich inbound requests and uploaded decks with AI

- Query and filter using natural language

- Assess top deals with structured insights

- Collaborate by sharing deals and research

- Integrate with your existing deal management stack

Disclaimer: Accorata emphasizes data protection and privacy, with data storage on EU-based servers and tailored IT support for enterprise needs.