BellmanLoop

Open siteIntroduction

AI platform for smart debt recovery with automation features.

Featured

BellmanLoop Product Information

BellmanLoop | Smart, Scalable, Cost-Effective Debt Collection

BellmanLoop is an AI-powered debt collection platform designed to manage diverse collection scenarios with strict compliance standards. It enables rapid handling of large case loads, multi-language outreach, and data-driven optimization to improve recovery rates while reducing operational costs. The solution emphasizes consistency, quality, and real-time analytics to scale collections without sacrificing adherence to regulatory requirements.

Key Capabilities

- Multi-language support (English, Spanish, Chinese) to engage borrowers across regions

- AI-driven debt collection agent capable of handling multiple cases in parallel

- Compliance-focused workflow with strict regulatory alignment

- Real-time analytics and dashboards for performance, outcomes, and strategy optimization

- Multi-channel outreach with tailored communications matching brand voice

- Flexible, scalable deployment with pay-as-you-go pricing

- Self-learning system that improves strategies through reinforcement learning

- Tools for faster ramp-up and consistent interaction quality across channels

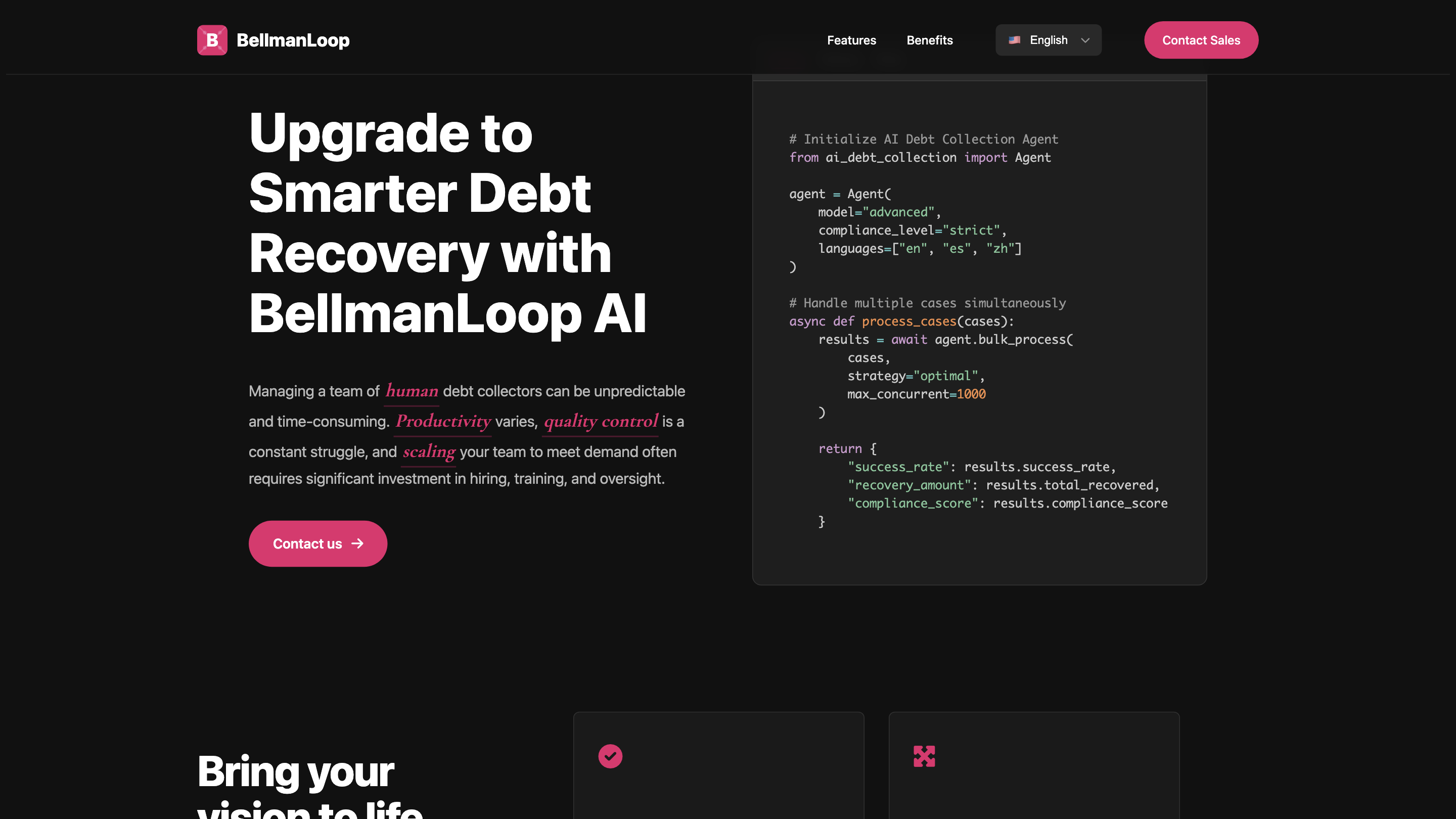

How It Works

- Initialize an AI Debt Collection Agent configured for advanced models, strict compliance, and supported languages.

- Feed cases into the system; the agent processes cases concurrently using an optimal strategy.

- Retrieve performance metrics such as success rate, total recovered, and compliance score to guide actions and adjustments.

The platform is designed to handle high volumes with automated, compliant outreach and adaptive strategy recommendations, reducing manual overhead and improving outcomes over time.

How to Use BellmanLoop

- Initialize the agent with your preferred model, compliance level, and languages.

- Submit a batch of cases for bulk processing.

- Monitor results through the provided metrics and dashboards.

Example inputs across popular programming languages (illustrative):

- Python: Initialize Agent(model="advanced", compliance_level="strict", languages=["en", "es", "zh"])

- JavaScript: new Agent({ model: 'advanced', complianceLevel: 'strict', languages: ['en', 'es', 'zh'] })

- Ruby: AIDebtCollection::Agent.new(model: 'advanced', compliance_level: 'strict', languages: ['en', 'es', 'zh'])

Safety & Compliance Considerations

- Ensure outreach complies with local debt collection regulations and consumer protection laws.

- Maintain data privacy; use only authorized data for case processing and avoid sharing sensitive information externally.

- Use the system’s compliance features to standardize communications and avoid coercive or misleading practices.

Core Features

- AI Debt Collection Agent with multi-language support (en, es, zh)

- Bulk case processing with concurrent handling (high maxConcurrency)

- Compliance-first configuration and reporting

- Real-time analytics dashboards for performance and outcomes

- Multi-channel outreach with brand-consistent communications

- Flexible, scalable pay-as-you-go pricing

- Self-learning reinforcement learning to optimize strategies

- Cross-language and cross-channel consistency in interactions

- Easy integration with existing case management systems

Benefits

- Higher Recovery Rate: Optimized strategies increase recovery per dollar invested.

- Cost Reduction: Lower operational costs through automation and scalable processing.

- Enhanced Satisfaction: Professional, consistent customer interactions.

- Real-time Insights: Actionable dashboards to refine processes and outcomes.

Get Started

Ready to transform your debt collection operations with compliant, AI-powered automation? Contact the BellmanLoop team to learn more about pricing and implementation for your business.

Contact: [email protected] © 2024 BellmanLoop. All rights reserved.