ComplyCube

Open siteLegal & Finance

Introduction

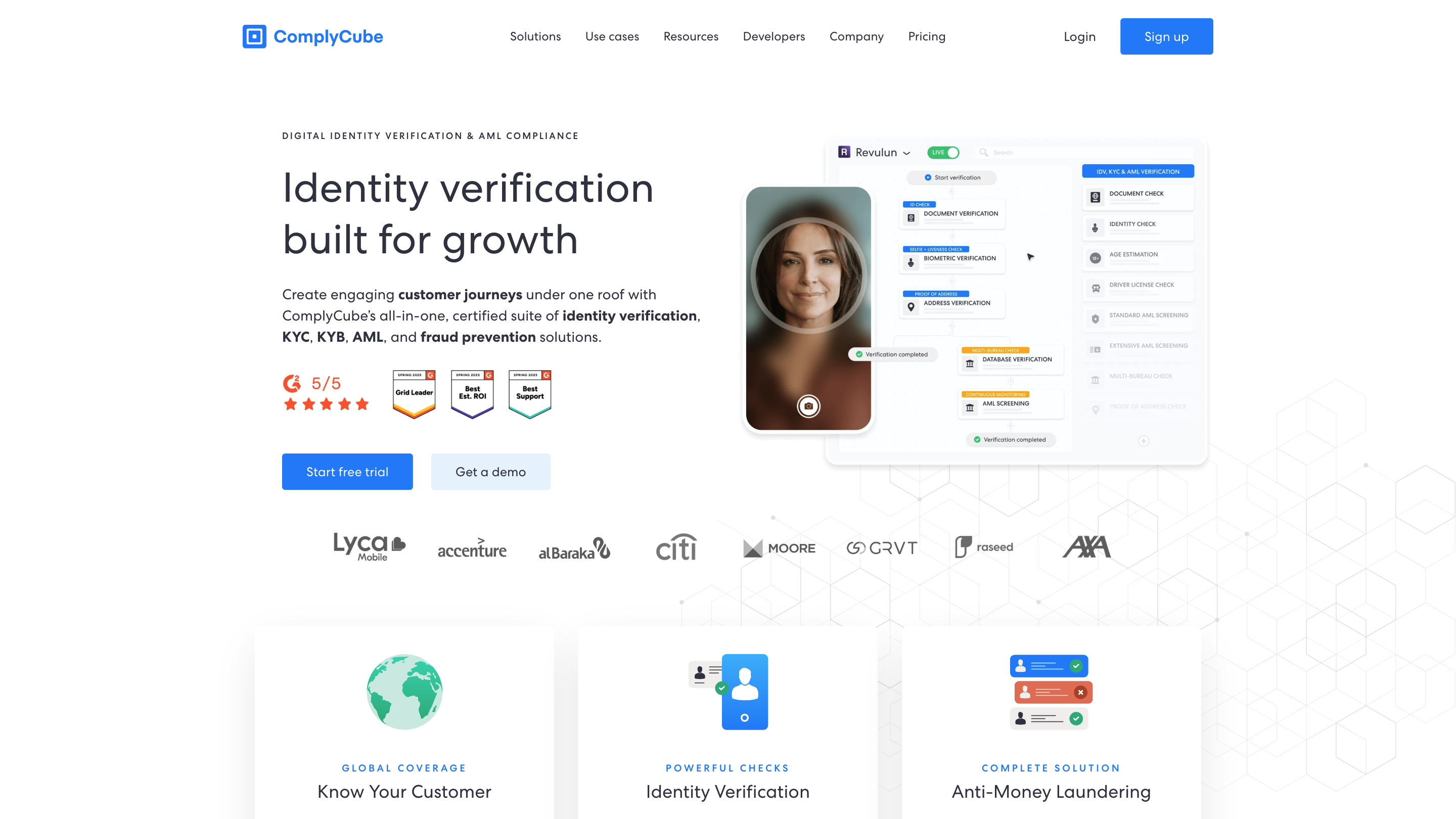

ComplyCube is a top SaaS platform offering fast and accurate customer identity verification.

ComplyCube Product Information

ComplyCube is a digital identity verification and AML compliance platform that provides an all-in-one suite for identity verification, KYC, KYB, AML, and fraud prevention. It enables businesses to create engaging customer journeys while meeting global regulatory requirements and reducing onboarding friction.

Key Capabilities

- Global coverage for identity verification and AML checks across 220+ countries.

- Fast identity verification: verify customers’ true identity in under 30 seconds.

- Comprehensive KYC/KYB and AML workflows designed for onboarding, ongoing monitoring, and risk-based decisioning.

- Age verification, proof of address, and multi-bureau identity checks to support age-restricted and regulated use cases.

- Ongoing due diligence and continuous monitoring to stay compliant over time.

- Fraud prevention and risk scoring to deter and detect suspicious activity.

- Role-specific use cases for financial services, telecoms, crypto, fintech, and more.

- Developer-friendly: API, client libraries, SDKs (Web, mobile, hosted pages), and codeless options to accelerate integration.

- Ready-made templates and no-code/low-code solutions to design compliant onboarding journeys.

- Security and compliance certifications recognized by regulators and industry bodies.

How It Works

- Integrate via API or hosted verification pages to start the identity verification workflow.

- Collect and verify identity documents, biometrics, and supporting data using multi-source checks.

- Run risk-based screening (sanctions, Adverse Media, PEP, watchlists) and AML screening.

- Apply age, address, and other verifications to confirm eligibility for restricted services.

- Perform KYC/KYB due diligence and ongoing monitoring with automated case management and reporting.

- Access dashboards and insights to manage risk, compliance, and user journeys.

Use Cases

- Customer onboarding and identity verification

- Age verification for restricted content or products

- Ongoing due diligence and continuous AML monitoring

- Regulatory-compliant crypto onboarding and KYB for crypto services

- Telecoms SIM holder verification and compliance

- MLROs (Money Laundering Reporting Officers) risk oversight

- Fraud analysts investigations and case management

- UX-focused onboarding experiences with fast, low-friction verification

Why ComplyCube

- Global, scalable identity verification and AML platform built for growth

- Strong data coverage: 3,000+ data points and 10+ million transactions processed weekly

- High onboarding conversion with a 98% client onboarding rate

- Flexible deployment options: APIs, hosted verification pages, SDKs, and codeless solutions

- Security and compliance validated by independent bodies and regulators

Use Cases By Process, Industry, and Profession

- By Process: Customer onboarding, Age verification, Transaction monitoring, Ongoing due diligence, Know Your Business, Case management

- By Industry: Financial services, Crypto, Telecoms

- By Profession: MLROs, Compliance managers, Onboarding specialists, Fraud analysts, UX professionals

Resource and Support

- Documentation, quick guides, API references, and SDKs

- Help center, FAQs, and dedicated support

- Partner and startup programs to accelerate integration and deployment

Feature Highlights

- Global coverage: 220+ countries and territories

- Identity verification in under 30 seconds

- KYC, KYB, AML, and fraud prevention in a single platform

- Age verification and Proof of Address checks

- Multi-bureau and trusted-source data validation

- Ongoing due diligence and continuous monitoring

- Risk scoring and case management

- Hosted verification pages and developer-friendly SDKs/APIs

- Codeless solutions for quick deployment

- Privacy-focused data handling and compliant workflows