Decode.tax

Open siteLegal & Finance

Introduction

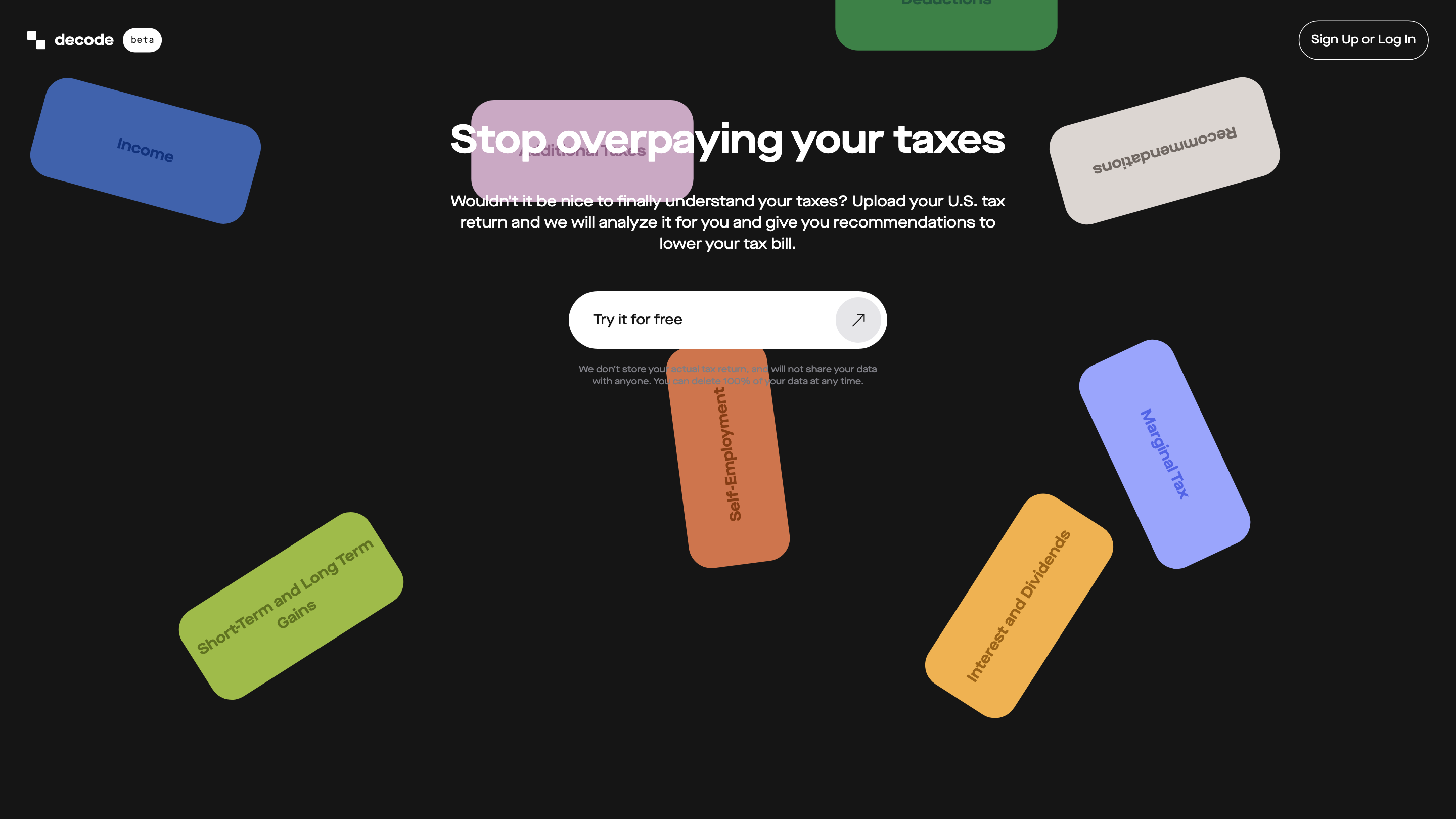

Understand your taxes and save money.

Decode.tax Product Information

Decode.tax is an AI-powered tax analysis tool that analyzes your U.S. tax return to provide personalized recommendations to legally lower your tax bill. It emphasizes privacy by not storing your actual tax return data and offers the option to delete all data at any time. The service is positioned as a free-try tool to help users understand and optimize their taxes.

How to Use Decode.tax

- Upload your U.S. tax return. Provide your tax document to be analyzed (formats supported by the platform).

- Receive analysis. The tool interprets your return and highlights areas where you can reduce taxes across categories like Income, Short-Term and Long-Term Gains, Additional Taxes, Self-Employment Deductions, Interest and Dividends, and Marginal Tax Recommendations.

- Apply recommendations. Review suggested strategies and implement them in your tax planning.

Privacy and Data Handling

- The service claims it does not store your actual tax return.

- You can delete 100% of your data at any time.

- Data is not shared with third parties.

Possible Use Areas

- Income optimization

- Capital gains planning (short-term vs long-term)

- Self-employment deduction optimization

- Interest and dividends tax management

- Marginal tax rate understanding and reduction strategies

Safety and Legal Considerations

- Use the recommendations as guidance and consult a tax professional for final tax reporting and compliance.

Core Features

- Analyze uploaded U.S. tax returns and provide optimization recommendations

- Focus areas: Income, Gains, Additional Taxes, Self-Employment Deductions, Interest and Dividends, Marginal Tax Recommendations

- Privacy-first design: no storage of actual tax returns; data can be fully deleted

- Free-to-try access

- Clear guidance to lower tax bill within legal means