Harbr - Modern Trade Credit

Open siteLegal & Finance

Introduction

AI-powered credit application software for efficient onboarding.

Harbr - Modern Trade Credit Product Information

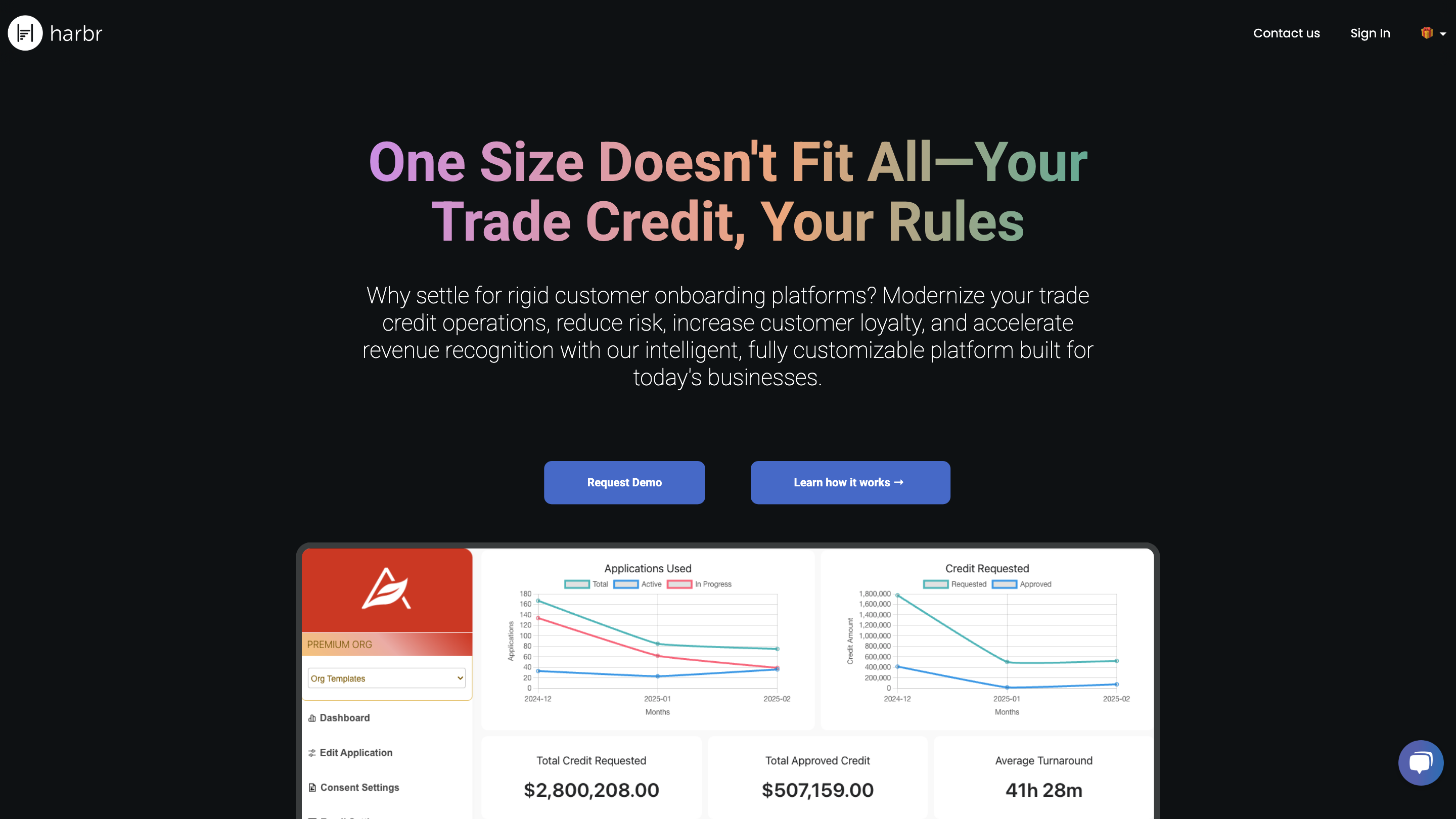

Harbr is a customizable trade credit platform designed to modernize onboarding, risk assessment, and credit decisioning for businesses of all sizes. It offers enterprise-grade controls, no-code and API-based integrations, real-time data from trusted sources, and seamless banking connections to accelerate revenue recognition while reducing risk and increasing customer loyalty.

Overview

- Tailored for global enterprises and growing mid-market companies with high transaction volumes.

- Combines adaptive decisioning, data-driven insights, and streamlined collaboration to optimize the entire credit lifecycle.

- Emphasizes flexibility, security, and scalability to fit unique business needs.

How it Works

- Gather data from trusted sources in real-time to inform credit decisions.

- Configure decisioning policies and workflows (no-code options available) to automate approvals and triage applications.

- Onboard customers efficiently through a branded portal and automated data collection.

- Integrate with existing systems via APIs or no-code connectors to embed credit decisioning into your tech stack.

- Connect with banking institutions for secure financial data and payment processing.

- Monitor, analyze, and optimize credit operations with analytics and reports.

Use Cases

- Enterprise and mid-market credit management with multi-entity structures

- Real-time decisioning and automated approvals

- Branded customer onboarding portals with customized workflows

- API-first integration for embedding credit capabilities into existing apps

- Secure data sharing and collaboration across teams

Benefits

- Faster onboarding and faster credit decisions

- Improved data accuracy and input controls

- Centralized governance with administrator access controls

- Higher customer satisfaction through transparent, real-time updates

- Increased revenue recognition with higher and more accurate credit limits

- Stronger risk management via global risk assessment and customizable policies

Core Features

- Enterprise-grade credit management with multi-entity support

- Automated and customizable decisioning policies

- No-code platform for rapid configuration and workflow design

- Real-time data ingestion from 9,000+ trusted sources

- API Platform for real-time credit decisions and seamless integration

- Branded customer portal for onboarding and communication

- Banking integration for secure data exchange with clients’ financial institutions

- Performance analytics and reporting

- Secure, role-based access control and administrator governance

- Flexible integration options (API-first and no-code adapters)