JIFFY.ai

Open siteOffice & Productivity

Introduction

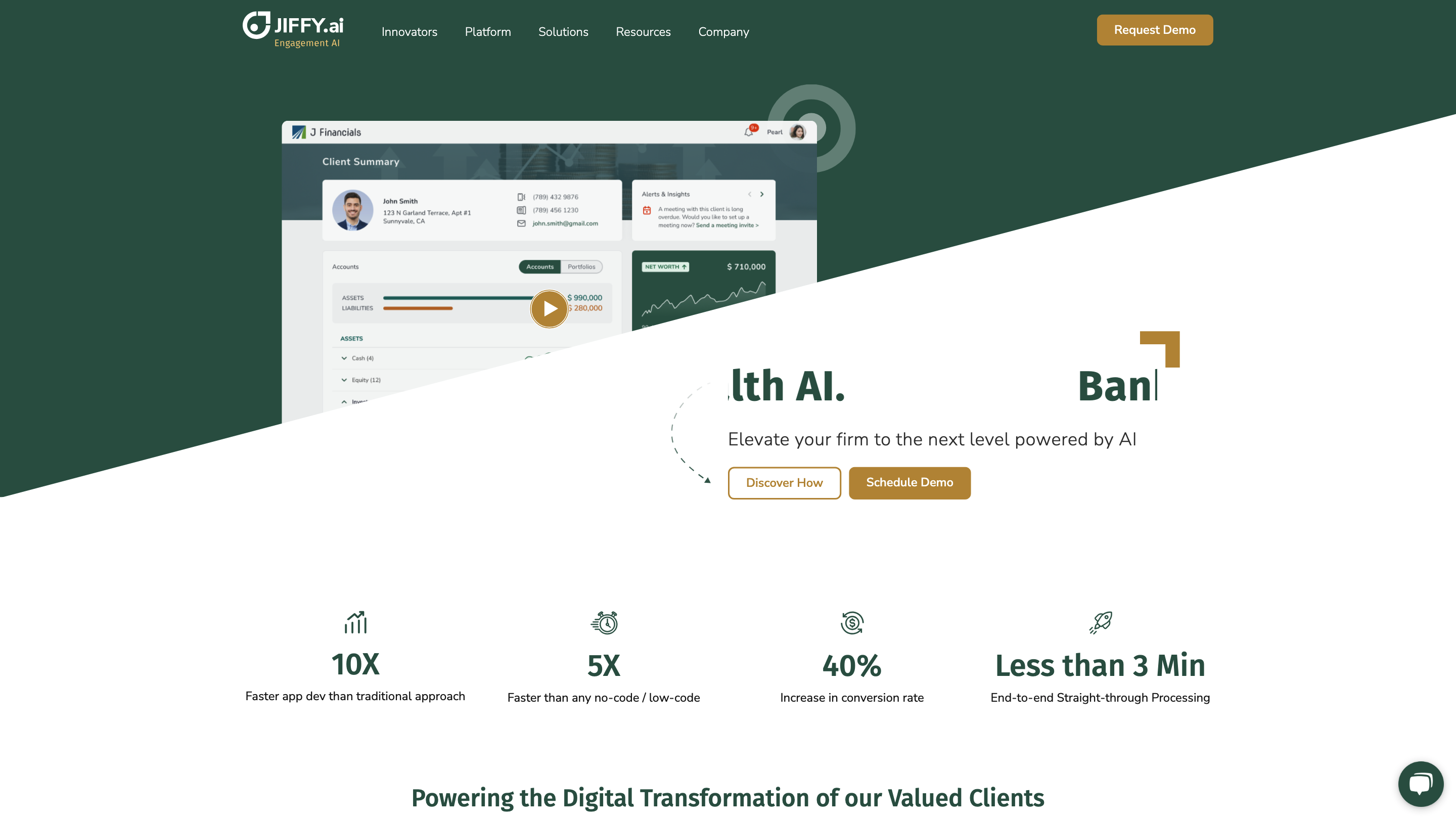

Accelerate digital transformation with JIFFY.ai's AI-powered intelligent automation.

JIFFY.ai Product Information

JIFFY.ai is an AI-powered no-code/low-code platform for intelligent automation designed to accelerate digital transformation in financial services, banking, wealth management, and related verticals. It enables rapid application development, end-to-end workflow automation, and seamless data processing with robust integrations, all while delivering faster time-to-value and higher operational efficiency.

Overview

- No-code/low-code platform tailored for financial services use cases (wealth management, banks, credit unions, accounting, financing).

- Combines AI-powered automation, rapid app development, and seamless integrations to replace or augment custom software and legacy ecosystems.

- Emphasizes speed: claims 10x faster app development vs traditional approaches and 5x faster than typical no-code/low-code tooling.

- Demonstrates tangible outcomes: higher conversion rates, faster onboarding, reduced turnaround times, and significant hours saved on manual processes.

What it enables

- End-to-end process automation across customer onboarding, KYC, data porting, statement curation, notifications, and servicing.

- Unified onboarding experiences for individuals, advisors, and institutions.

- AI-assisted workflows and decision-making to accelerate operations and improve client experiences.

- No-code/low-code platform to build, deploy, and iterate applications quickly without heavy IT backlog.

Key Use Cases (Financial Services)

- Wealth Management & Banking: onboarding, account servicing, advisor workflows, investor onboarding, and client engagement.

- Unified Onboarding: rapid onboarding of consumers, advisors, and investors with streamlined, compliant workflows.

- Account Servicing: end-to-end handling of service requests across channels to reduce costs and improve satisfaction.

- Advisor Workstation: dashboards with actionable insights on books of business, client profiles, and service requests.

- Advisor Transition: automate advisor and investor transitions to reduce delays and improve perceived value.

- Consumer Engagement: AI-powered campaigns and content delivery to boost revenue and retention.

How It Works (High-Level)

- No-code platform to design AI-powered workflows and applications.

- AI models for planning, onboarding, servicing, and engagement are embedded to automate complex tasks.

- Integrates with core applications and data sources to deliver seamless operations.

- Delivers end-to-end automation from planning and onboarding to servicing and engagement.

Outcomes & Metrics (Illustrative)

- 10x faster application development.

- 5x faster than typical no-code/low-code platforms.

- Up to 40% increase in conversion rates.

- Reductions in manual hours and KYC processing times (example: significant time savings in KYC workflows).

Safety & Compliance

- Built for regulated environments; emphasizes governance, security, and compliance in financial services workflows.

- Supports secure data handling and enterprise-grade integrations (as per platform positioning).

Case Highlights (From Provided Content)

- US financial services leader saved thousands of manual hours via automation of customer data porting, statement curation, and notifications.

- Personal finance app accelerated real-time financial monitoring development; onboarding a services firm scaled to 100+ employees per month.

- Global bank achieved dramatic reductions in KYC turnaround time using no-code automation.

Core Features

- No-code/Low-code platform for rapid app development

- AI-powered automation across onboarding, servicing, planning, and engagement

- Unified onboarding and advisor/workstation solutions

- End-to-end process automation with seamless data processing

- Robust integrations with core banking and enterprise systems

- Rapid digitization and streamlined ETL capabilities

- End-to-end straight-through processing for financial workflows

- AI-driven consumer engagement and marketing automation

How It Helps Your Organization

- Accelerates digital transformation and modernizes legacy ecosystems.

- Increases efficiency, reduces manual work, and speeds time-to-market for new financial services apps.

- Improves client experiences through faster onboarding, servicing, and personalized engagement.

- Provides governance-ready automation suitable for banks, wealth managers, and credit unions.