LevelFields AI Trading

Open siteLegal & Finance

Introduction

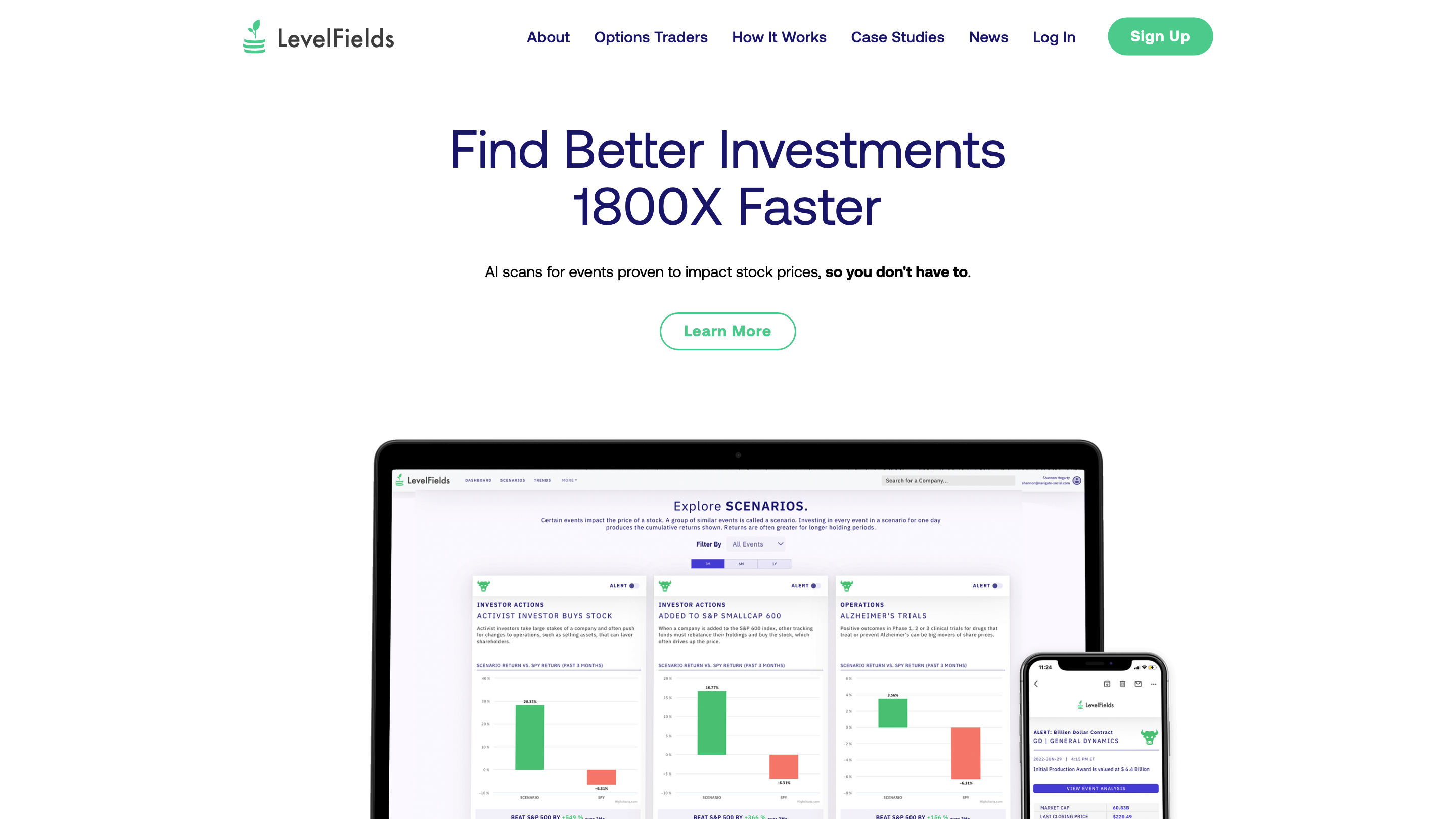

AI-driven fintech for automated stock and options trading

LevelFields AI Trading Product Information

LevelFields AI Stock Trading Platform is an AI-powered stock and options trading tool designed for self-directed investors. It analyzes millions of events that could impact stock prices to reveal high-probability opportunities, helping you invest faster and smarter with patterns showing how events affect price movements. The platform emphasizes speed, accessibility, and data-driven decision making, offering event-driven insights, alerts, and structured guidance for both beginners and experienced traders.

How It Works

- Select Event Type. Choose categories like product changes, leadership changes, lawsuits, government actions, restructurings, and more.

- View Price Reactions. Use event-pattern insights to determine potential buy/sell points by comparing to similar past events.

- Set Event Alerts. Receive AI-generated opportunities via inbox notifications based on your target profits.

Why LevelFields

- AI stock trade finder identifies events most likely to trigger outsized returns, filtering out the majority of news that doesn’t affect stock prices.

- Monitor news, significant events, growth metrics, and upcoming catalysts on stocks you own via Watchlists.

- Supports long-term entry points and short-term opportunistic trades with event-driven signals.

- Technical insights help you understand how price moves relate to events.

Recent Alerts and Performance (Examples)

- NXGL Nexgel — Return of Capital: 1 Day +22.5%, 1 Week +36.7%, 1 Month +18.5%

- GOTU Gaotu Techedu INC — Return of Capital: 1 Day +1.8%, 1 Week +20.8%, 1 Month +140.2%

- MDIA MediaCo Holdings — Return of Capital: 1 Day +18.3%, 1 Week +14.5%, 1 Month +37.9%

- ISEE Iveric Bio — Government Actions: 1 Day +25.6%, 1 Week +28.7%, 1 Month +34.1%

- W Wayfair — Restructuring: 1 Day +21.0%, 1 Week +42.0%, 1 Month +33%

How It Helps Different Investors

- Opportunistic traders: Find niche opportunities with high return potential.

- Long-term investors: Identify great entry points based on catalysts for durable gains.

- Technical traders: Correlate price moves with event-driven patterns to enhance trading edge.

Plans and Subscriptions (FAQ Highlights)

- Level 1: DIY access with data, alerts, and trends; limited human assistance, fewer years of data, and no one-on-one training.

- Level 2: Includes analyst-delivered alerts, potential trade positioning for future events, SMS alerts, and one-on-one training. Higher upfront value with added support.

- Subscriptions can be upgraded from Level 1 to Level 2; downgrades from Level 2 to Level 1 are rarely available.

- Level 1 is marketed as more affordable upfront but with less personalized support; Level 2 provides more guided trading insights.

Safety and Use Considerations

- These tools provide insights based on historical event patterns and probability; they do not guarantee profits.

- Trading, especially with options, involves risk; ensure you have risk capital and understand the strategies used.

Core Features

- AI-driven event scanning across millions of events to identify price-impacting catalysts

- Event-type selection (product changes, leadership changes, lawsuits, government actions, restructurings, etc.)

- Price reaction modeling and pattern-based buy/sell guidance

- Real-time event alerts delivered via email and SMS (Level 2)

- Watchlists to monitor stocks and upcoming catalysts

- Long-term and short-term trading perspectives with a focus on catalysts

- Technical context to understand price movements related to events

- Access to multiple scenarios, data, alerts, and trends with customization

- Time-efficient research: turn hours of work into minutes with AI-driven insights

How to Use (High-Level)

- Subscribe to Level 1 or Level 2 depending on your needs.

- Create Watchlists for stocks you own or are tracking.

- Select relevant event types and let AI surface opportunities.

- Review suggested entry/exit points and set alerts for upcoming catalysts.

- Use Level 2 alerts and training to enhance trade positioning and risk management.

Disclaimer

- LevelFields’ AI trading insights are informational and educational and should not be construed as financial advice. All trading involves risk, and past performance is not indicative of future results. Always perform your own due diligence before making investment decisions.