neonFin

Open siteIntroduction

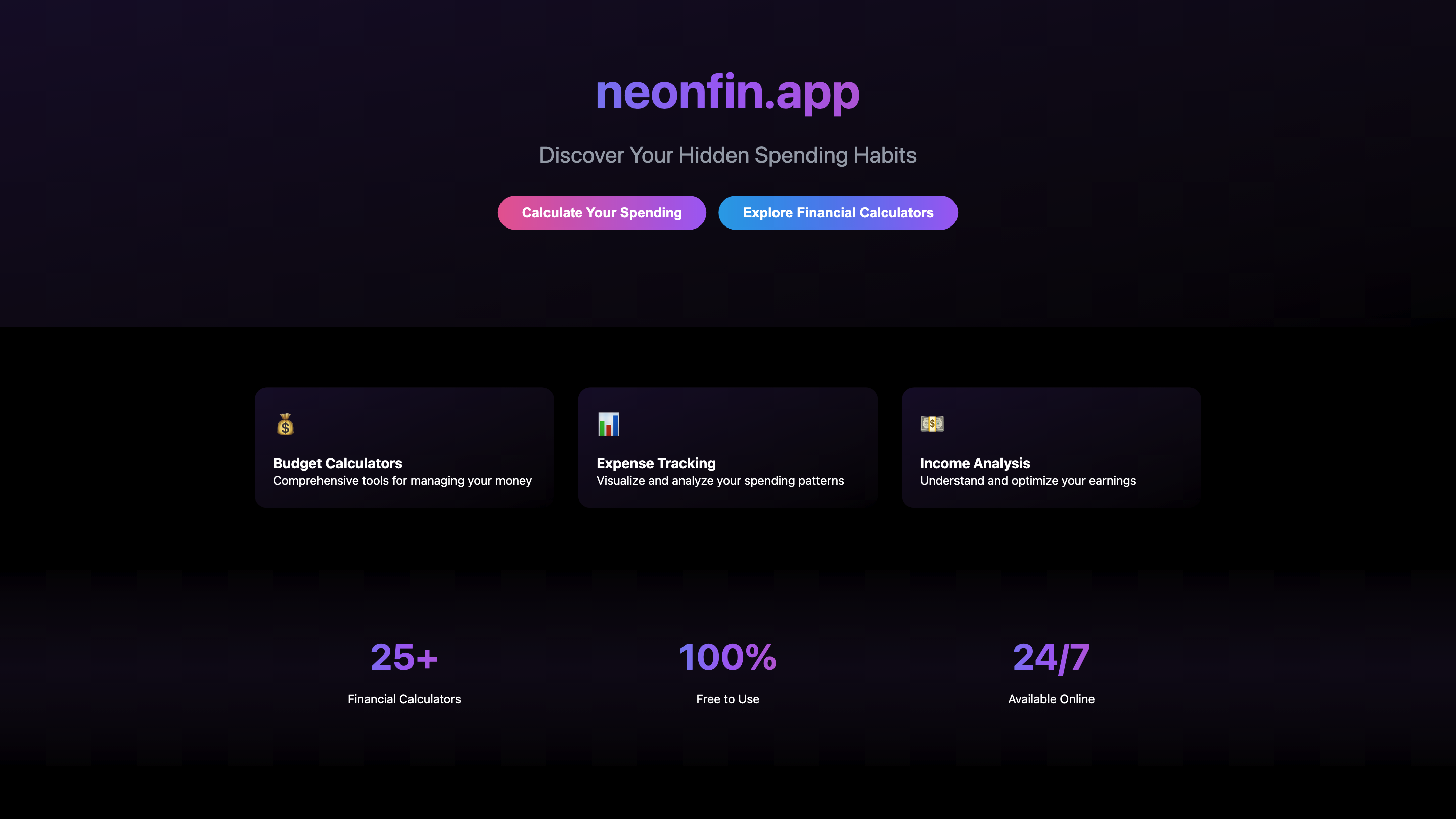

neonFin is a budgeting app that helps users track their finances with advanced features.

neonFin Product Information

NeonFin - Smart Financial Calculator Suite | Track Your Spending Habits

NeonFin is a comprehensive, 100% free online financial toolset designed to help you understand, track, and optimize your spending and income. With 25+ calculators and 24/7 accessibility, it guides you through budgeting, expense tracking, income analysis, and strategic financial planning, turning your financial data into actionable insights.

Key capabilities include:

- Expense tracking and visualization to reveal spending patterns

- Income analysis to understand earnings and optimize cash flow

- A suite of 25+ financial calculators for budgeting, savings, debt, investments, and more

- Free, 24/7 online access with no signup required

- Practical guidance and frameworks for improving spending habits and financial health

How NeonFin Helps You Discover Your Financial Habits

NeonFin positions financial self-discovery as mapping your financial DNA. It provides a structured guide to where your money goes and why, helping you make informed decisions aligned with your goals.

Core Spending Categories

- Fixed Expenses (50-60% of income): Housing, Utilities, Insurance, Basic phone plan, Essential subscriptions

- Variable Necessities (20-30% of income): Groceries, Transportation, Healthcare, Personal care, Clothing

- Debt Obligations (10-20% of income): Credit cards, Student loans, Personal loans, Car payments

- Discretionary Spending (20-30% of income): Entertainment, Dining out, Shopping, Hobbies, Travel

Tracking Methods

- Digital tracking via banking apps

- Budgeting software

- Spreadsheet templates

- Receipt scanning apps

- Manual tracking and expense journals

Strategic Budget Allocation

A practical budget framework dividing income into:

- Essential Living Expenses (50-60%)

- Housing (25-35%), Utilities (5-10%), Transportation (10-15%), Food and Groceries (10-15%), etc.

- Financial Goals and Savings (20-30%)

- Emergency Fund (10%), Retirement (10-15%), Other Goals (5-10%)

- Other Financial Goals (5-10%)

Advanced Planning Strategies

- Emergency Fund Development: staged approach from $1,000 to 3–6 months of expenses with automation

- Debt Management: Avalanche vs. Snowball methods to minimize interest and maximize motivation

- Investment Planning: prioritize employer match, reduce high-interest debt, maximize tax-advantaged accounts, then taxable investments

- Lifestyle Optimization: smart shopping, energy efficiency, and transportation optimization

Ready to Calculate Your Financial Future?

Access NeonFin’s full Calculator Suite to start tracking and planning now:

- Spending Habits Calculator

- Monthly Income Calculator

- Housing, Transportation, Food, Utilities, and Entertainment analyzers

- Other Spending Analysis and Financial Calculator Suite

Feature Summary

- 25+ financial calculators for budgeting, saving, debt, investment planning, and more

- Expense tracking with visualization of spending patterns

- Income analysis to optimize earnings and cash flow

- Comprehensive budget allocation framework (Essential, Financial Goals, Other Goals)

- 24/7 free online access with no signup required

- Step-by-step guidance and practical financial planning frameworks

- Cross-category insights to improve spending habits and financial health