SageFusion

Open siteIntroduction

SageFusion is an AI platform that gives investment advice to accredited investors.

SageFusion Product Information

SageFusion | Intelligent Investment Management

Overview

SageFusion is an AI-powered investment management platform based in New York that targets sophisticated investors, banks, hedge funds, family offices, private equity firms, and finance departments. It emphasizes intelligent investing, advanced risk management, transparent investments, and competitive fees. The platform positions itself as a bridge between cutting-edge AI-driven market analysis and traditional banking expertise to optimize portfolios.

What It Is

- A wealth and investment management service powered by an AI platform, designed to optimize portfolios and improve returns while managing risk.

- Provides access to investment strategies, real-time market intelligence, and portfolio optimization tools.

- Uses a combination of statistical models, financial statement analysis, and social-media signals to inform asset allocation across multiple investments.

Key Claims

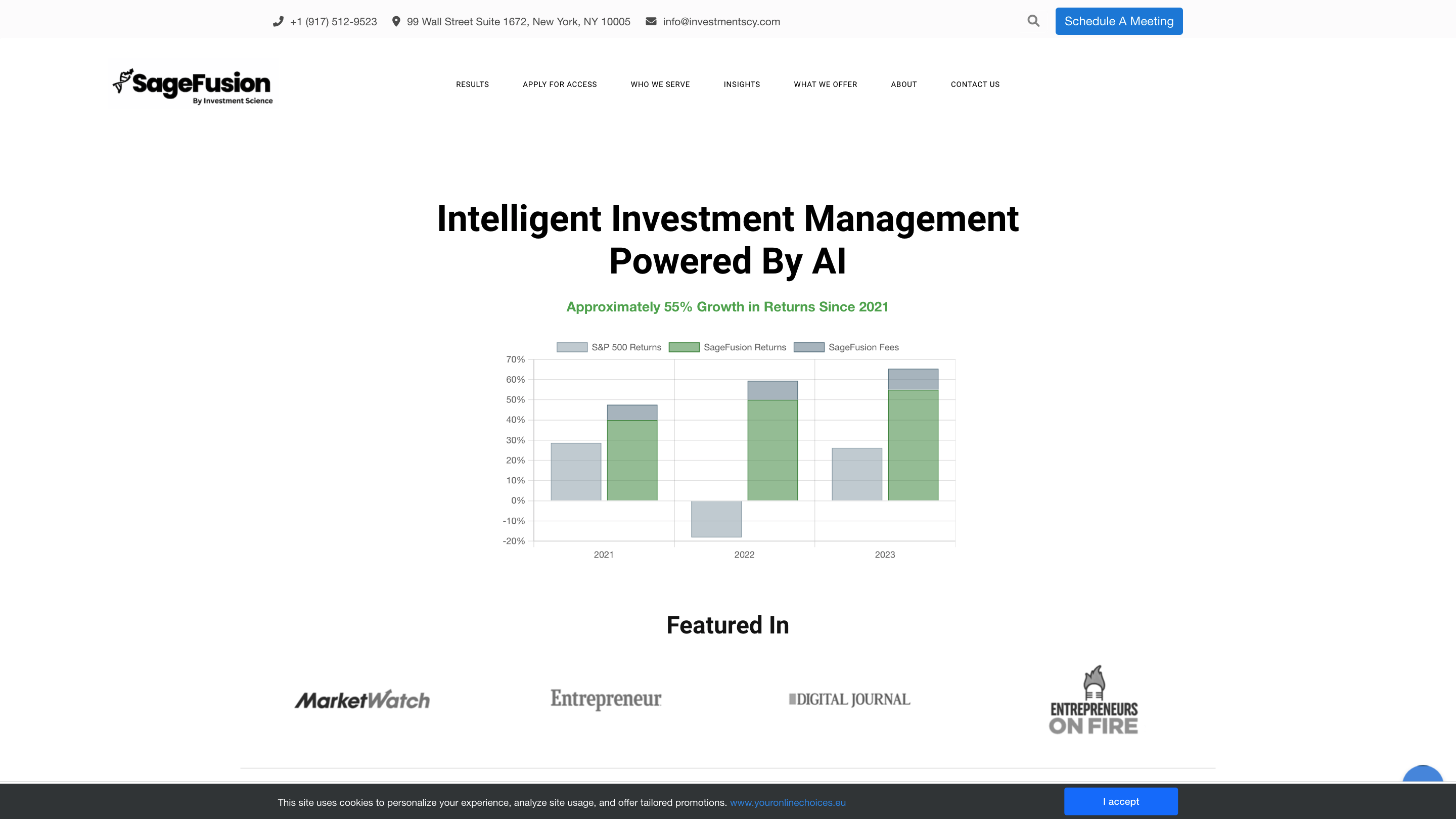

- Approximately 55% growth in returns since 2021 (as presented by their visuals).

- Emphasizes intelligent investing, transparent fee structures, and advanced risk management.

- Funds are held at Interactive Brokers (custodial broker), enabling client-owned accounts with anonymity in trading.

Why Go With SageFusion?

- Intelligent trend forecasting

- Proper risk management

- Transparent investments

- Competitive fees

- Advanced risk management and portfolio optimization supported by AI

How It Works

- Investment science combines AI with banking expertise to optimize portfolios.

- Allocation uses AI-driven analysis of financial statements and social media signals to target investments across market directions.

- Real-time market intelligence feeds into portfolio decisions.

- Funds are held at Interactive Brokers, ensuring custodian security and client control of funds.

Investment Methodology

- Advanced statistical models and data sources, including financial statements and social-media signals, guide allocation.

- The model aims to profit across various market directions by diversifying investments.

- Emphasis on transparency, with ongoing visibility into holdings and performance.

Where Is My Money Held?

- Your funds are held at Interactive Brokers, a member SIPC, providing a custodial brokerage account that SageFusion manages on your behalf. The system supports anonymous trading in line with client arrangements.

Who We Work With

- Investors: Banks, hedge funds, family offices, private equity firms, and finance departments.

- Governments: Client focus includes government institutions seeking infrastructure and economic growth funding.

- Data Vendors: Data resellers, banks, hedge funds, traders, asset managers, and financial institutions.

What We Offer

- Innovative strategies and insights to diversify portfolios.

- Real-time investment visibility and transparent reporting.

- A focus on reducing fees while improving risk-adjusted returns.

- Access to exclusive insights and market intelligence via the SageFusion AI platform.

The Process (Four Simple Steps)

- Initial Application: Complete the preliminary qualification form to determine eligibility (approval within 48 hours).

- Full Application: If approved, receive a comprehensive IBM/Interactive Brokers-based application to open the brokerage account (approx 30 minutes).

- Onboarding Call: Schedule a call to align tax structure, questions, goals, and funding details.

- Start Investing: Upon approval, SageFusion optimizes the portfolio based on current economic indicators.

Leadership

- Michael Kelly — Founder & CEO / Quantitative Trader

- Experienced in investment banking, fintech, and data science. Former roles at Barclays, UBS, Mizuho. Adjunct professor teaching data mining and data science.

- Dr. Andrew Weinbach — Founder & Chief Compliance Officer / Wealth Manager

- Professor of economics with a background in applied economics, sports economics, financial economics, and behavioral economics. Applies advanced probability modeling for sports betting to financial markets.

Real-Time Investment Visibility

- The platform emphasizes transparency, allowing clients to log in and monitor investments and trend-based decisions.

- Unique risk management approach includes allocating 5% of cash into options as a hedge.

Advanced Market Intelligence

- SageFusion’s AI-driven platform delivers real-time market analysis.

- Continuous monitoring and adaptation to market fluctuations to align investments with current conditions.

What It Feels Like to Use SageFusion

- Transparent, data-driven portfolio management with AI-backed insights.

- Access to a clear workflow for onboarding and ongoing portfolio optimization.

- A focus on balancing risk and return with a modern, AI-powered toolkit.

Contact and Access

- Email: [email protected]

- Phone: +1 (917) 512-9523

- Address: 99 Wall Street Suite 1672, New York, NY 10005

- Website sections include Results, Apply for Access, Who We Serve, Insights, What We Offer, About, Contact Us.

Note

- The content presented includes marketing and claims about performance and capabilities. Prospective clients should conduct due diligence, verify regulatory compliance, and assess risk and suitability before engaging.

- AI-driven investment platform combining advanced statistical models with banking expertise

- Real-time market intelligence and portfolio optimization

- Transparent investment visibility with 5% cash hedging via options

- Funds held at Interactive Brokers (SIPC member) for custodial accounts

- Four-step client onboarding process

- Leadership with holdings in academia and industry

- Target clients include banks, hedge funds, family offices, private equity, and government institutions

- Access to exclusive insights and market trends via SageFusion

- Data-driven approach using financial statements and social media signals

- Emphasis on competitive fees and risk management