Salient

Open siteMarketing & Advertising

Introduction

A platform that automates personalized and relevant outreach emails to optimize cold outbound engagement.

Salient Product Information

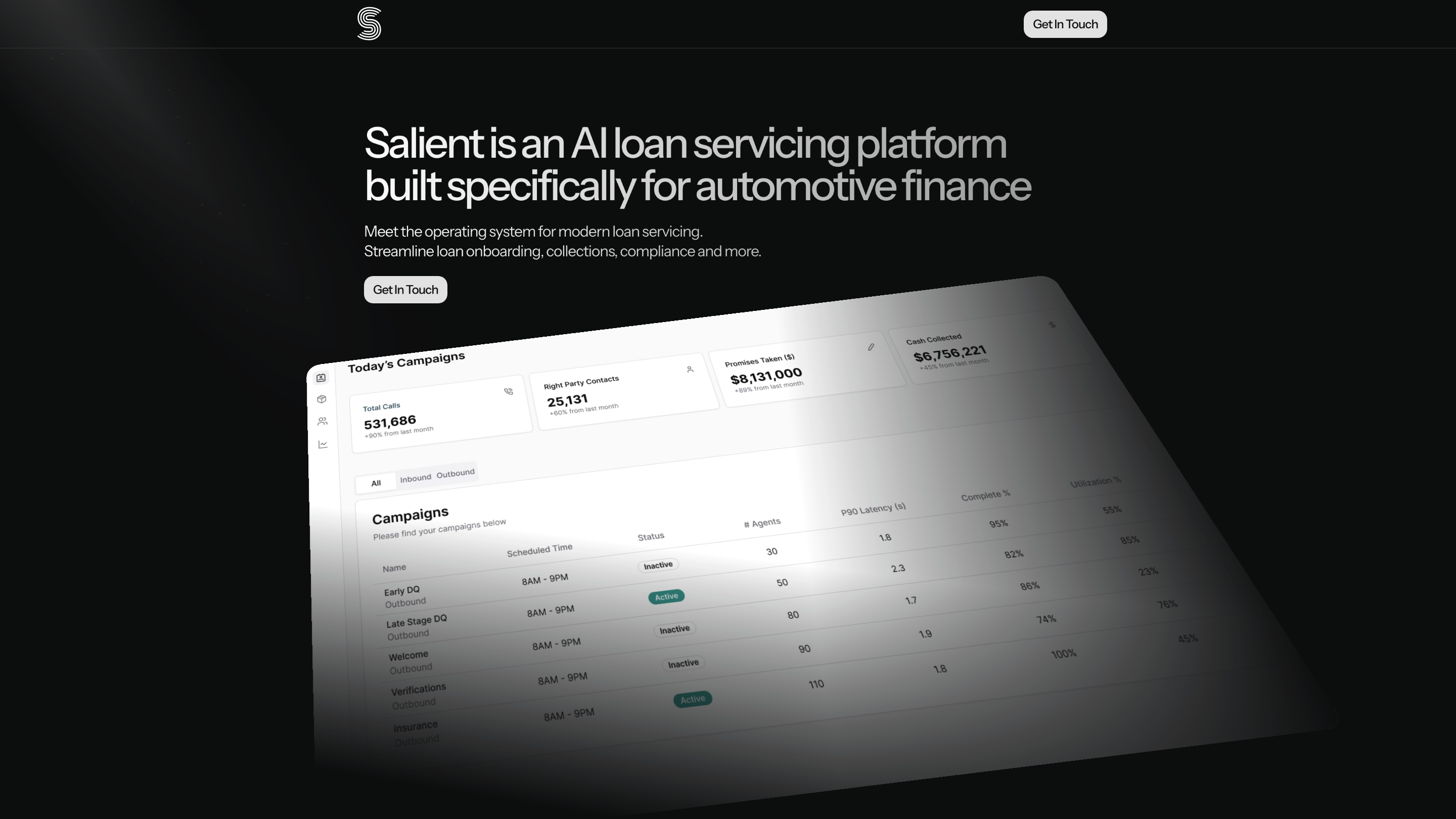

Salient AI Agents for Loan Servicing is an AI loan servicing platform purpose-built for automotive finance. It acts as an operating system for modern loan servicing, designed to streamline onboarding, collections, compliance, and more. Trusted by tech-forward lenders, it handles millions of unique consumer interactions, reduces handle times, and processes substantial loan activity. It offers three products tailored to automotive lending and provides real-time, compliant automation across voice, text, email, and web chat.

How Salient Helps Your Lending Team

- Deploy AI Agents to interact with customers via voice, text, email, and web chat

- Automate payments, due date changes, extensions, payoffs, and insurance information updates in real time

- Built for enterprise with complete model observability, data privacy, and security

- Designed to minimize human effort while maximizing compliance and customer experience

Features

- AI Agents for payments, due date changes, extensions, funding verification, and insurance claims

- Real-time, multi-channel customer interactions (voice, text, email, web chat)

- 70%+ reductions in handle time

- 0-Day integration with existing auto lending stacks (OFSLL, Shaw Systems, Nortridge)

- Seamless integration with payment processors (Stripe, ACI, PayNearMe, Nowpay)

- Real-time borrower data push/pull to existing Loan Management Systems (LMS)

- CCaaS-friendly contact center capabilities (make/transfer/end calls within your CCaaS)

- Enterprise-grade security and compliance (SOC 2, PCI L1, private cloud per lender)

- Built-in regulatory compliance coverage for CFPB, FCRA, TILA, UDAAP and related rules

- Monthly updates to compliance guidelines

- Multilingual support: English, Spanish, Portuguese, Vietnamese

- Dedicated customer success management and high SLAs

Core Capabilities

- Compliance-first AI agents: fully trained on major financial regulations before handling any call; real-time monitoring ensures compliant interactions

- Data privacy and security: private cloud per lender; SOC 2 and PCI L1 compliant; regular penetration testing

- Comprehensive documentation: every interaction is documented and dispositioned to support audits

- Enterprise scalability: safe, scalable generative AI with complete observability and security

- Rapid integration: 0-Day integration with existing auto lending stacks and easy expansion with new tools

Integrations & Data Flows

- Payment processors: Stripe, ACI, PayNearMe, Nowpay

- Loan management systems: OFSLL, Shaw Systems, Nortridge

- Contact centers: seamless work within your CCaaS platform

Security, Compliance & Privacy

- Compliance training on CFPB, FCRA, TILA, UDAP and related regulations

- Real-time monitoring to ensure regulatory adherence

- Private lender cloud hosting to prevent data leakage

- Ongoing security testing and monthly guideline updates

FAQs Highlights (Condensed)

- What makes Salient different? Purpose-built for financial services with built-in compliance and real-time monitoring

- Language support: English, Spanish, Portuguese, Vietnamese

- Compliance updates: monthly updates incorporated

- Data security: private cloud per lender; SOC 2 and PCI L1 compliant

- Integrations: broad support with payment processors, LMS, and CCaaS; new integrations added regularly

- Support: dedicated CSM and industry-leading SLAs

How to Use Salient (Overview)

- Connect Salient to your existing lending stack (LMS, payment processors, CCaaS)

- Configure AI agents for payment collection, due-date changes, extensions, and insurance updates

- Deploy across channels (voice, text, email, web chat) and monitor performance

Adoption & Compliance Notes

- Salient’s agents are designed for financial services from the ground up, prioritizing compliance, privacy, and customer trust

- Real-time oversight helps prevent non-compliant interactions and supports regulatory audits

Quick Reference: Key Benefits

- Significant reduction in handle times (70%+ potential)

- Real-time, compliant automation across channels

- Easy integration with existing lending tech stack and processors

- Enterprise-grade security and privacy protections