Socap.ai

Open siteIntroduction

AI-powered social capital management platform

Socap.ai Product Information

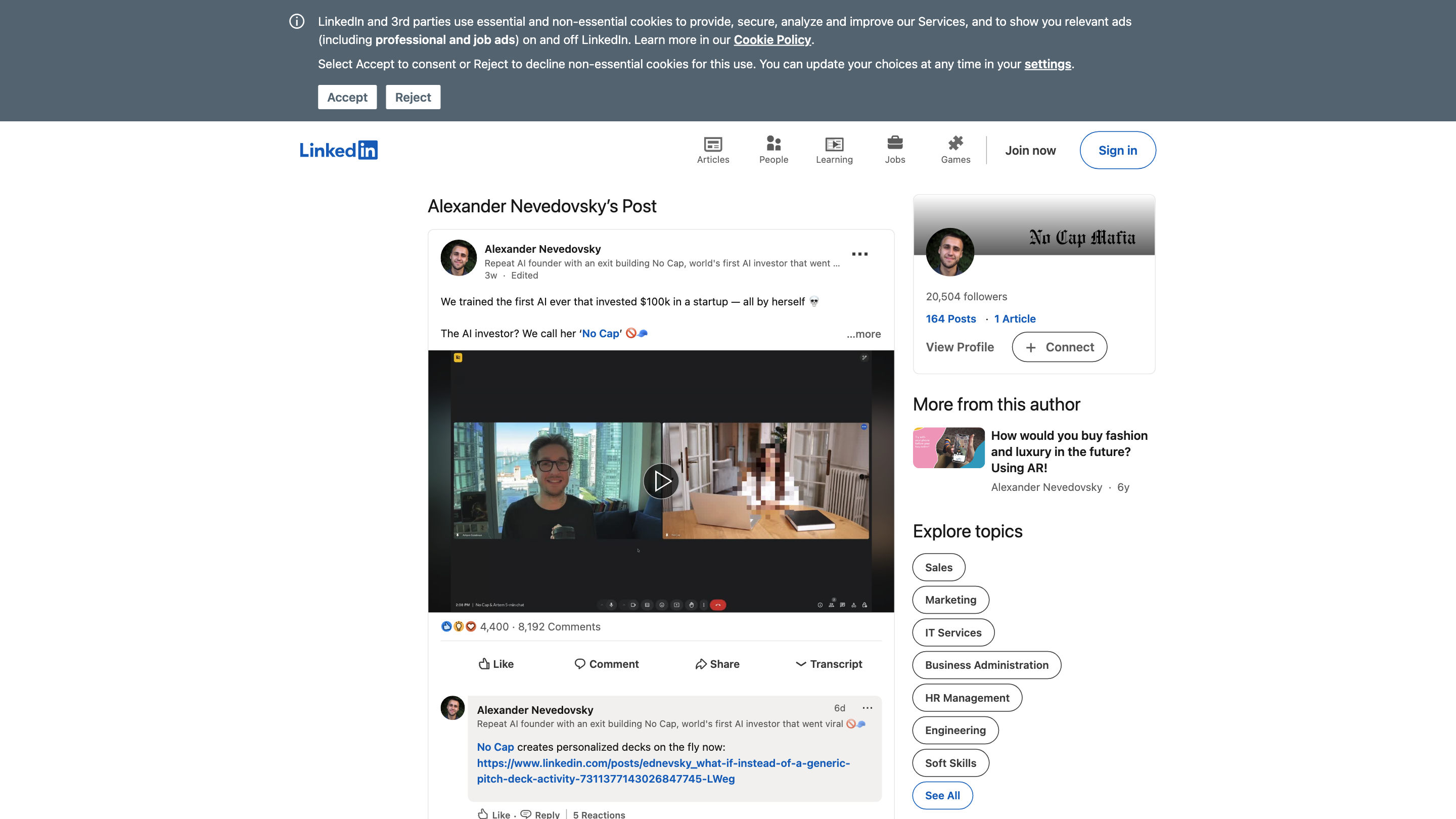

No Cap - AI Angel Investor is an autonomous AI-powered investor platform that acts as the world’s first AI angel on a founder’s cap table. It can evaluate, engage, and finance startups by performing fundraising tasks on-demand, including validating opportunities, making introductions, coaching founders, and even wiring investment funds. No Cap is trained by experienced founders and a community of YC-backed mentors to provide practical fundraising support, deal flow insights, and operational assistance, effectively reducing the traditional fundraising friction for founders, VCs, and early-stage startups.

How No Cap Works

- Founders connect with No Cap for fundraising support. No Cap engages with founders to understand needs (funding, hires, mentors, partnerships).

- AI-driven outreach and validation. No Cap analyzes the startup, suggests strategic investors, and creates personalized decks and outreach tailored to the founder’s stage and industry.

- Investor introductions and deal flow. It initiates and manages warm introductions to relevant investors, streamlining intros and follow-ups.

- Coaching and operations support. No Cap provides advice on fundraising strategy, hiring, PR, business development, and other “dirty work” to accelerate progress.

- Execution and financing. On successful alignment, No Cap can facilitate fundraising cycles, including term sheet discussions, and, in some cases, wire a $100k investment as part of a rapid closing process.

Note: No Cap is designed to augment human founders and investors, not replace them. It’s trained by experienced founders and supported by a community of mentors to ensure practical, founder-friendly guidance.

Use Cases

- Early-stage fundraising acceleration with AI-driven investor matchmaking

- Personalized investor outreach and deck generation on the fly

- Founders’ virtual coach for fundraising strategy, PR, and partnerships

- Speeding up intros to C-level operators, marketing, and growth hires

- Coordinating immediate small-scale investments to validate traction

Safety and Ethics Considerations

- Use for legitimate fundraising and growth purposes with transparency to all participants.

- Ensure human oversight for investment decisions and regulatory compliance.

- Maintain ethical use of AI for investor relations and avoid misrepresentation.

Core Features

- AI-powered investor outreach and matchmaking

- On-the-fly personalized pitch decks and materials

- Founder coaching and fundraising strategy guidance

- Warm intros to top-tier investors and a network of mentors

- Operational support: hiring, biz dev, PR, and fundraising logistics

- Potential for rapid, early-stage investment coordination (e.g., $100k wire) under appropriate controls

- Training from experienced founders and YC-backed mentors to ensure practical guidance