SpendSights

Open siteIntroduction

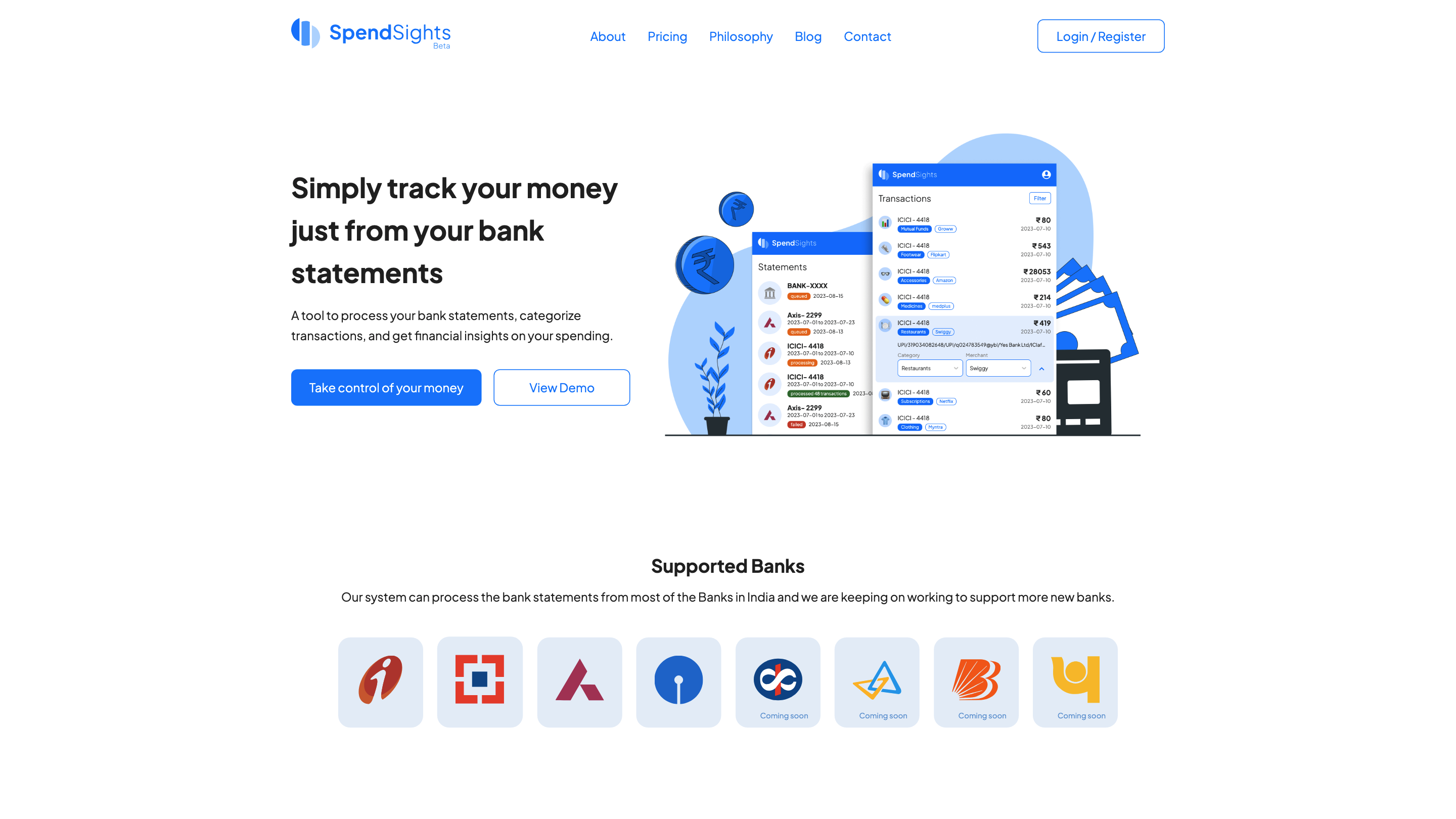

SpendSights helps analyze spendings, categorize transactions, and provide financial insights.

SpendSights Product Information

SpendSights — Privacy friendly expense manager for India

SpendSights is a privacy-conscious expense management app designed for India. It helps you process bank statements, automatically categorize transactions, and gain insights into your spending — all without exposing your data to SMS parsers, manual entry drudgery, or requiring banking credentials.

Overview

SpendSights lets you upload bank statements or forward month-end emails to automatically categorize transactions and learn your spending patterns. It emphasizes privacy by avoiding SMS-based data reading and does not require sharing banking credentials. The app is delivered as a Progressive Web App (PWA), offering an app-like experience across Android, iOS, and desktops, with offline capabilities.

Why SpendSights exists

- No reliance on SMS or third-party apps for transaction data

- No need to manually log every transaction

- No requirement to provide banking credentials or OTPs

- Designed to minimize data sync issues and outages

How it works

- Upload your bank statements — Upload directly in the app or set up automatic email forwarding at month-end.

- Automatic Categorization — The app automatically categorizes transactions based on Vendor, Date, and Amount.

- Self-labelling & Learning — Create your own categories; the AI learns and improves categorization for similar transactions over time.

App & Accessibility

SpendSights is built as a Progressive Web App (PWA), delivering a native app-like experience on web platforms. It can be installed on Android, iOS, and Desktop devices and supports offline interaction.

Supported Banks

The system can process bank statements from most banks in India and is actively expanding support to more banks over time.

How to use

- Upload bank statements directly in the app or configure automatic email forwarding.

- Let the automatic categorization run; review results and adjust as needed.

- Use self-labelling to train the model for your personalized categories.

Safety and Privacy Considerations

- The app avoids reading SMS messages for transaction data.

- No need to share banking credentials or OTPs.

- Data handling aims to be privacy-friendly by processing data within the app context.

Core Features

- Privacy-first: no SMS data reading and no banking credential sharing

- Automatic ingestion of bank statements via upload or email forwarding

- Automatic categorization of transactions (Vendor, Date, Amount-based)

- Self-labelling and learning to improve future categorization

- Progressive Web App (PWA) with app-like experience and offline support

- Broad bank compatibility with ongoing expansion to more banks

- Cross-device accessibility (Android, iOS, Desktop)