TaxTim SA

Open siteLegal & Finance

Introduction

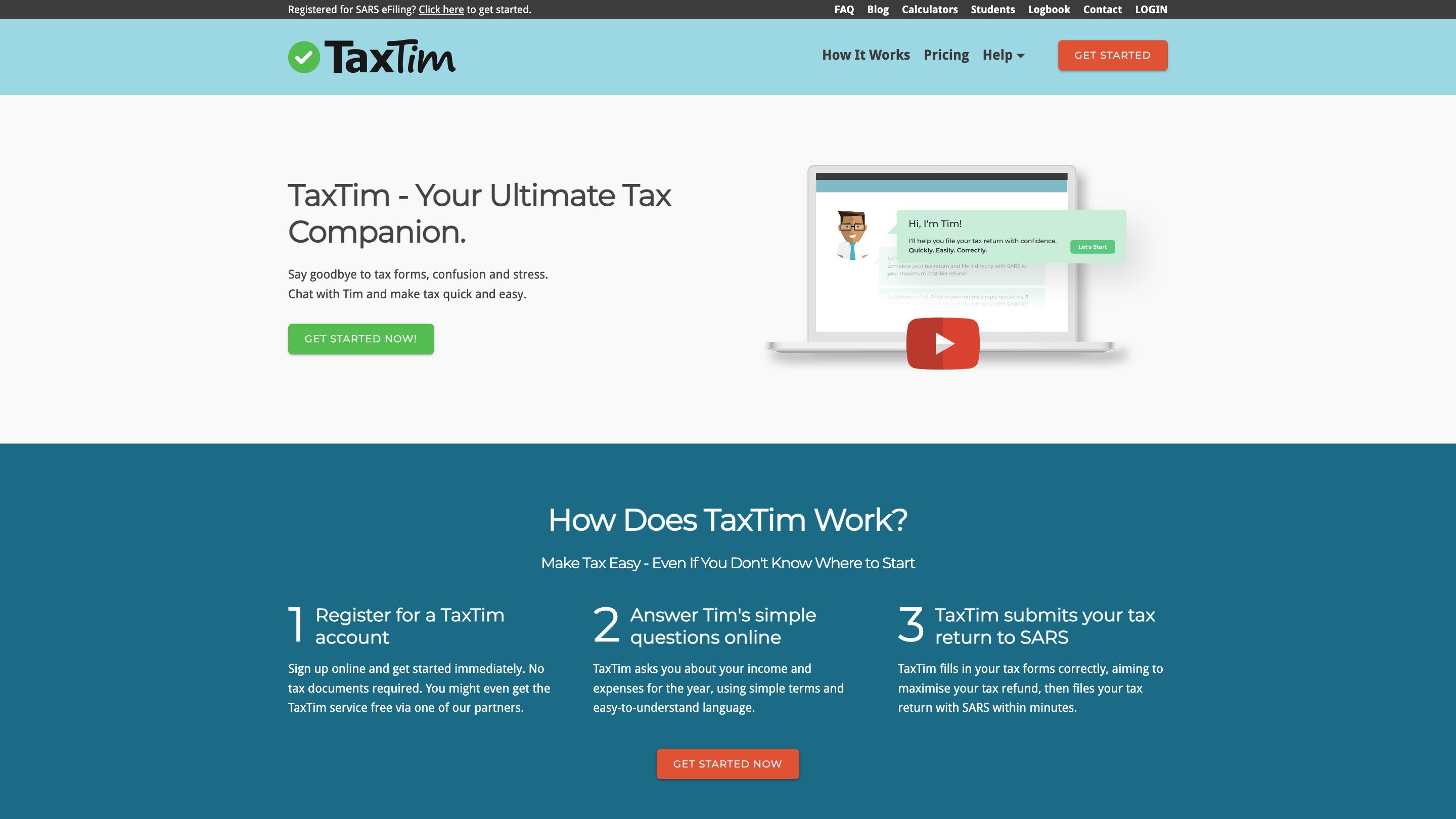

Online platform for easy tax return filing

TaxTim SA Product Information

TaxTim SA is a tax filing assistant designed to help South African users complete and submit their tax returns quickly and accurately, with guidance from registered tax practitioners. It offers a user-friendly, step-by-step experience that connects with SARS eFiling, provides built-in checks, and aims to maximize refunds while ensuring data security and compliance.

How TaxTim Works

- Create an account: Register for a TaxTim account to start the tax return process.

- Answer simple questions: The system asks clear, plain-language questions about income and expenses. No tax knowledge is required.

- Submit to SARS: TaxTim fills out the tax forms and submits the return to SARS via SARS eFiling, with a focus on accuracy and completeness.

TaxTim integrates with SARS eFiling, imports relevant data, offers built-in checks, and provides access to tax practitioners for more complex inquiries. Returns can be completed in 20 minutes or less for many users.

Core Features

- No prior tax knowledge required: Guided, questions-based workflow

- Full SARS eFiling integration: Direct submission to SARS

- Built-in checks: 1,300+ checks to maximise deductions and refunds

- Expert support: Tax practitioners available via online helpdesk

- Security-first: 256-bit SSL encryption and secure data handling

- Time-efficient: Most users complete filings quickly

- Refund optimization: Designed to uncover all eligible deductions

- Expense tracking tools: Helpful for ongoing tax management

- Plain-language explanations: Easy-to-understand tax guidance

- Free refund estimate: Get an idea of your potential refund upfront

Pricing and Plans

- Pricing varies by complexity (Lite, Smart, Ultra) to accommodate basic to advanced tax situations.

- Some offers and partner promotions may apply (free access or discounts).

- The platform emphasizes affordable access with scalable options depending on your tax needs.

Who Is It For

- Salaried employees, provisional taxpayers, self-employed/sole proprietors

- Individuals with foreign income, rental income, investments, or multiple income streams

- Small businesses seeking a streamlined filing process with SARS integration

Getting Started

- Sign up for TaxTim

- Answer a series of simple questions about income, deductions, and circumstances

- Connect to SARS eFiling and import relevant data

- Review the pre-filled forms, confirm details, and file

- Access post-filing support if needed

Safety and Privacy

- Data is transmitted securely with SSL and stored according to strict privacy policies

- No storage of sensitive documents beyond what is necessary for filing

- Access to qualified tax practitioners helps address complex scenarios while maintaining compliance

What Happens After You File

- TaxTim provides confirmation of submission to SARS and keeps you informed about refunds and processing status

- You can track refunds and review tax positions for future filings

Related Resources

- Tax help articles, calculators, tutorials, and guides

- Journal of tax definitions and step-by-step guides for common tax scenarios

- Support channels via online helpdesk and contact options

How It Differs From DIY or Free eFiling

- Guided, plain-language questionnaire reduces guesswork

- Built-in checks aim to maximise refunds and minimize errors

- Access to qualified practitioners for more complex issues

- Optimized for speed and ease of use, without requiring tax expertise

Safety and Legal Considerations

- TaxTim assists with return preparation and submission; users remain responsible for the accuracy of information provided

- It is recommended to review all data for accuracy before submission

Get Started Today

- Sign up for TaxTim and begin a guided filing experience designed to simplify South African tax returns and SARS eFiling submission.